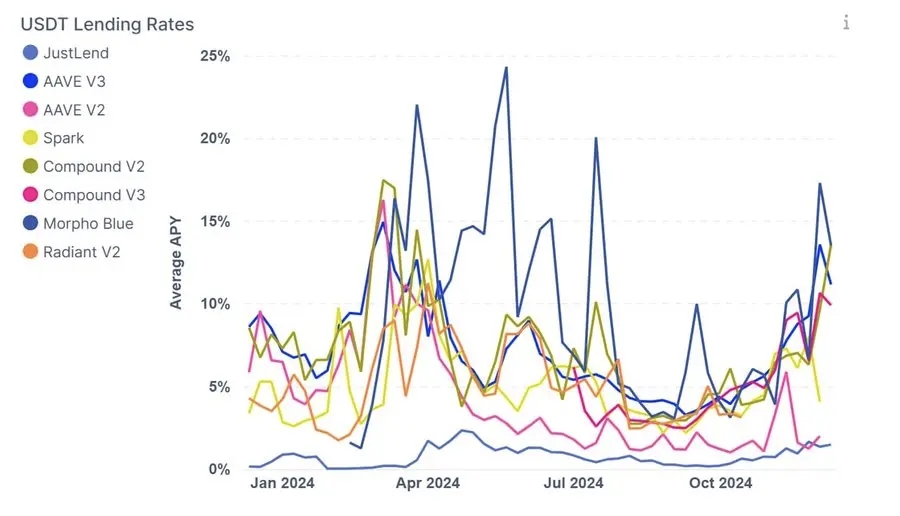

Data: The lending rate in the DeFi market has reached a new high since 2022, with Aave seeing a net inflow of funds reaching 500 million US dollars this week

According to IntoTheBlock data, with users extensively using WBTC and WETH as collateral for borrowing stablecoins, the DeFi lending market has welcomed a new wave of popularity. The lending rate has broken through 10%, with some projects reaching up to 40%, setting a new high since the bull market in 2022. The largest lending protocol on Ethereum, Aave, had a net inflow of funds reaching $500 million this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Suspected BitMine address increases holdings by 20,532 ETH

Data: 400 millions USDT transferred out from a certain exchange detected

Circle issues 500 million USDC on Solana