Date: February 1, 2025 | 06:02 PM GMT

The cryptocurrency market is seeing a pullback today, with major altcoins trading in red as Ethereum (ETH) retesting its breakout level around $3,250.

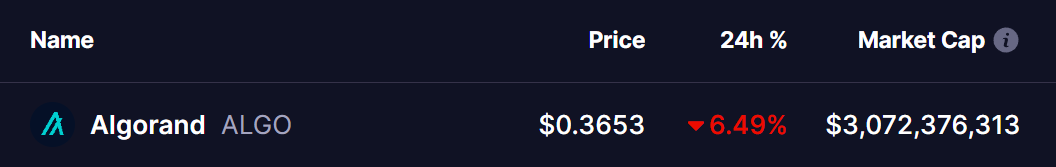

Amid this, Algorand (ALGO) is also experiencing a 6% decline, currently trading at $0.3653. However, a key technical setup suggests that a potential upside move could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Technical Analysis – Bullish Pennant Formation

According to crypto analyst @JohncyCrypto , Algorand is forming a bullish pennant pattern on the 12-hour chart, a structure often associated with strong upward moves after a period of consolidation.

Algorand (ALGO) 12H Chart/Source: @JohncyCrypto (X)

Algorand (ALGO) 12H Chart/Source: @JohncyCrypto (X)

Currently, ALGO is testing the lower support trendline of the pennant around $0.35. This level has held multiple times in recent weeks, making it a key zone for buyers to step in.

Another important technical factor is the 50-period moving average (MA 50), which is acting as a resistance near $0.39. If ALGO manages to break above this level, it could gain momentum and move toward the next resistance zones at $0.43, $0.50, and $0.60.

The Volume Profile suggests that a significant amount of buying has occurred in the $0.35-$0.36 range, indicating strong accumulation. Additionally, the Relative Strength Index (RSI) is approaching oversold territory, suggesting that selling pressure may be fading.

Final Thoughts – Breakout or Breakdown?

Algorand is at a key turning point. Holding $0.35 support and breaking above $0.39 (MA 50) could fuel a rally toward $0.43, $0.50, and $0.60. However, failure to hold support may lead to a drop toward $0.30-$0.32 before any recovery attempt.

Traders should keep a close eye on Ethereum’s movement and how ALGO reacts to the 50MA resistance in the coming days.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.