Stablecoin market capitalization has reached a new all-time high at $168 million amid 11 months of consecutive growth.

DefiLlama data shows the total stablecoin market cap is now at the highest point ever, beating its last peak in March 2022.

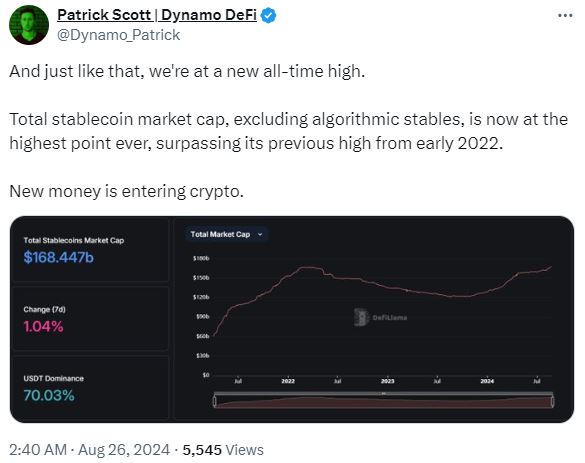

The stablecoin market cap, excluding algorithmic stablecoins, has reached $168 billion, its highest point in history.

Stablecoin market capitalization has reached a new all-time high at $168 million amid 11 months of consecutive growth.

DefiLlama data shows the total stablecoin market cap is now at the highest point ever, beating its last peak in March 2022.

The data excludes algorithmic stablecoins, whose value is maintained through algorithmic mechanisms rather than being pegged to external assets like fiat or gold.

The market reached an all-time high of $167 billion in March 2022, but it tumbled soon after, dropping to $135 billion before the end of that year.

Crypto analyst Patrick Scott, also known as “Dynamo DeFi,” said in an Aug. 26 post on X that he thinks this is a sign that “New money is entering crypto.”

“And just like that, we’re at a new all-time high. Total stablecoin market cap, excluding algorithmic stables, is now at the highest point ever, surpassing its previous high from early 2022,” he said.

While he didn’t speculate as to what caused the uptick, he did note, “Retail has been in some form for at least eight months,” when asked by another user if institutional investment was behind the rally.

Leading the pack of stablecoins has been Tether ( USDT ). Soon after the new year rang in, USDT had a market cap of $91.69 billion.

Throughout 2024, it has registered steady monthly gains, reaching over $117 billion in market capitalization for the first time in August.

Circle USD ( USDC ) has also had a year of gains, reaching a market cap of over $34 billion, its highest point for 2024, but still a far cry from its all-time high of $55.8 million in June 2022.

According to a July report by CCData , Stablecoin trading volumes fell 8.35% to $795 billion last month due to lower trading activity on centralized exchanges.

The report points to MiCA regulations , which have raised concerns about the future of USDT in Europe, as contributing factors in the decrease of stablecoin trading activity on centralized exchanges throughout July.

The trend has continued into August, with the market’s trading volume currently sitting just above $46 billion, according to CoinMarketCap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.