Crypto funds see $3.2 billion inflows in July amid bullish investor sentiment

Key Takeaways

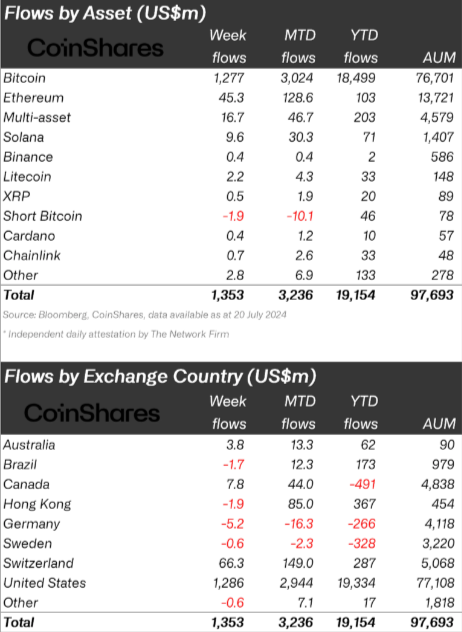

- Digital asset investment products saw $1.35bn inflows last week, totaling $3.2bn over three weeks.

- Ethereum surpassed Solana in year-to-date inflows, reaching $103m compared to Solana's $71m.

Crypto products saw inflows of $1.35 billion last week, bringing the total inflows over the last three weeks to $3.2 billion, according to asset management firm CoinShares.

Bitcoin dominated with $1.27 billion in inflows, while short Bitcoin products saw outflows of $1.9 million. Since March, short Bitcoin exchange-traded products (ETP) have experienced outflows totaling $44 million, representing 56% of assets under management.

Ethereum saw $45 million in inflows, surpassing Solana as the altcoin with the most inflows year-to-date at $103 million. Solana attracted $9.6 million in inflows last week, bringing its year-to-date total to $71 million. A noteworthy mention is Litecoin, which also saw inflows of $2.2 million.

Moreover, crypto funds indexed to digital assets’ baskets saw $16.7 million in weekly inflows, signaling an appetite for diversification from investors.

Image: CoinShares

Image: CoinShares

Regionally, the US and Switzerland led regional inflows with $1.3 billion and $66 million respectively, while Brazil and Hong Kong experienced minor outflows of $1.7 million and $1.9 million.

Notably, Brazil only saw two weeks of net outflows this year, making it the fourth-largest country on year-to-date assets under management.

ETP trading volumes increased by 45% week-on-week to $12.9 billion, representing 22% of the broader crypto market volumes. In contrast, blockchain equities experienced outflows of $8.5 million last week, despite most ETFs outperforming world equity indices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US won’t start Bitcoin reserve until other countries do: Mike Alfred

After an 80% drop in stock price, is there a value mismatch in BitMine?

With the three main buying channels simultaneously under pressure and the staking ecosystem losing momentum, Ethereum's next stage of price support faces a structural test. Although BitMine is still buying, it is almost fighting alone. If even BitMine, the last pillar, can no longer buy, what the market stands to lose will not just be a single stock or a wave of capital, but potentially the very foundation of belief in the entire Ethereum narrative.

Bitcoin falls below the 90,000 mark, hidden opportunities emerge amid spreading panic

Major Earthquake in Digital Assets: Billion-Dollar Compensation Storm from Mt.Gox and FTX