Solana (SOL) Longs Seek Recovery After $60 Million Liquidation Setback

Solana faces bearish pressure after $60M liquidations, but bullish sentiment among longs persists. Can SOL reclaim $210 and rally further?

Solana (SOL) traders seem confident that the recent decline in the altcoin’s price is only a brief decline instead of a long-haul choppy period. This is evident from the position Solana longs has taken since the broader market liquidation, which ran into hundreds of thousands of dollars.

But do indicators agree with this sentiment? Here is a thorough analysis of the potential SOL price movement.

Solana Traders Confident in the Altcoin’s Recovery

According to Coinglass, the Solana Long/Short ratio is 1.14. As the name implies, the long/short ratio acts as a barometer of traders’ expectations in the market. When the ratio is below, it means there are more shorts than longs in the market.

A reading above 1, however, signifies more longs than shorts. For context, longs are traders with positions anticipating a price increase. Shorts, on the other hand, are traders expecting a decrease.

Therefore, the current ratio indicates that Solana longs are dominant in the market. Hence, the average sentiment is bullish and, if validated, could turn profitable for these traders. Interestingly, this is happening at a time when the market faced the highest number of liquidations in the last few days.

Solana Long/Short Ratio. Source:

Coinglass

Solana Long/Short Ratio. Source:

Coinglass

Over the past 24 hours, SOL liquidations have totaled approximately $60 million. Of this amount, long positions accounted for over $57 million, while shorts made up the rest. Liquidations occur when a trader’s margin falls short, prompting the exchange to close the position to prevent further losses.

This wave of liquidations was triggered by Solana’s price dropping below $215, sparking a cascade of margin calls and forced closures.

Solana Liquidations. Source:

Coinglass

Solana Liquidations. Source:

Coinglass

SOL Price Prediction: Not Yet Time for a Rebound

On the daily chart, the SOL price has dropped below the 20 and 50 Exponential Moving Averages (EMA), which are technical indicators that measure trend direction.

When the price is above the EMA, the trend is bullish. On the other hand, if the price is below the EMA, the trend is bearish, which is the case with the SOL price.

Another noticeable trend on the chart below is that the SOL price is trading below the demand zone at $210. If the altcoin fails to recover above this zone, the correction might intensify, and the token’s value might decline to $189.36.

Solana Daily Analysis. Source:

TradingView

Solana Daily Analysis. Source:

TradingView

However, if Solana sees increased buying pressure, the trend might reverse, and it could rally toward $264.66.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

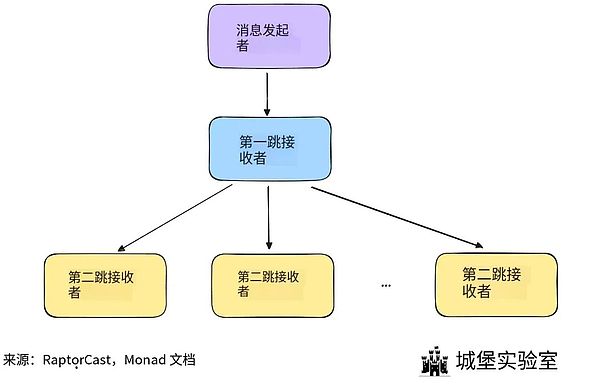

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

Grayscale formalizes its IPO filing