XRP Takes 10% Hit After SEC Files Appeal in Ripple Lawsuit

The appeal challenges a ruling that clarified while some XRP transactions are securities, XRP itself is not inherently a security.

XRP’s value dropped over 10% on Thursday after the SEC filed an appeal against the court’s decision in its lawsuit against Ripple. This follows Judge Analisa Torres’s final ruling on Aug. 7, imposing a $125m penalty on Ripple, far less than the SEC’s initial $2b demand .

The court ruled that Ripple’s XRP sales to institutional investors were securities transactions, resulting in the penalty. However, Judge Torres said that these sales were neither fraudulent nor malicious, with no fraud claims or financial harm shown.

Further, the ruling clarified that while certain XRP transactions are considered securities, XRP itself is not inherently a security, providing key regulatory guidance for Ripple and the broader industry.

SEC Appeal Aims for XRP to Be Classified as Security Across All Transactions

The SEC appealed to the Second Circuit Court of Appeals, indicating its intent to challenge the ruling on several grounds. Central to the SEC’s appeal is its belief that the district court’s decision conflicts with long-standing Supreme Court precedents and established securities laws.

According to the SEC, XRP should be classified as a security in all sales, whether institutional or retail. It argues that XRP’s classification shouldn’t differ based on the transaction type.

Ripple’s CLO Says SEC Appeal is ‘Embarrassing’

Ripple’s chief legal officer Stuart Alderoty said on X that the SEC’s appeal was “disappointing, but not surprising.”

“This just prolongs what’s already a complete embarrassment for the agency. The Court already rejected the SEC’s suggestion that Ripple acted recklessly, and there were no allegations of fraud and, of course, there were no victims or losses,” he said.

Meanwhile, Ripple CEO Brad Garlinghouse said the company is prepared to defend its position in court for as long as necessary.

“Let’s be clear: XRP’s status as a non-security is the law of the land today – and that does not change even in the face of this misguided – and infuriating – appeal,” he said.

Garlinghouse discussed the lawsuit last month at KBW2024 in Seoul, South Korea. He said he was uncertain about whether the SEC would appeal, yet he maintained that there was no viable way for the regulator to overturn the fundamental decision that “XRP is not, in and of itself, a security.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

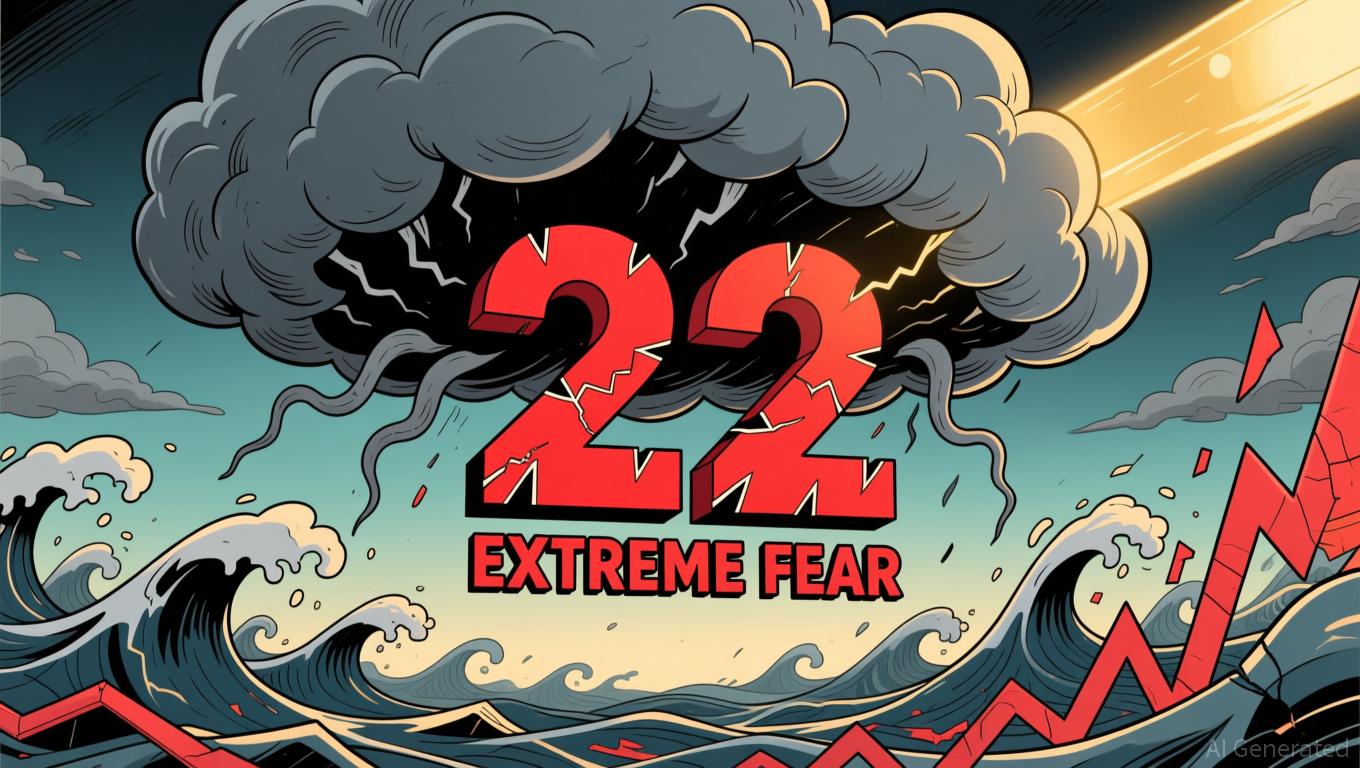

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou