QCP: Ether Forward Spreads Have Shifted From Put Options to Call Options With 9% Higher Implied Volatility Than Bitcoin

In cryptocurrency terms, an overall bullish trend has led to greater price gains for ethereum relative to bitcoin, with the ETH/BTC cross rate rising from 0.038 on Friday to 0.0415 today, Bitget News said in a daily report from QCP.This is a sign of restored confidence in ETH or simply high volatility due to impaired liquidity.

In the options market, the front-end skew in ETH has shifted from puts to calls, while ETH implied volatility is 9% higher than BTC, suggesting upside sentiment and higher expected volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

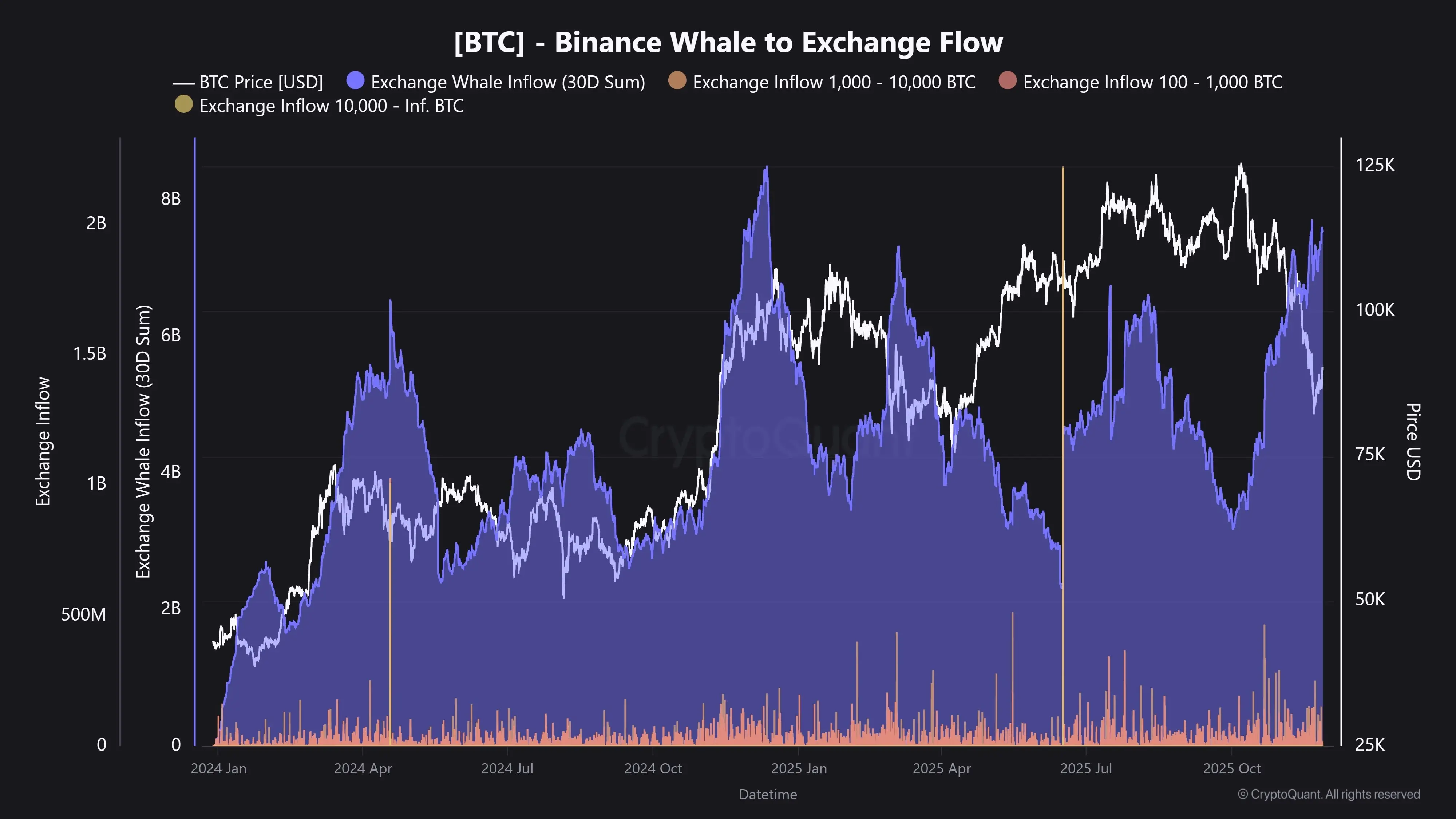

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended