US listed spot Bitcoin exchange-traded funds (ETF) are witnessing a rough time after a few weeks of regular inflows. Bitcoin ETFs posted a massive outflow of $287 million on September 3, pushing BTC price to trade at the $56,000 price level.

Recently launched Ethereum linked ETFs are on the same track, registering days of back to back outflows. ETH ETFs reported a net outflow of a huge $47.4 million on September 3. The biggest altcoin also took a dip of around 5% in the last 24 hours.

Bitcoin ETFs record $287M outflow

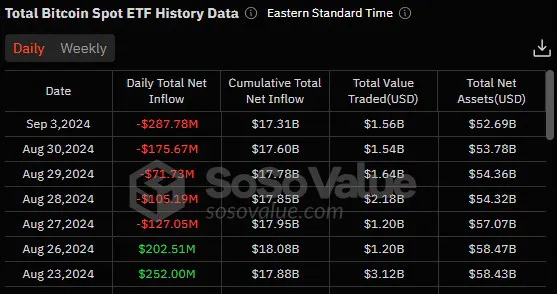

As per the data shared by Sosovalue, Bitcoin ETFs continued to bleed for 5 days in a row, reflecting the investors’ sentiments. These investment funds have now lost more than $765 million since August 27. However, BTC ETFs had posted a rally of inflows for straight 8 days before the recent dump.

Bitcoin ETFs saw an outflow of $287 million on Tuesday after hitting a negative flow of $175 million on August 30. This marks the largest single-day exodus since May 1, when $500 million fled the funds. Fidelity’s FBTC led the charge in withdrawals with a huge $162.3 million, while Grayscale’s GBTC saw $50.4 million making an exit from the fund.

Source: Sosovalue

Source: Sosovalue

ARK 21Shares Bitcoin ETF and Bitwise Bitcoin ETF weren’t spared either as they lost $33.6 million and $25 million respectively. The total net asset value of Bitcoin spot ETF is $52.689 billion which is equivalent to 4.58% of the BTC market cap.

BTC drops by 4% in the last 24 hours

Nvidia’s sell-off and disappointing US ISM manufacturing numbers have added more to the selling pressure. Bitcoin price dropped by 4% and dipped to the $55K zone in the last 24 hours. BTC is trading at an average price of $56,770, at the press time. Its 24 hour trading volume is up by 31% to stand at $33 billion.

Data shared by Coinglass shows that more than $55 million worth of long and short positions set on Bitcoin price got liquidated in the last 24 hours. Around $44.4 million worth of liquidated positions (80%) turned out to be long bets. This suggests that traders were expecting BTC price to continue its recovery but the emerging selling pressure made its mark.

Ether ETFs post $476M monthly outflow

Spot Ether ETFs had a brutal debut month. It registered a staggering $476 million in outflows within its first 30 days of trading since launching on July 23.

According to Bloomberg’s Eric Balchunas, Grayscale’s ETHE unlock was “too powerful” for the new ETFs to overcome. ETHE’s conversion from a trust to an ETF unlocked assets that had been stuck and this led to high outflows. ETHE’s assets shrank from $10 billion to $4.7 billion, with some funds shifting to Grayscale’s Ethereum Mini Trust.