When you hear folks talking about Bitcoin and the U.S. election, they often act like the two are connected at the hip. You’ve got people claiming that Donald Trump’s chances of winning are somehow linked to Bitcoin’s price, as if one moves with the other.

But is that actually the case, or is it just another narrative being forced down our throats? Truth of the matter is that Trump, or rather his team, has found a way to rake in some serious passive income through crypto.

Into the maze of Trump’s passive crypto streams

Over the weekend, some new details about Trump’s finances came out. We saw about $635 million in assets, including a bunch of properties like Mar-a-Lago and various golf courses. Plus, there’s millions rolling in from royalties.

A big percentage of that royalty cash—$7.2 million, to be exact—is coming from licensing fees through NFT INT LLC.

This is the company that’s been using Trump’s likeness for those Trump Digital Trading Card NFT collections on Polygon.

Trump’s other assets are no joke either. The man’s got holdings in U.S. Treasuries, bonds, index funds, stocks, and a cool 114.75 million shares in his media company DJT, currently valued at $2.65 billion.

And come September, when the six-month lock-up period ends, those shares will be tradable. So yeah, there’s a lot going on here.

Let’s not forget about his crypto holdings. Trump’s disclosure reveals he’s got somewhere between $1 million and $5 million in Ethereum, plus some gold bars worth between $100,000 and $250,000.

But what is particularly interesting is that Trump’s crypto wallets—especially those on Ethereum and Polygon—are bringing in tens of thousands of dollars each month without him having to lift a finger.

Talk about a sweet deal.

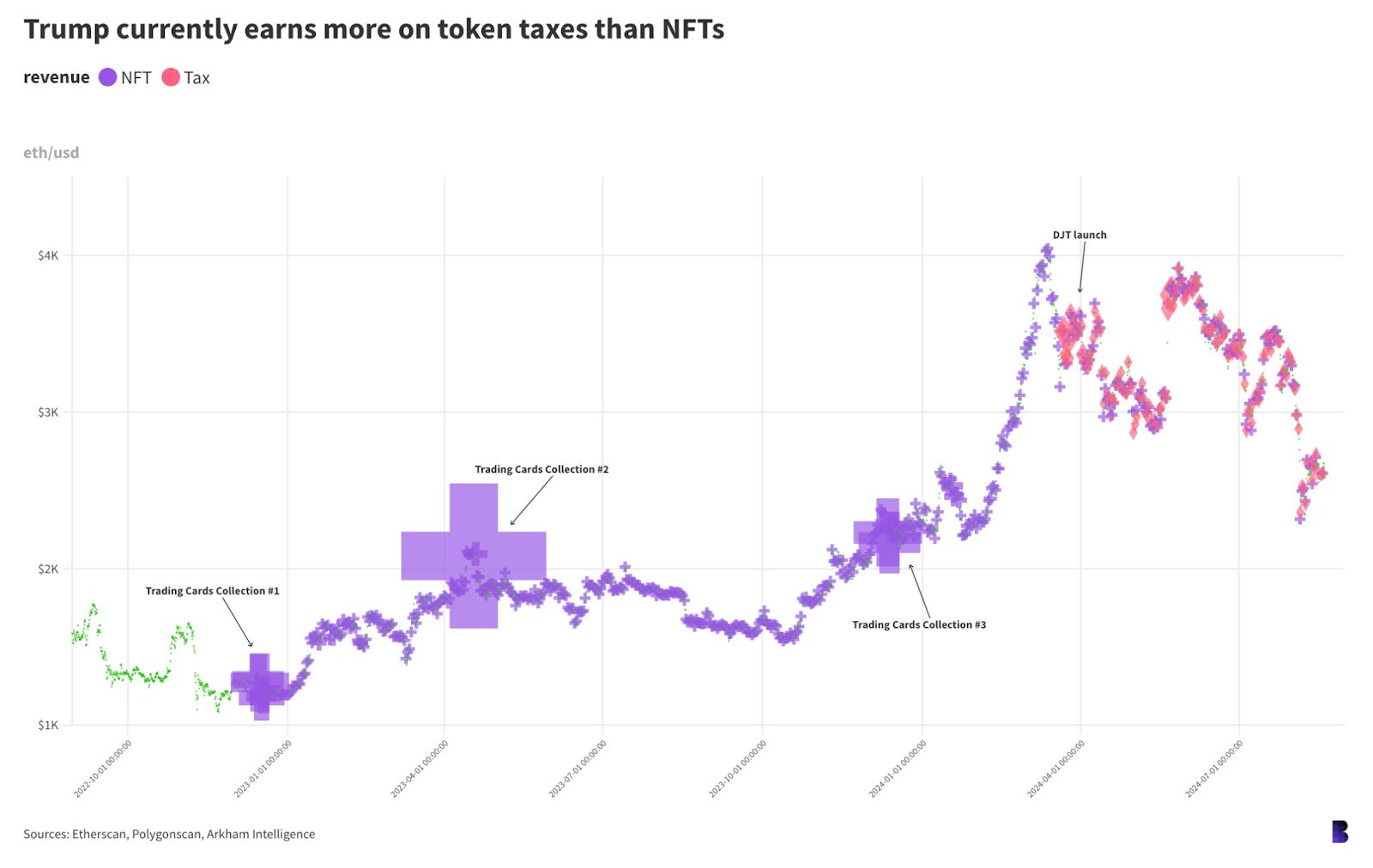

Data shows that Trump’s first three NFT collections pulled in up to 1,237 ETH in their first weeks. That’s around $2.14 million going straight to Trump’s Polygon wallet. If those same NFTs were sold today, they’d be worth over $3 million.

But here’s the thing: that NFT cash is drying up. Since January 2023, Trump’s Polygon wallet has seen an extra 782.32 ETH, or about $2 million, from secondary NFT sales.

Not too shabby, but the pace has slowed down. These days, his wallet is bringing in just a few hundred dollars a day, sometimes even less than ten bucks. That’s chump change compared to what he was pulling in before.

Fortunately for him, there’s a new player on the scene: memecoins. A whole bunch of unofficial memecoins on Ethereum are now pouring a steady stream of Ether into Trump’s Ethereum wallet.

These coins might be illegitimate, but they’re bringing in some real cash. It’s almost as if Trump’s wallet has become a magnet for these memecoin taxes.

Even if the NFT money dries up, this memecoin revenue stream keeps the crypto flowing in Trump’s direction.

No, Trump’s odds do not control the market

Now, let’s get back to the question at hand: is Bitcoin’s price really tied to Trump’s chances in the election? A lot of people seem to think so, especially after Trump’s mid-June meeting with Bitcoin miners.

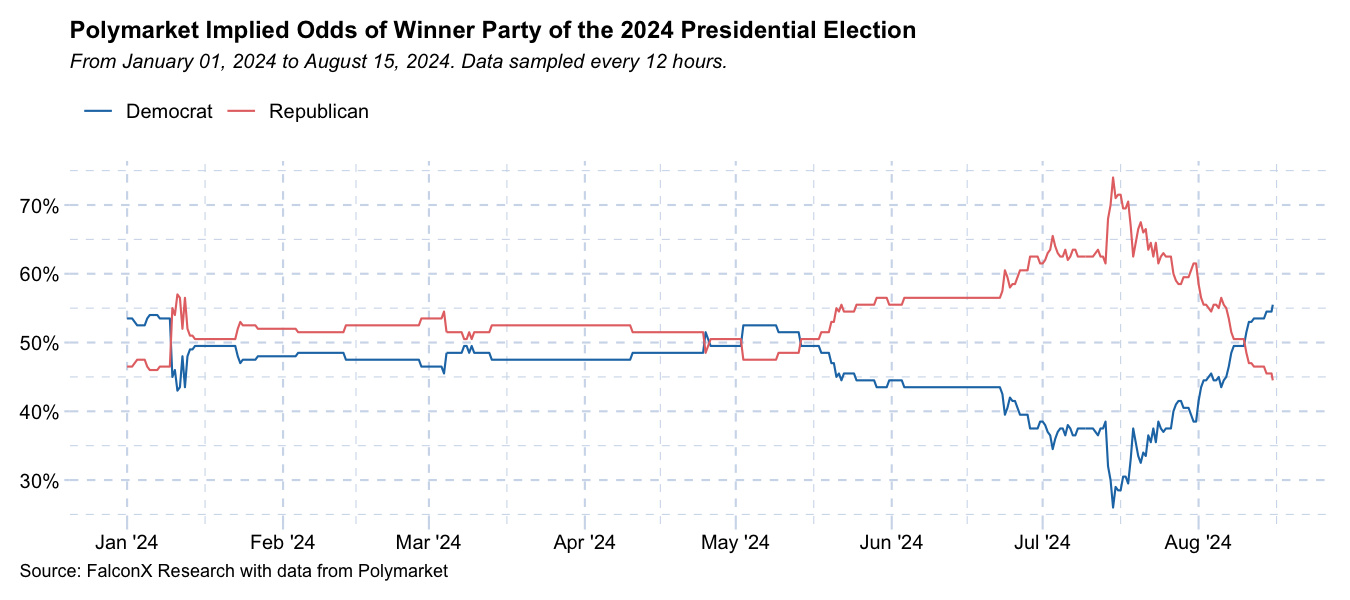

The idea picked up even more steam when he survived an assassination attempt in July, and Bitcoin took a hit as Kamala Harris started gaining momentum in the betting markets.

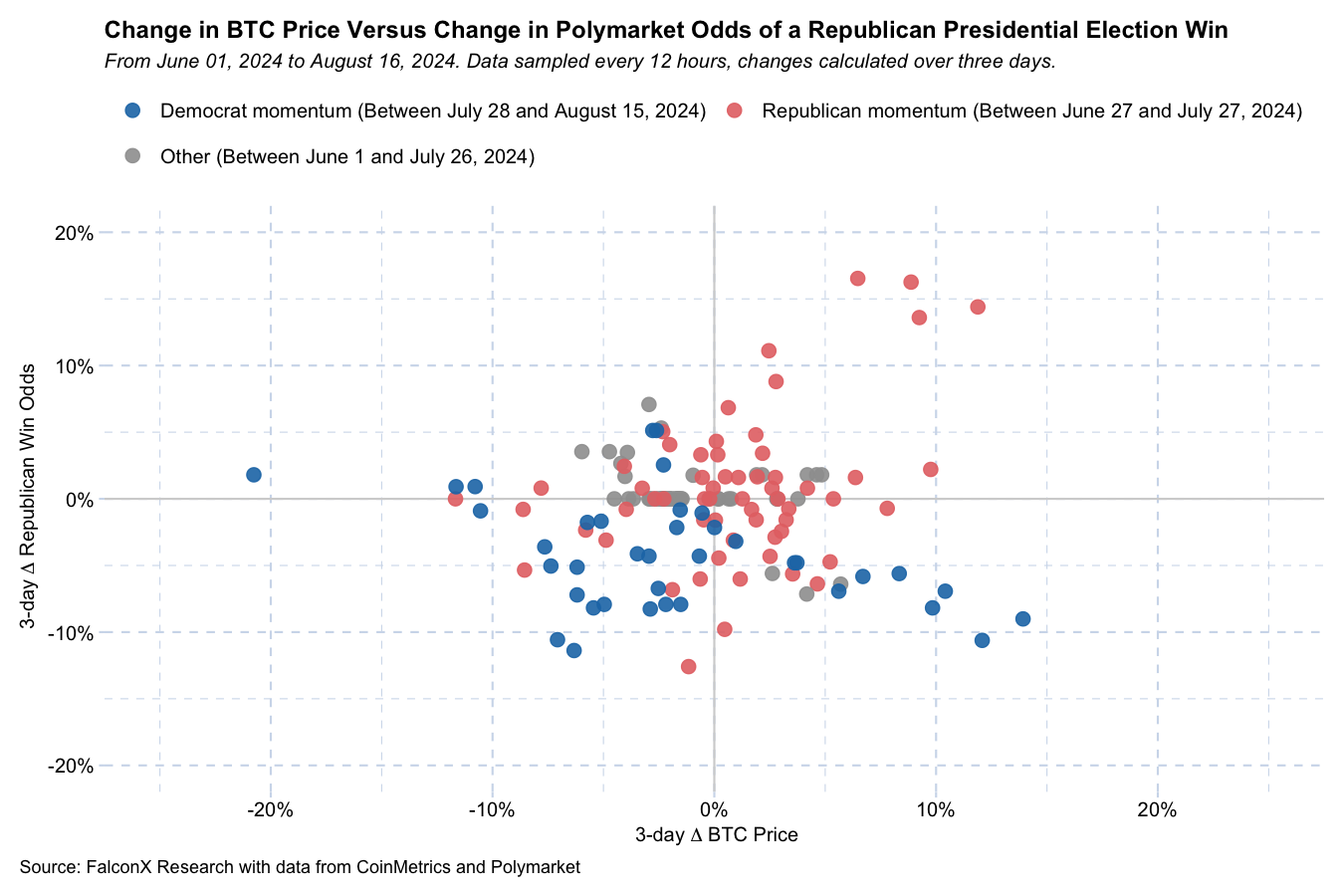

But according to FalconX, a prime broker that analyzed the data , there’s no solid link between Trump’s odds and Bitcoin’s price movements.

They looked at how Bitcoin’s price changed over three days and compared it to the odds of Trump winning the election over the same period. The data, sampled every 12 hours, doesn’t show any clear pattern.

Look at the chart below. The X-axis shows the percentage change in Bitcoin’s price, while the Y-axis shows the change in the odds of a Republican victory.

Red dots mark the period from June 29 to July 29, when Trump’s odds of winning surged on Polymarket.

Blue dots represent the period when Democrats were gaining momentum. Grey dots cover the rest of the time between June 1 and August 15.

What the chart shows is a scattered mess. The red dots are all over the place, which suggests there’s no connection between changes in Republican odds and shifts in Bitcoin’s price.

The same goes for the blue and grey dots. In short, there’s no smoking gun here. The idea that Bitcoin’s price is tied to Trump’s election odds just doesn’t hold water when you look at the data.