Galaxy Research Unveils H1 and Q4 2025 Price Targets for Bitcoin, Sees Ethereum Hitting New Highs Next Year

The research arm of Galaxy Digital is revealing its predictions for the two largest crypto assets in 2025.

In a new thread on the social media platform X, Galaxy Research’s Alex Thorn says he sees Bitcoin ( BTC ) surging by nearly 100% from current levels before 2025 expires amid increasing adoption of the largest digital asset by market cap.

“Bitcoin will cross $150,000 in H1 and test or best $185,000 in Q4 2025.

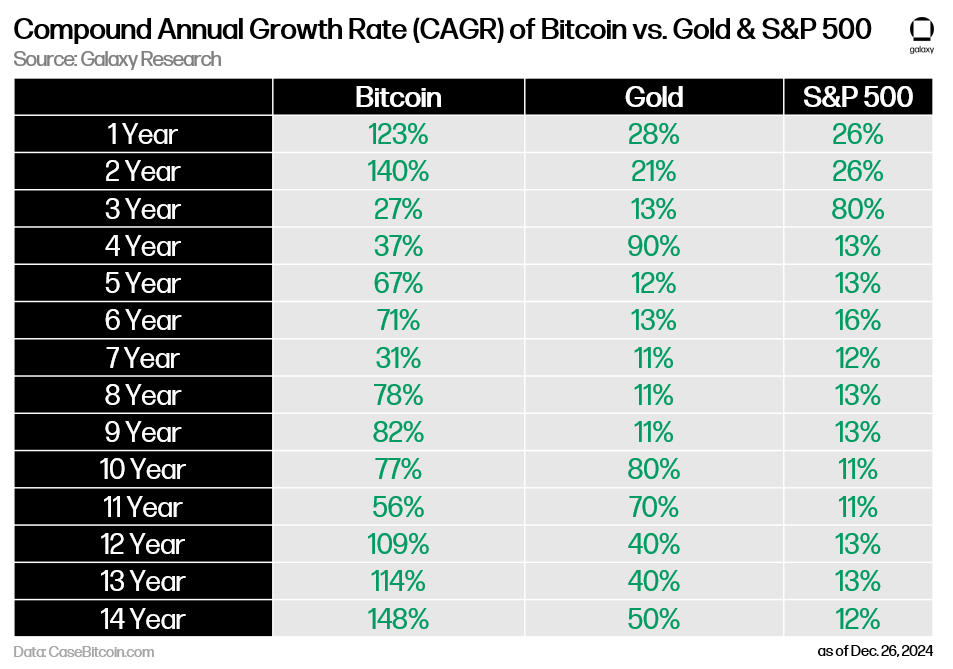

A combination of institutional, corporate, and nation-state adoption will propel Bitcoin to new heights in 2025. Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the SP 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of gold’s market cap.”

Source: Galaxy Research/X

Source: Galaxy Research/X

Thorn also believes that Bitcoin exchange-traded products (ETPs) will witness tens of billions of dollars in inflows next year.

“The US spot Bitcoin ETPs will collectively cross $250 billion in AUM (assets under management) in 2025.

In 2024, the Bitcoin ETPs collectively took in more than $36 billion in net inflows, making them the best ETP launch as a cohort in history. Many of the world’s major hedge funds bought the Bitcoin ETPs, including Millennium, Tudor, and D.E. Shaw, while the State of Wisconsin Investment Board (SWIB) bought a position, according to 13F filings.

After just 1 year, the Bitcoin ETPs are only 19% away ($24 billion) from flipping the AUM of all the US physical gold ETPs.”

Data from crypto analytics firm Coinglass shows that Bitcoin exchange-traded funds (ETFs) collectively have nearly $110 billion in AUM. At time of writing, Bitcoin is trading for $93,687.

Looking at Ethereum ( ETH ), Thorn predicts that the leading layer-1 protocol will see fresh all-time highs next year.

“Ether will trade above $5,500 in 2025.

A relaxation of regulatory headwinds for DeFi (decentralized finance) and staking will propel Ether to new all-time highs in 2025.

New partnerships between DeFi and TradFi (traditional finance), perhaps conducted inside new regulatory sandbox environments, will finally allow traditional capital markets to experiment with public blockchains in earnest, with Ethereum and its ecosystem seeing the lion’s share of use.

Corporations will increasingly experiment with their own layer-2 networks, mostly based on Ethereum technology. Some games utilizing public blockchains will find product-market fit, and NFT (non-fungible token) trading volumes will meaningfully rebound.”

At time of writing, ETH is trading at $3,420.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/WhiteBarbie/Troyan

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing CSCOUSDT, PEPUSDT, ACNUSDT STOCK Index perpetual futures

Stock Futures Rush: Trade popular stock futures and share $250,000 in equivalent TSLA tokenized shares. Each user can get up to $8,000 TSLA.

Bitget margin trading to support BGB cross margin trading and loans

Bitget margin trading to support BGB cross margin trading and loans