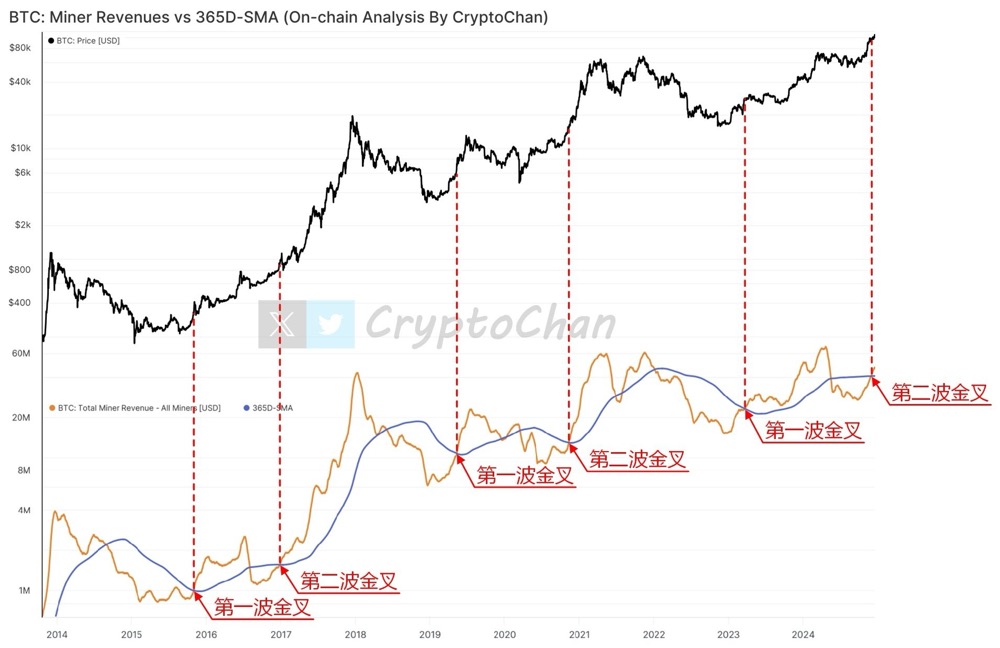

Indicator update: BTC completes the second wave of golden cross, historical signals reappear!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market in "Extreme Fear" as Market Braces for Bitcoin to Drop Towards $80,000

The cryptocurrency market is crowded with investors who have suffered such deep losses that they cannot continue buying in, yet are unwilling to cut their losses.

Arthur Hayes’ New Article: BTC May Drop to 80,000 Before Kicking Off a New Round of “Money Printing” Rally

The bulls are right; over time, the money printer will inevitably go “brrrr.”

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.