Bitcoin whales accumulate 1,002 BTC daily

Following a price correction after Donald Trump's inauguration, Bitcoin (CRYPTO:BTC) whales have resumed significant accumulation, acquiring an average of 1,002 BTC daily.

This activity comes in the wake of Bitcoin's record high of over $109,000 on January 20, which was followed by a decline as initial policies from the new administration failed to address the cryptocurrency market effectively.

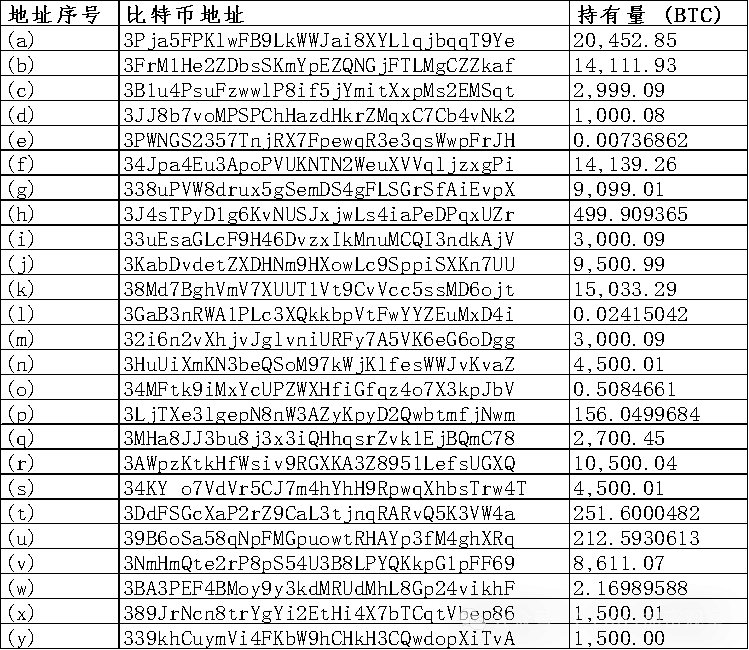

Data from Santiment indicates that wallets holding more than 10 BTC have been actively accumulating during this period, contributing to a 2.8% price increase over the last five days.

Historically, whale activity has been a strong indicator of market trends.

For instance, from July to October 2024, a daily accumulation of 164 BTC coincided with a 7.3% price decline.

However, this trend shifted dramatically in subsequent months with higher accumulation rates leading to notable price increases.

The most substantial accumulation occurred between November and December 2024 when whales added 2,060 BTC daily, resulting in a remarkable 35.8% price surge.

Current whale activities suggest renewed confidence among large holders, despite the recent volatility in the market.

High accumulation rates are often seen as a sign of optimism, while stagnation can indicate potential corrections.

The post-inauguration period has also seen increased speculation regarding crypto-related executive orders, contributing to market volatility.

As traders adjust their positions, approximately $816 million in long positions were liquidated following the inauguration.

QCP Capital has noted that Bitcoin volatility remains elevated and anticipates continued fluctuations as markets await further developments regarding Trump's policies on cryptocurrencies.

In addition to individual whale movements, states like Texas and Massachusetts are exploring proposals for independent crypto reserves, signaling growing institutional interest in Bitcoin.

At the time of reporting, the Bitcoin (BTC) price was $105,960.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Argentina Web3 Industry Report: A Digital Ark Amid the Inflation Tsunami

Argentina represents a significant real-world use case for cryptocurrency driven by economic necessity.

The U.S. "national team" turns on itself: The perfect scam of swallowing 127,000 bitcoins

ZK Roadmap "Dawn": Is the roadmap to Ethereum's endgame accelerating across the board?

ZKsync has become a representative project of the Ethereum ZK track and has shown outstanding performance in the RWA sector, with on-chain asset issuance second only to the Ethereum mainnet. Its technological advancements include a high-performance sequencer and privacy chain architecture, accelerating Ethereum's transition into the ZK era. Summary generated by Mars AI. The accuracy and completeness of this summary's content, generated by the Mars AI model, are still in the iterative update stage.

20x in 3 months, is the ZEC $10,000 prophecy coming true?