MicroStrategy stock reaches 25-year high at $245 ahead of Q3 earnings report

Key Takeaways

- MicroStrategy's stock reached a 25-year high of $245 ahead of its Q3 earnings report.

- The MSTR/BTC Ratio hits a record high, reflecting strong performance relative to Bitcoin.

MicroStrategy (MSTR) stock surged after the US markets opened Friday, rising from around $235 to $245, its highest level over the past 25 years, data from Google Finance shows. The jump comes ahead of the company’s third-quarter earnings report, which is set to be released next Wednesday.

At the time of reporting, MSTR cooled off to around $242, but it still outperforms the S&P 500. Data shows that MicroStrategy’s stock has increased by 286% year-to-date while the S&P 500 has gained around 37% during the stretch.

Over the past five years, MicroStrategy has experienced a staggering 1,588% increase in its stock price, surpassing the S&P 500’s 94.18% return.

MicroStrategy’s stock tends to perform in tandem with the broader crypto market, particularly Bitcoin, due to the company’s close ties to the largest crypto asset.

According to the MSTR tracker , the MSTR/BTC Ratio, which provides insights into how MicroStrategy’s stock value trends in relation to Bitcoin’s market movements, hit an all-time high of 0.354. This indicates that the stock has been performing well relative to Bitcoin.

The company’s net asset value (NAV) has also seen growth, with the NAV premium approaching 3, the highest since early 2021.

According to CoinGecko data , Bitcoin edged closer to the $69,000 level after resurging above $68,000 in the early hours of Friday. It has since corrected below $68,000, but still outperformed the broader market.

MSTR is about 23% away from its previous all-time high of $313 in March 2020. Its market cap now sits at around $44 billion. If MicroStrategy’s Bitcoin playbook proves successful, its stock price may hit new highs in the future.

Since adopting the strategy, MicroStrategy has seen its stock outperform Bitcoin itself. It is currently the world’s largest corporate holder of BTC, owning over 252,000 BTC, valued at around $17 billion at current prices.

The company shows no intention of selling its Bitcoin holdings. Instead, it plans to accumulate more coins using diverse funding methods.

As the company’s Bitcoin stash grows over time, so does its ambition. MicroStrategy’s CEO Michael Saylor projected a vision for the company to become a leading Bitcoin bank with a possible trillion-dollar valuation through strategic US capital market maneuvers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

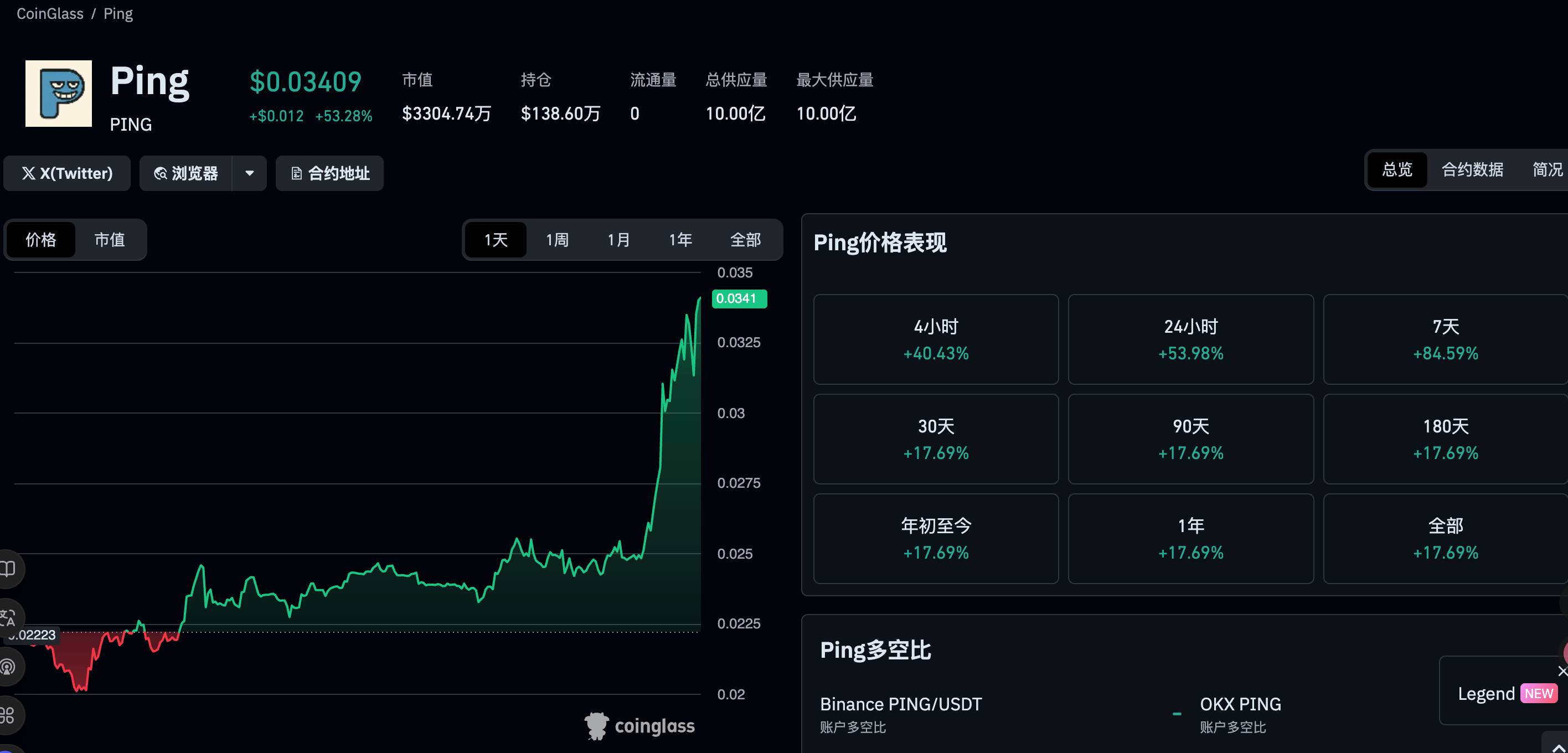

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

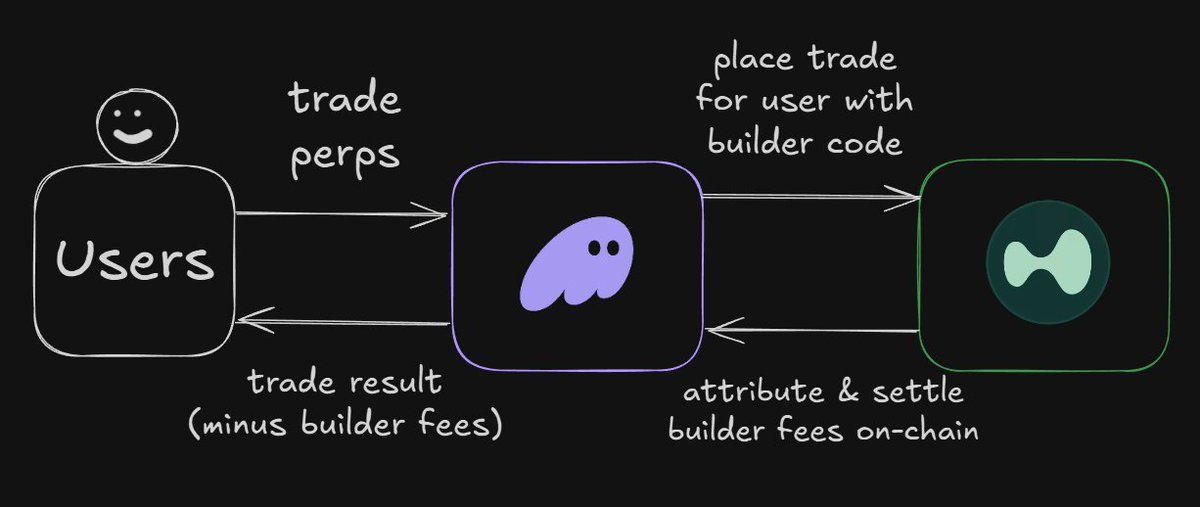

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

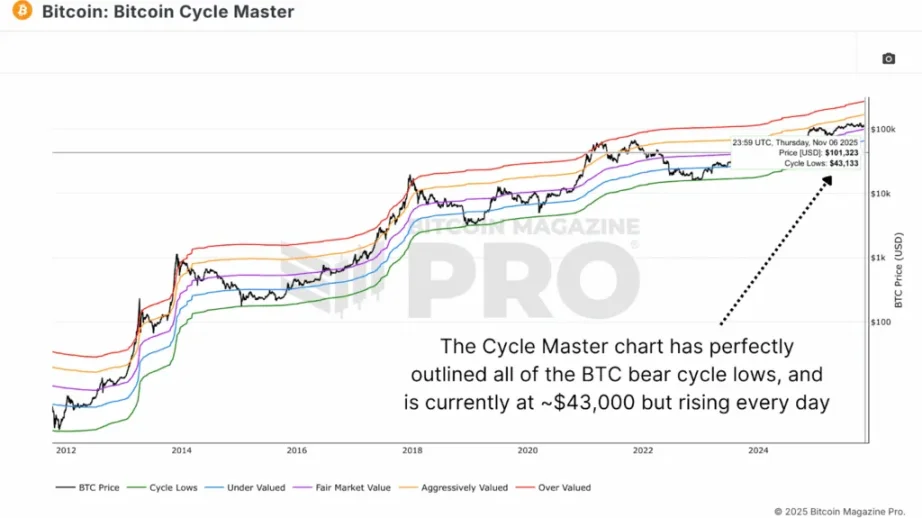

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.