Greeks.live: Currently, the ETH Doomsday IV has exceeded 80%, significantly higher than the recent average level

PANews reported on July 23 that Adam, a macro researcher at Greeks.live, posted on the X platform stating that ETH spot ETF will start trading at 9:30 tonight Singapore time. Currently, the end-of-day implied volatility (IV) of ETH has exceeded 80%, significantly higher than the recent average level (60%). Looking at the distribution of transactions, active bullish buying accounted for nearly half of today's volume. Skew is slightly bullish and today's options market is mainly dominated by bulls with strong upward momentum.

However, we also saw during the BTC ETF listing that a large amount of selling led to a decline, so today's bull power is weaker than during the BTC ETF listing period. Another interesting point is that most of today's block trades are concentrated in BTC with over 5000 deep out-of-the-money call options traded while ETH is more focused around market makers who are actively adjusting their positions amidst lively market activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

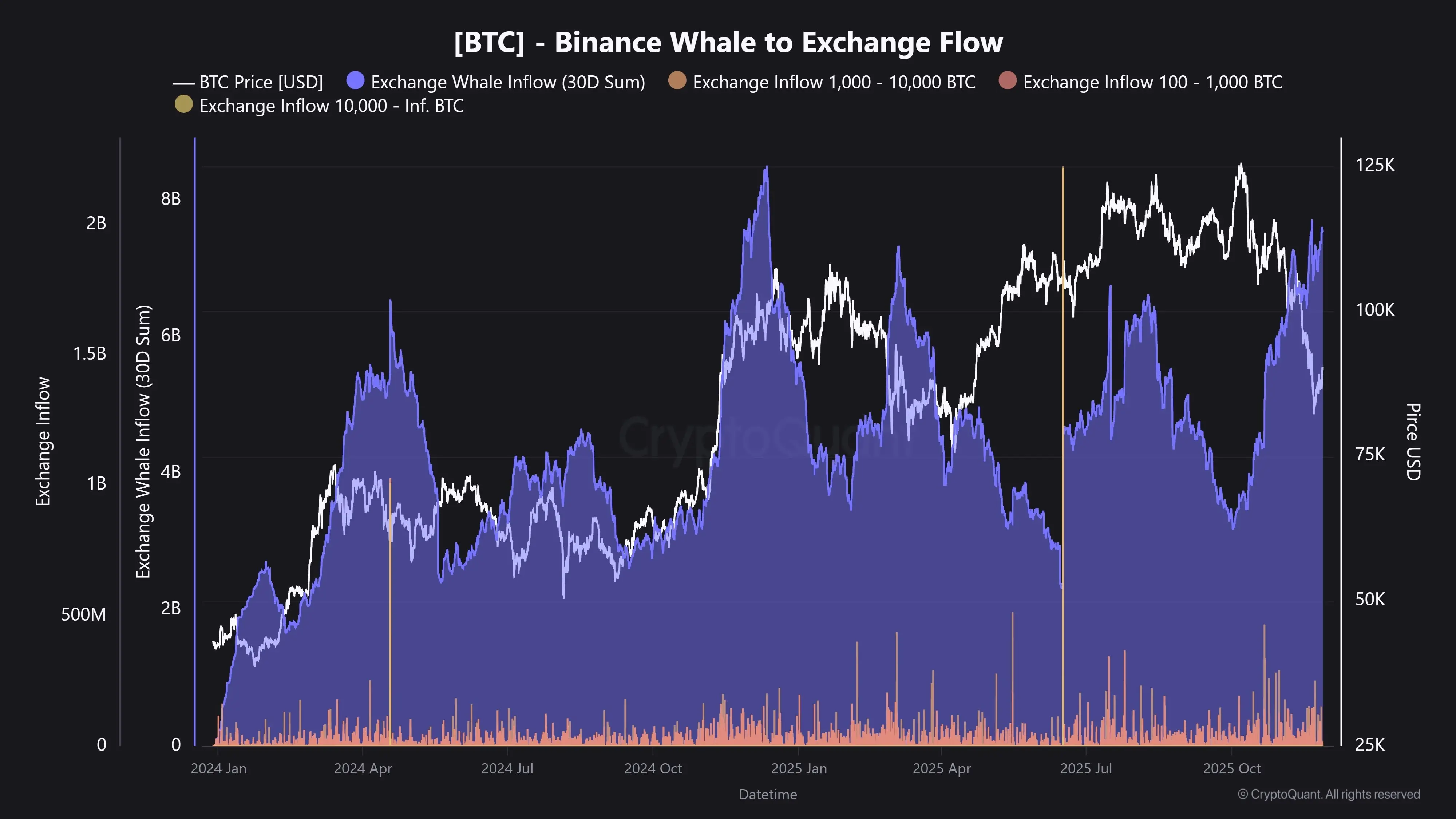

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended