Why is Ethereum Name Service (ENS) Price UP?

Ethereum Name Service (ENS) has been making waves in the crypto world, and its price has just shot up by an impressive 41% in the last 24 hours, reaching $35. But what’s behind this sudden spike? Is it a new feature, increased adoption, or just market hype? In this ENS price prediction article, we’ll break down the reasons fueling ENS’s rise and what it could mean for its future. Let’s dive in!

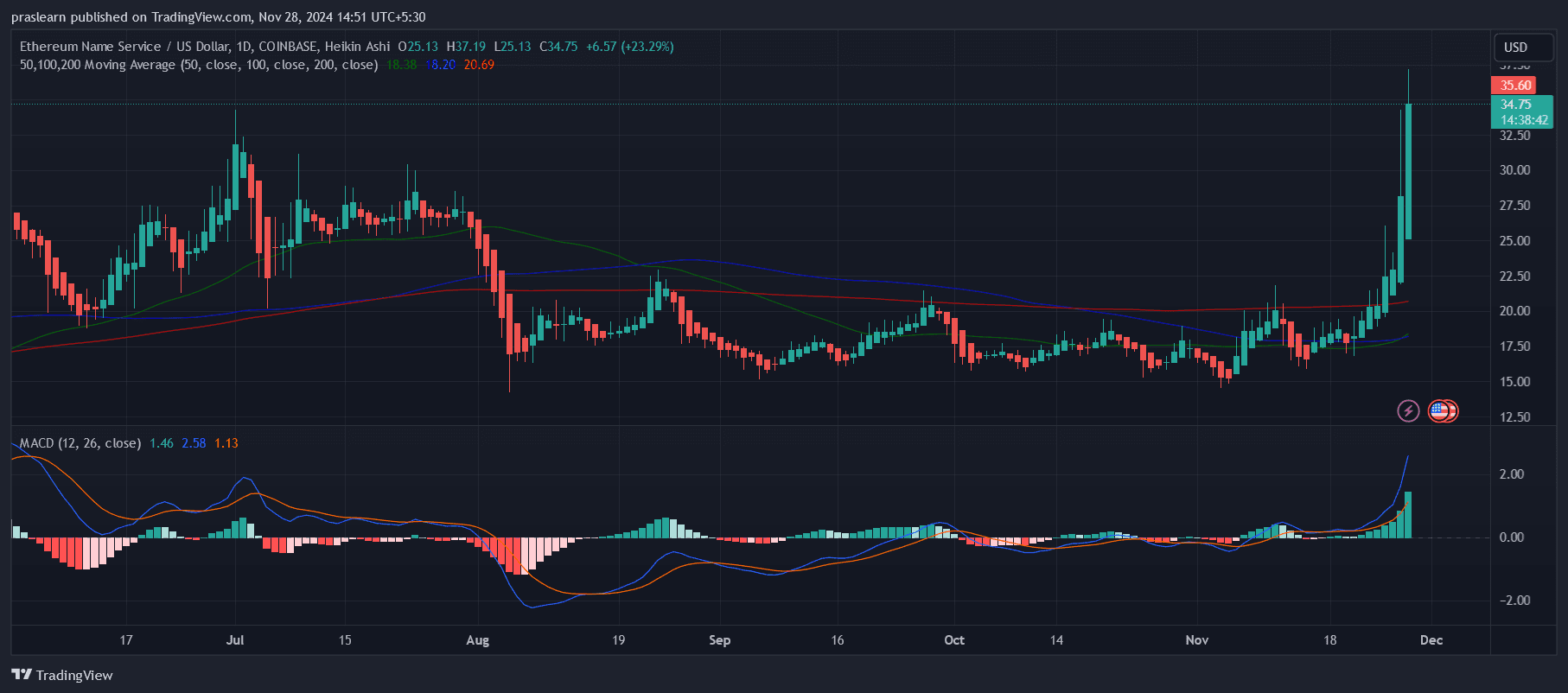

How has the Ethereum Name Service (ENS) Price Moved Recently?

ENS/USD Daily chart- TradingView

ENS/USD Daily chart- TradingView

The current price of ethereum Name Service (ENS) stands at $35.23 , with a 24-hour trading volume of $4.56 billion. Its market capitalization has reached $1.16 billion, accounting for a market dominance of 0.03%. Over the past 24 hours, the ENS price has surged by an impressive 45.67%.

Ethereum Name Service price hit its all-time high of $83.40 on November 11, 2021, while its lowest point was recorded on October 20, 2023, at $6.69. Following this cycle low, the highest price ENS has achieved is $37.16. The market sentiment around ENS remains bullish, with the Fear Greed Index indicating a score of 77, signifying "Extreme Greed."

Currently, the circulating supply of ENS is 33.06 million tokens, out of a maximum supply of 100 million. The annual supply inflation rate is 9.70%, with 2.92 million ENS tokens minted in the past year.

Why is Ethereum Name Service (ENS) Price UP?

The sharp rise in the price of Ethereum Name Service (ENS) is fueled by a combination of strong on-chain activity, bullish market sentiment, and a pivotal endorsement from Coinbase CEO Brian Armstrong. This convergence of factors has positioned ENS as a cornerstone in the evolving decentralized identity ecosystem, driving investor confidence and market demand.

Recent on-chain data reveals a significant uptick in both transaction count and velocity for ENS since late October. These metrics highlight the increasing utility and adoption of the token within its ecosystem.

Transaction count, which measures unique daily network transactions, indicates growing user activity and confidence in Ethereum Name Service price as a functional asset. Meanwhile, the rising velocity of the token, reflecting how often it changes hands, points to its growing role in daily blockchain interactions. Combined, these metrics paint a picture of a robust and active network, laying the foundation for sustained price appreciation.

Adding to this momentum is the 90-day Market Value to Realized Value (MVRV), which remains positive. This indicator suggests that ENS token holders are experiencing unrealized profits, creating a psychological barrier to sell and fostering a sense of optimism for further gains. This positive sentiment amplifies the token’s upward momentum, as investors increasingly view ENS as a valuable long-term asset.

A key catalyst for ENS’s recent surge was the endorsement by Coinbase CEO Brian Armstrong, who publicly described ENS as a crucial piece in the decentralized identity puzzle. Armstrong's statement, "The Internet of Money is happening," underscores the transformative potential of blockchain-based identities, with ENS playing a pivotal role. By linking user-friendly domain names to Ethereum addresses, ENS simplifies blockchain interactions, making it an integral tool for mainstream adoption.

Armstrong’s vision outlined ENS as part of a broader ecosystem essential for consumer utility. Alongside solutions like smart wallets to reduce onboarding friction and stablecoins like USDC for a reliable medium of exchange, ENS provides the identity layer needed to connect users seamlessly to decentralized applications. This endorsement from a high-profile industry leader not only validated ENS’s utility but also attracted new interest from investors and developers eager to capitalize on its growing relevance.

What’s Next for ENS?

The combination of increasing on-chain activity and strategic positioning within the blockchain ecosystem suggests a bullish outlook for ENS. The Coinbase CEO’s recognition of ENS as a fundamental element of decentralized identity has sparked renewed interest, encouraging both retail and institutional participation.

As the infrastructure for "The Internet of Money" continues to mature, ENS is likely to see further adoption, boosting its value proposition.

However, the trajectory of ENS’s growth is not without challenges. Broader macroeconomic factors, such as market volatility or changes in investor sentiment, could affect its price momentum. Additionally, competition from other decentralized identity solutions could impact its dominance in the long term.

Ethereum Name Service’s price surge reflects its growing importance in the blockchain ecosystem, bolstered by strong on-chain metrics and a game-changing endorsement from Coinbase’s Brian Armstrong . Positioned as a key enabler of decentralized identity, ENS is benefiting from increased network activity and heightened investor interest.

With its role firmly established in the foundational layers of blockchain infrastructure, ENS is poised for further growth as blockchain adoption accelerates. However, maintaining its momentum will require continued innovation and a favorable market environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Babylon partners with Aave Labs to launch native Bitcoin-backed lending services on Aave V4

Babylon Labs, the team behind the leading Bitcoin infrastructure protocol Babylon, today announced the establishment of a strategic partnership with Aave Labs. Both parties will collaborate to build a native Bitcoin-backed Spoke on Aave V4 (the next-generation lending architecture developed by Aave Labs). This architecture adopts a Hub and Spoke model, aiming to support markets built for specific scenarios.

With both buyback and presale as dual engines, can Clanker reignite the Base craze?

What are the features and innovations of the Clanker presale mechanism?