Blast Royale: $500K raised within 15 minutes of the Open Pool opening

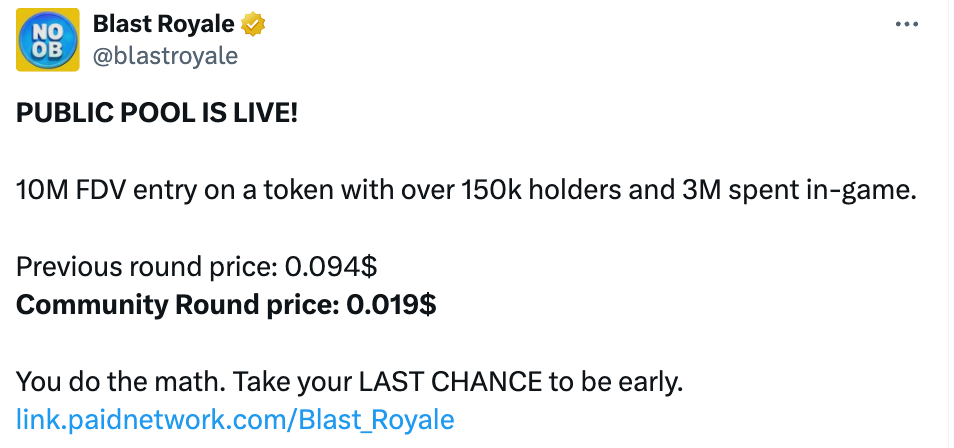

On November 13, Blast Royale published a post on the X platform, announcing that the Blast Royale token NOOB has opened a public fundraising (Public Pool). After the token was opened for fundraising, the funds raised reached $500,000 in 15 minutes.

The community round price of the Noob token was $0.019, and the price in the previous round was $0.094. The current FDV of Blast Royale token is $10 million, and the holders exceed 150,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Texas Invests $5 Million in Bitcoin ETF, Strengthening Cryptocurrency’s Standing Among Institutions

- Texas becomes first U.S. state to allocate $5M to BlackRock’s Bitcoin ETF as part of state-level crypto reserve. - Investment follows market dip near $87,000, with plans to transition to direct Bitcoin custody later. - Despite $1.09B in ETF outflows, Texas cites confidence in regulated Bitcoin exposure via IBIT . - Move aligns with broader institutional adoption trends as Bitcoin nears seven-month lows amid macroeconomic uncertainty.

Ethereum News Today: "MegaETH's $5 Billion Stablecoin Rollout Stumbles Amid Technical Issues and Security Breaches"

- MegaETH scrapped its USDm stablecoin pre-deposit plan after technical glitches and user exploits caused a $1B cap to surge to $5B within minutes. - KYC system failures and a misconfigured 4-of-4 multisig transaction allowed unauthorized deposits to exceed the initial $250M threshold rapidly. - A suspected crypto whale exploited pre-signed workflows to accelerate allocations, triggering unfair access and forcing a withdrawal mechanism for affected users. - Despite the chaos, MegaETH maintains its 2026 mai

Bitcoin News Update: Crypto Market's "Extreme Fear" Index Hits 15—Could This Indicate a Historical Bottom?

- Crypto Fear & Greed Index hits 15 ("extreme fear"), with Bitcoin trading below $90,000 after 30% drawdown from $126,000 peak. - $3.5B ETF outflows in November and $4.6B stablecoin cap contraction highlight liquidity strains, while Kaspa (KAS) and Quant (QNT) see isolated gains. - 10x Research notes historical correlation between index lows (<5) and market bottoms, citing March 2025 $76,000 Bitcoin floor as precedent. - Crypto IPOs face 31% average Q4 decline, with 2026 recovery expected amid macroeconomi

ICP Jumps 30% Following Significant Network Update and Increased Institutional Interest

- Internet Computer (ICP) surged 30% in Q3 2025 due to network upgrades, institutional adoption, and AI-driven innovations like Caffeine. - Strategic partnerships with Microsoft Azure and Google Cloud boosted infrastructure scalability, while TVL grew 22.5% to $1.14B amid 2,000 new developers. - Compute capacity rose 50%, but dApp engagement fell 22.4%, highlighting tensions between technical progress and user adoption. - Speculative trading spiked 261%, raising concerns about overvaluation, while regulato