RoOLZ Community Sale Info

RoOLZ is the first IP of RoOLZ Studio Inc. - a Community Orientated Entertainment company with RoOLZ Season 1 as its first IP. RoOLZ LLC is a company that is integrating Animated Content, Mobile Apps on Telegram with Digital Collectibles which shall be known by its Ticker: $GODL.

More information on RoOLZ will be published soon.

-

A community sale in the crypto world is a type of token sale where a project reserves a portion of its token supply to its community members.

-

The aim of this is to reward community participation and ownership amongst the community.

-

The Community Sale is taking place in October in the RoOLZ App.

-

The Community Sale has the same valuation as our private investors.

$GODL is the ticker and name of the RoOLZ token. $GODL is used for Governance, Staking, Rewards and Play To Earn Mechanics. $GODL can be used to influence the outcome of the Anime, sponsor RoOLZ episodes or in-app, or decide on future content to be produced.

RoOLZ has raised $1M in funding from (Institutional) Private investors as Yolo Ventures, Contango Digital and TON Ventures. These investors allow the RoOLZ Company to produce further content, pay its employees, and build new apps surrounding the Entertainment Studio.

The valuation for RoOLZ ($GODL) is the same for Private Investors as participants in the Community Sale and is accessible to the public

📱 The RoOLZ App Stats

RoOLZ currently has 8M App Users, with 3.5MAU. RoOLZ has 5M+ followers on Telegram, 650K on Twitter, and 450K combined on Instagram Tiktok. App Link: T.me/roolzquest_bot

Participation happens in the RoOLZ Telegram App on sale date (expected on OCT 25): T.me/roolzquest_bot *This sale is for >1000 GEM Holders, that have connected their wallet.*

Access can be acquired by owning a RoOLZ NFT that can only be acquired from GetGems. You can earn a Level 50, 75 or 100 NFT by playing the game (also tradable on GetGems). If you own these NFT's on the snapshot date you can participate.

NFTs can be found and bought here:

RoOLZ Game

You can also receive one of these NFTs by playing the game free of cost. Level NFT's are also given as a prize to community events. Just follow us and get yours! Participation Tiers:

💎 Diamond: Tier: 6+ RoOLZ NFT's or GOD NFT Max Purchase: $1000 Min Purchase: $500 🥇 Gold Tier: RoOLZ NFT or Level 100 NFT Max Purchase: $300 Min Purchase: $100 🥈 Silver Tier: Level 75 NFT Max Purchase: $100 Min Purchase: $50 🥉 Bronze Tier: Level 50 NFT Max Purchase: $50 Min Purchase: $25 OCT 25: 1000 GEM Holders 8,000,000 GODL (1%) of Supply Max Purchase: $50 Min Purchase: $25

-

Name: $GODL

-

Total Supply: 800,000,000

-

Community Sale Supply: 96,000,000

-

Price $0.01

-

Valuation: $8,000,000 FDV

-

Est. Market Cap: $2,900,000 on TGE

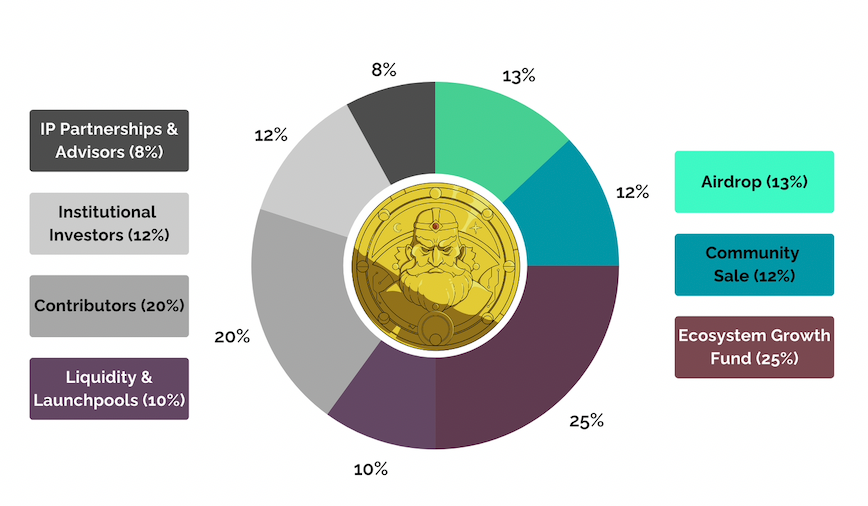

$GODL Distribution

Highlights:

-

13% Airdrop, 100% on TGE

-

12% Community Sale, 100% on TGE

-

Rest is on a Vesting Schedule

-

Community Sale Private Sale Participants joint at the same valuation

-

Price can fluctuate based on denominator (TON) with which participants participate

-

Contributors: The Contributors behind RoOLZ will get 0% on TGE and are on a vesting schedule to foster long-term commitment to RoOLZ

|

Airdrop |

Gem- NFT Holders |

13% |

100% at TGE |

|

Community Sale |

Community Participants |

12% |

100% at TGE |

|

Ecosystem Growth Fund |

IP Funding, Play-to-Earn, development |

25% |

Over 2 years |

|

Liquidity Launchpools |

$GODL Token Liquidity for CEX and DEX Listings |

10% |

At listing |

|

Contributors |

Team and builders behind RoOLZ |

20% |

0% at TGE, 1 Year Vesting |

|

Institutional Investors |

Strategic Investors, fueling expansions |

12% |

TGE Unlock, 11-month vesting |

|

IP Partnerships Advisors |

Collaborations of New IP launching through RoOLZ Token Launch Partners |

8% |

0% at TGE, 1 Year Vesting |

Other Explainers:

More information on the Airdrop coming soon.

TGE stands for Token Generation Event. This is the day the tokens will get listed on Exchanges and you can Claim your tokens.

Disclaimer:

We reserve the right to amend this information from time to time. If any part of this information is deemed invalid by law, the rest of the agreement will still be binding. Please, re-check this document closer to the date. Read the disclaimer at the top of this page - none of this information is investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether (USDT) Price Fluctuations and Market Response to PENGU Sell Indicators: Assessing Potential Risks and Opportunities within a Divided Stablecoin Landscape

- Tether (USDT) faced 2025 depegging to $0.90, exposing reserve management flaws and triggering S&P's "weak" stability rating. - Algorithmic PENGU USDT's 28.5% price drop and $66.6M team outflows highlighted systemic risks in opaque collateral structures. - Regulatory shifts (GENIUS Act, MiCA) accelerated migration to compliant stablecoins like USDC , now dominating 30% of on-chain transaction volume. - Market fragmentation reveals dual dynamics: algorithmic risks vs. institutional adoption opportunities i

DASH Increases by 2.44% as Significant Insider Selling and Purchase Indicators Emerge

- DASH rose 2.44% in 24 hours to $50.1, showing a 31.63% annual gain despite a 11.79% seven-day drop. - High-ranking insiders sold millions via 10b5-1 plans, including $9. 3M by Stanley Tang and $6.19M by Andy Fang. - Alfred Lin’s $100.2M purchase signaled confidence, contrasting with other sales and suggesting undervaluation. - Market reacted positively short-term, but analysts expect macroeconomic and business fundamentals to support DASH ahead.

BCH Rises 36.52% Over the Past Year as Network Enhancements and Improved Mining Efficiency Drive Growth

- Bitcoin Cash (BCH) rose 36.52% in a year due to network upgrades and improved mining efficiency. - Growing merchant adoption boosts real-world use cases, enhancing BCH’s practical appeal. - Analysts predict continued momentum from stable updates and adoption efforts amid crypto volatility. - Recent stability, with no major forks, strengthens investor confidence in BCH’s scalability.

Why is COAI experiencing a downturn towards the end of 2025

- COAI token and index collapsed in late 2025 due to deteriorating market fundamentals, governance failures, and regulatory uncertainty. - C3 AI's Q3 2025 revenue growth (26% YoY) was overshadowed by Q1 2026 revenue decline (20% YoY) and leadership instability, eroding investor trust. - Token centralization (87.9% in ten wallets) and lack of transparent governance exacerbated liquidity crises and manipulation risks. - The CLARITY Act's ambiguity and jurisdictional loopholes deepened uncertainty, deterring