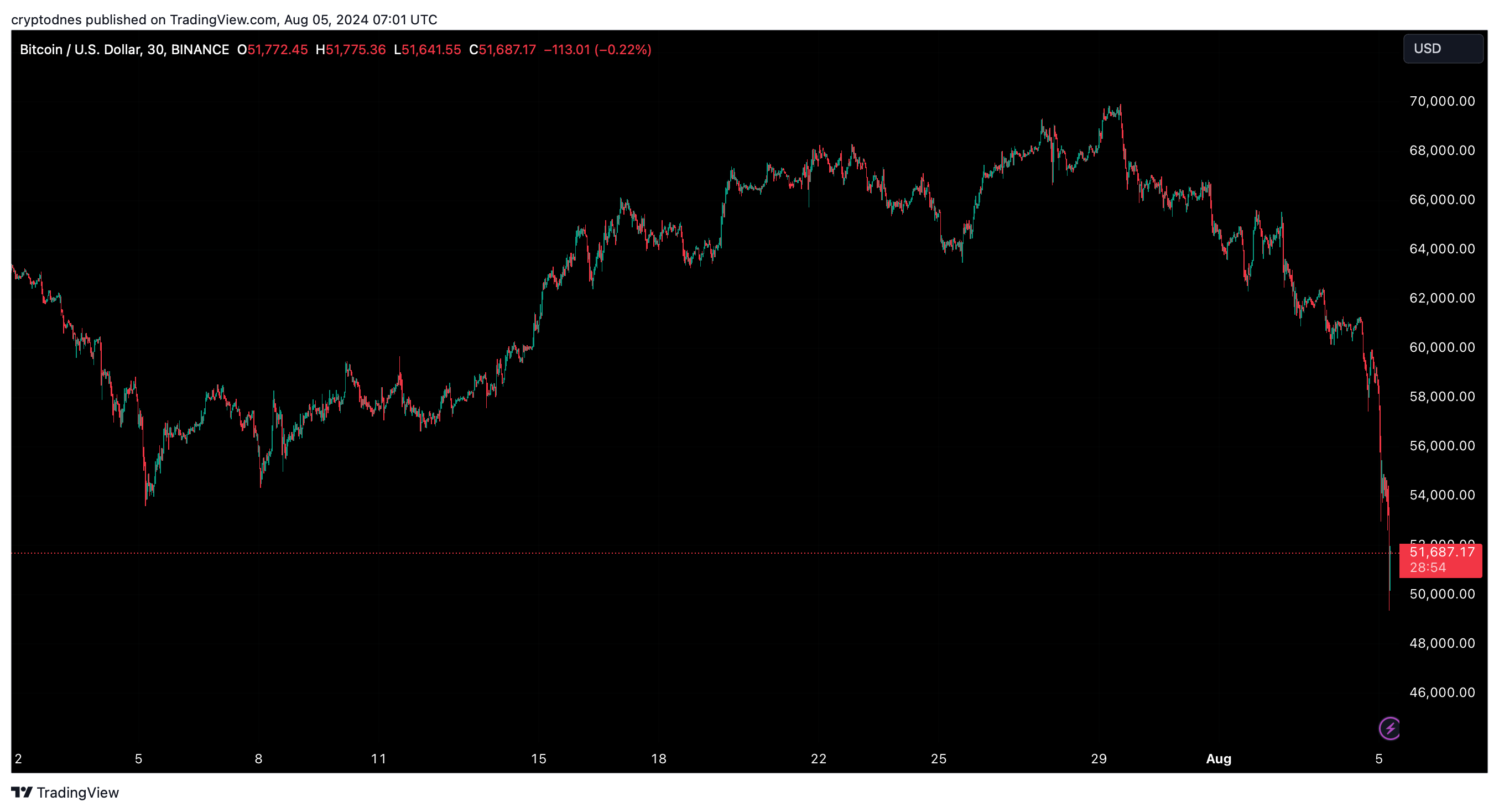

Bitcoin price crashed below $50,000

The crypto market saw a significant drop in value as investors continued to abandon high-risk assets.

Bitcoin led the decline with 16% and went below $50,000 in the last 24 hours, while Ethereum plummeted over 23% and at the time of writing is trading at $2,230. According to CoinMarketCap, the total market cap is down 11%. At this point it stands at $1.84 trillion.

This decline in cryptocurrencies has coincided with a broader decline in equity markets in the Asia-Pacific region. Japan’s Nikkei 225 fell 10%, extending losses from the previous week, after the Bank of Japan announced an increase in its benchmark interest rate to a 16-year high.

At the time of writing, the leading cryptocurrency has partially recovered and is trading at $51,900, down 27% in the last week, and its market cap has fallen to around $1 trillion.

It was also reported that $1,000,000,000 was liquidated from the crypto market in the last 24 hours.

The stock market also suffered a decline last week that was related in part to disappointing earnings, a weaker-than-expected jobs report, higher unemployment and a declining manufacturing sector. The U.S. Federal Reserve chose to hold its benchmark interest rate steady and did not promise a September rate cut, which many market experts had included in their forecasts. Lower interest rates usually correlate with better performance of risky assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%