The UAE's SCA has released a draft regulation on the tokenization of securities and commodities, with public feedback accepted until February 14

The United Arab Emirates Securities and Commodities Authority (SCA) has issued a draft regulation for securities and commodity tokens, inviting public feedback before February 14, 2025. According to the draft, security tokens include equity tokens, bond tokens, Islamic bond tokens; commodity tokens include gold tokens, oil tokens etc. These tokens are all established on blockchain/DLT platforms and can be traded on virtual asset DLT platforms. Among them, security-type and commodity-type tokens can only be traded and settled through markets or alternative trading systems while bonds and Islamic bonds can be traded over-the-counter (OTC) and settled off-exchange.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

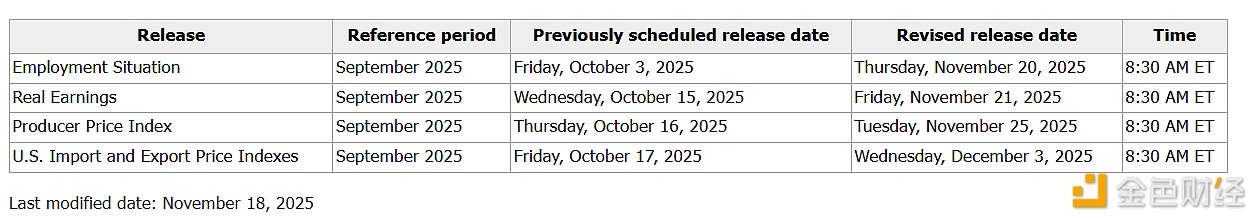

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.