CICC: The Federal Reserve's interest rate cut in September is likely to happen

The CICC research report states that the overall tone of this Federal Reserve meeting is dovish, and several wording adjustments suggest the approach of a rate cut in September. However, we also emphasize that being able to cut interest rates does not mean there will be many cuts, which is also the "specialty" of this round of rate cuts determined by this round of U.S. economic cycle. Due to these special circumstances, compared with previous rate cuts which all have similar impact paths, the difference this time mainly lies in the pace - it may be faster and earlier; misunderstanding this point might lead to wrong trading decisions. From the statements at this meeting and Powell's remarks at his post-meeting press conference, The Fed has further hinted at a rate cut in September by emphasizing easing inflationary pressures and focusing on balancing employment risks with inflation risks rather than just inflation risks alone. This suggests that unless something unexpected happens (like if inflation continues to fall before a September rate cut), a September rate cut should be highly probable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Governor Milan once again calls for a significant rate cut in December

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

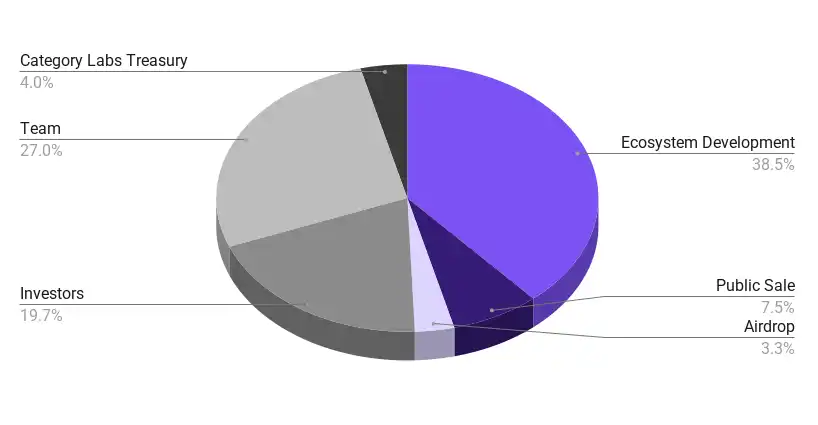

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

Federal Reserve Governor Milan once again calls for a significant rate cut in December