Tether CEO: We are currently purchasing a large amount of U.S. debt and doubling our efforts to enhance communication and transparency

Tether CEO Paolo Ardoino said that Tether is "doubling its efforts" in communication and transparency.

Ardoino also stated: "Compared to the United Arab Emirates, Australia, and Spain, Tether has more treasury bills. Treasury bills are considered a low-risk investment. Tether has decentralized the decision-making power of selling US debt, we are looking for hundreds of millions of new US bond buyers because through us, we can expose these emerging markets to the world's best currency while in this process, we are purchasing a large amount of U.S. debt."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Stablecoin circulating market cap returns to $305 billions, with a cumulative increase of 0.8% recently

S&P 500 index futures rise 0.2%

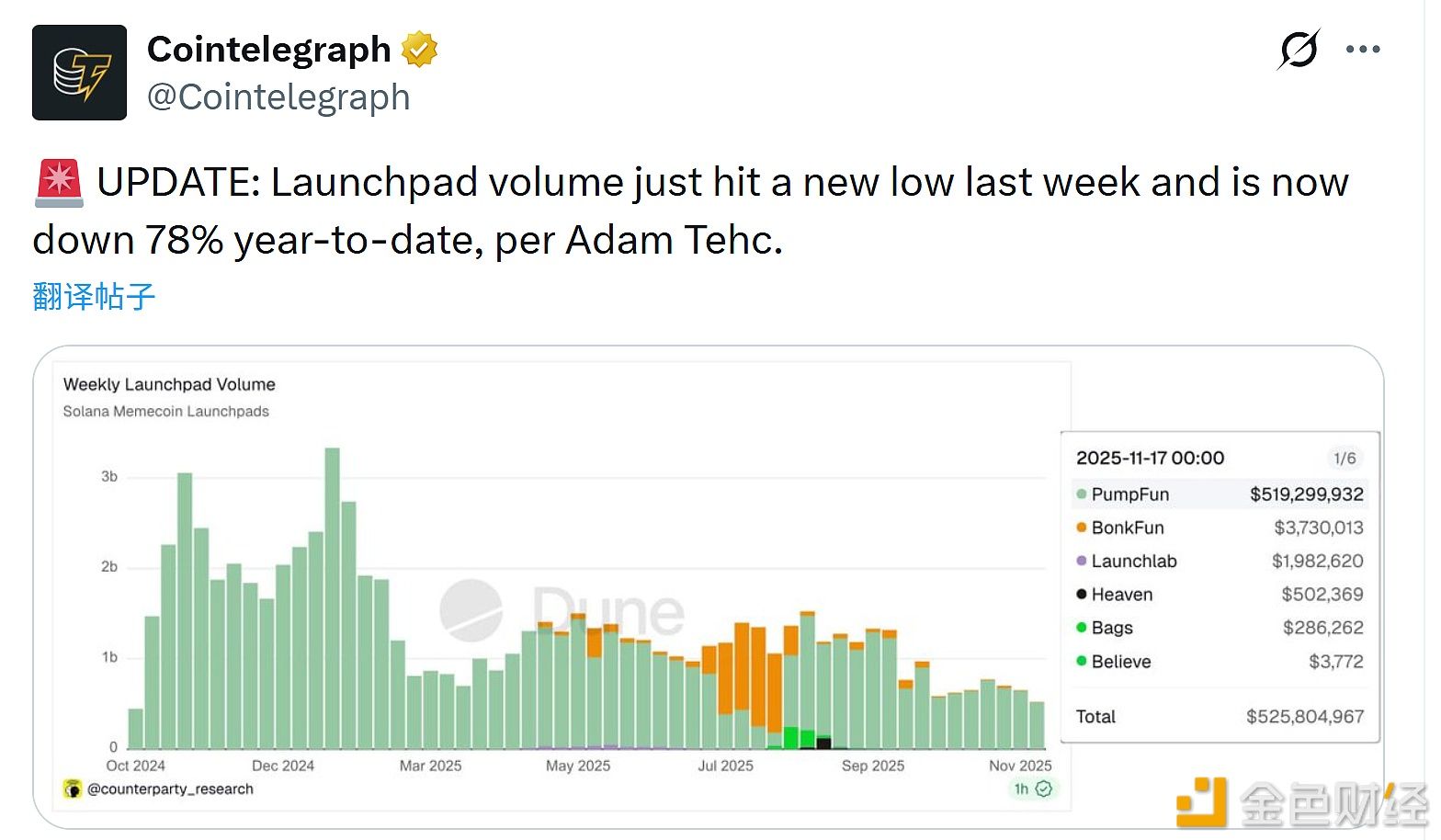

Adam Tech: Launchpad trading volume hit a new low last week