Analysis: Correlation Between Bitcoin and Gold Turns Negative as Investors Favor Traditional Hedging Assets

According to CryptoQuant, investors seem to favor traditional safe-haven assets like gold over bitcoin in the current risk-averse environment.

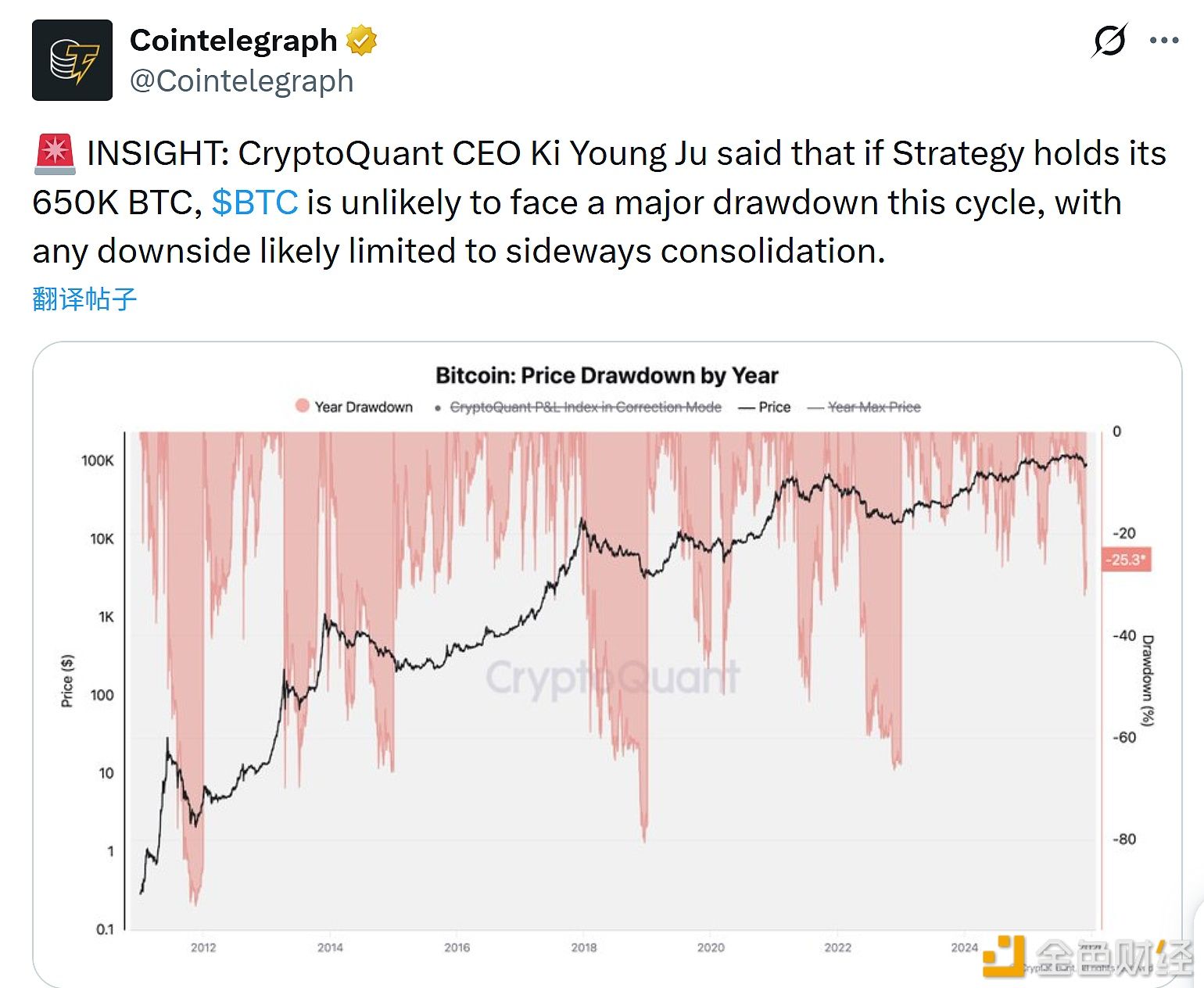

The correlation between bitcoin and gold has recently fallen sharply into negative territory, with the price of gold recently hitting new highs above $2,500 per ounce, while bitcoin has been declining and is now more than 20 percent below its all-time high of more than $73,000 set in March. As investors buy gold and sell bitcoin, the U.S. stock market has been underperforming, with the SP 500 down 3.6 percent since Aug. 30th.

CryptoQuant's Bull-Bear Cycle Indicator has been in a bearish phase since August 27, when Bitcoin was trading at $62,000.

The MVRV ratio (Market Value to Realized Value) has also been below its 365-day moving average since August 26, suggesting that the price may be headed for a further correction. the MVRV ratio falling below the moving average was a precursor to the 36% decline in Bitcoin in May 2021.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WisdomTree launches the first fully staked Ethereum ETP backed by stETH

Aster releases roadmap for the first half of 2026, with Aster Chain mainnet to launch in Q1

Data: Strategy Bitcoin monthly purchase volume plummeted from last year's peak of 134,000 to 9,100.