Ethereum Faces Criticism Amid Whale Sell-Off and Price Decline

Ethereum is facing renewed skepticism as Ether prices drop and a notable whale has begun selling off substantial amounts of ETH acquired during the 2014 initial coin offering.

Earlier today Lookonchain revealed that this Ethereum ICO participant has been actively liquidating their holdings, with approximately 19,000 ETH—valued at around $47.5 million—sold over the past two days alone. The selling activity, which began in late September, included an earlier transfer of over 12,000 ETH worth $31.6 million to Kraken.

Originally, this entity had accumulated 150,000 ETH during the ICO, which was worth about $46,500 back then but is now valued at nearly $400 million.

However, the price of ETH has plummeted around 10% since the beginning of October, dropping from $2,650 to an intraday low of $2,350—exceeding the broader crypto market’s decline.

READ MORE:

Controversial Theory Suggests Bitcoin Was Designed to Undermine the U.S. DollarThis downturn has sparked renewed criticism, with some traders commenting on the alarming sales by long-time holders. Yet, supporters of Ethereum are pushing back against the FUD (fear, uncertainty, doubt), emphasizing the platform’s growth and potential.

Despite the recent selling pressure, institutional interest appears to be reviving, as evidenced by a nearly $20 million inflow into nine spot Ether ETFs on October 2, primarily led by BlackRock. This was a significant rebound following a major outflow the day before. Meanwhile, Bitcoin ETFs experienced consecutive outflows totaling $53 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

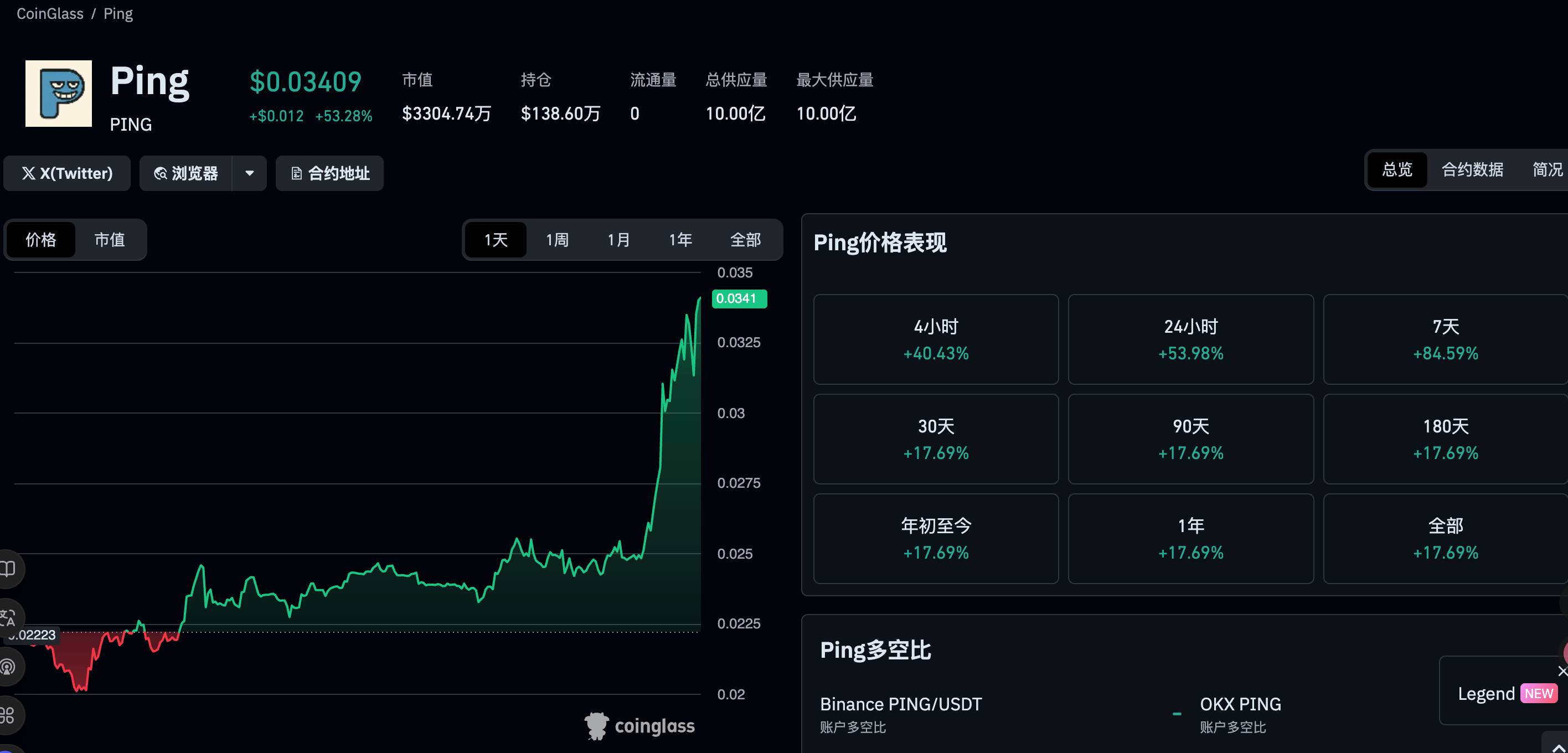

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

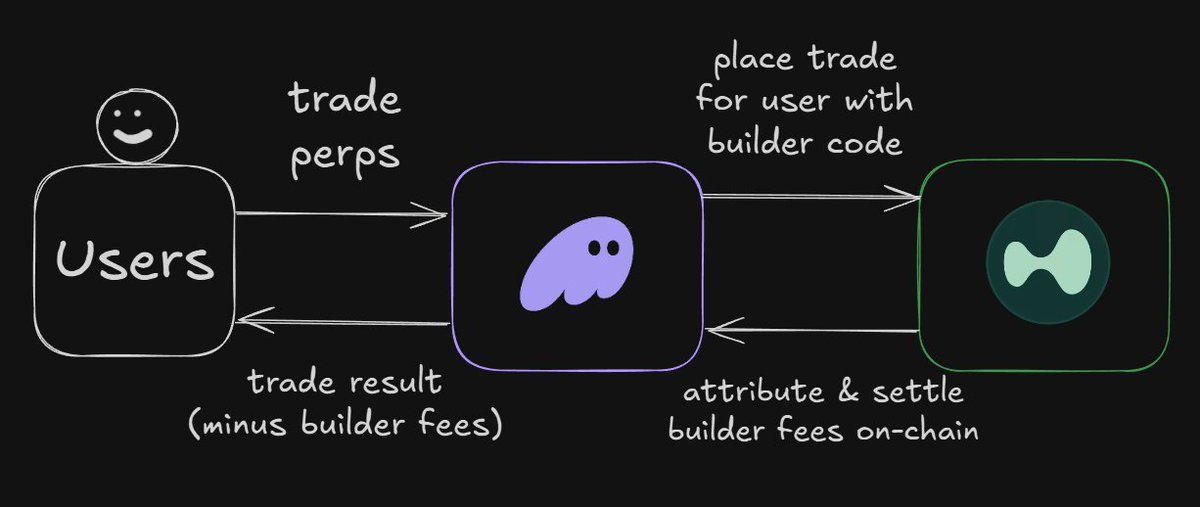

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

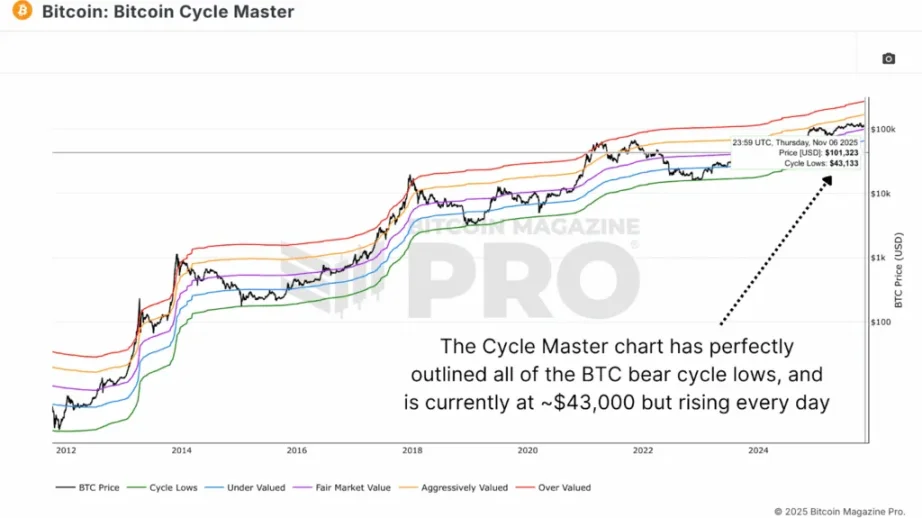

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.