Arthur Hayes sees Bitcoin surge with central bank rate cuts

Arthur Hayes, co-founder of the crypto exchange BitMEX, has shared a bullish outlook on Bitcoin (CRYPTO:BTC), attributing his optimism to recent central bank decisions to cut interest rates.

Hayes highlights recent rate reductions by the U.S. Federal Reserve, the Bank of England, and the European Central Bank as indicators that more substantial rate cuts might be forthcoming.

He suggests these actions are likely to increase the money supply and drive inflation higher.

In his recent commentary, Hayes argues that although rising inflation could challenge various sectors, Bitcoin could benefit significantly.

Bitcoin’s fixed supply and deflationary nature position it advantageously in an environment of increasing money supply.

Hayes emphasises that central banks cutting rates amidst persistent inflation might lead to more aggressive monetary policies, potentially resulting in a substantial rise in Bitcoin’s value.

He believes that if central banks continue to lower interest rates while economic growth remains strong and inflation stays high, further monetary easing is likely, particularly if a recession occurs.

This scenario could drive inflation higher, which might negatively impact traditional businesses but benefit assets with limited supply, such as Bitcoin.

Hayes’s perspective reflects his belief that Bitcoin is well-positioned to thrive in an inflationary environment.

He suggests that as central banks increase money printing and expand the money supply, Bitcoin’s status as a deflationary asset with a capped supply could lead to significant gains.

According to Hayes, Bitcoin could experience rapid appreciation as central banks' policies continue to shape the broader economic landscape.

At the time of writing, the Bitcoin price was $57,353.11.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who is rewriting the US dollar? The real battlefield of stablecoin public chains

Stablecoins are no longer just "digital dollars," but rather the "operating system" of the dollar.

Canton token CC to be listed, US CPI may be absent for the first time

Subscribe with one click to stay updated on the most noteworthy industry events and major project developments in the coming week, and keep your finger on the pulse of the market anytime, anywhere.

Trump's "Bitcoin Superpower" Plan: America's Monetary Hegemony Is Entering a New Crypto Phase

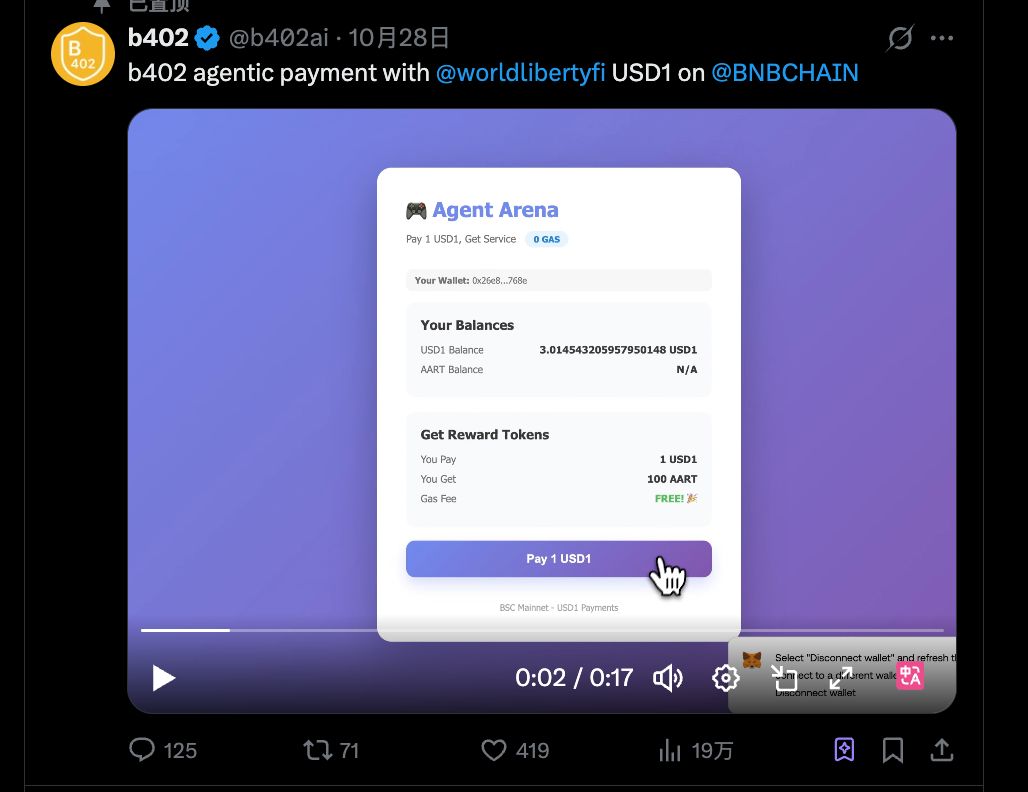

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.