Stablecoins Quietly Balloon by $14B in January — Who’s Leading the Charge?

Recent data reveals the stablecoin sector has grown by an additional $14.429 billion in value since Jan. 1, signaling renewed momentum in digital asset markets. Leading this upward trajectory, the dollar-pegged sky dollar (USDS) experienced a 116% growth spurt during the same period, outpacing its peers in the top ten pack to claim the most pronounced expansion among major stablecoins.

Stablecoin Sector Hits $217B as Ethereum, Solana, Tron, and Base Drive Fresh Issuance

The latest data illustrates the stablecoin ecosystem has ballooned by a striking $14.429 billion in the past month, reflecting heightened activity in crypto markets. Figures from defillama.com detail a climb in the fiat-anchored digital asset economy from $202.867 billion to $217.296 billion as of Feb. 1, 2025.

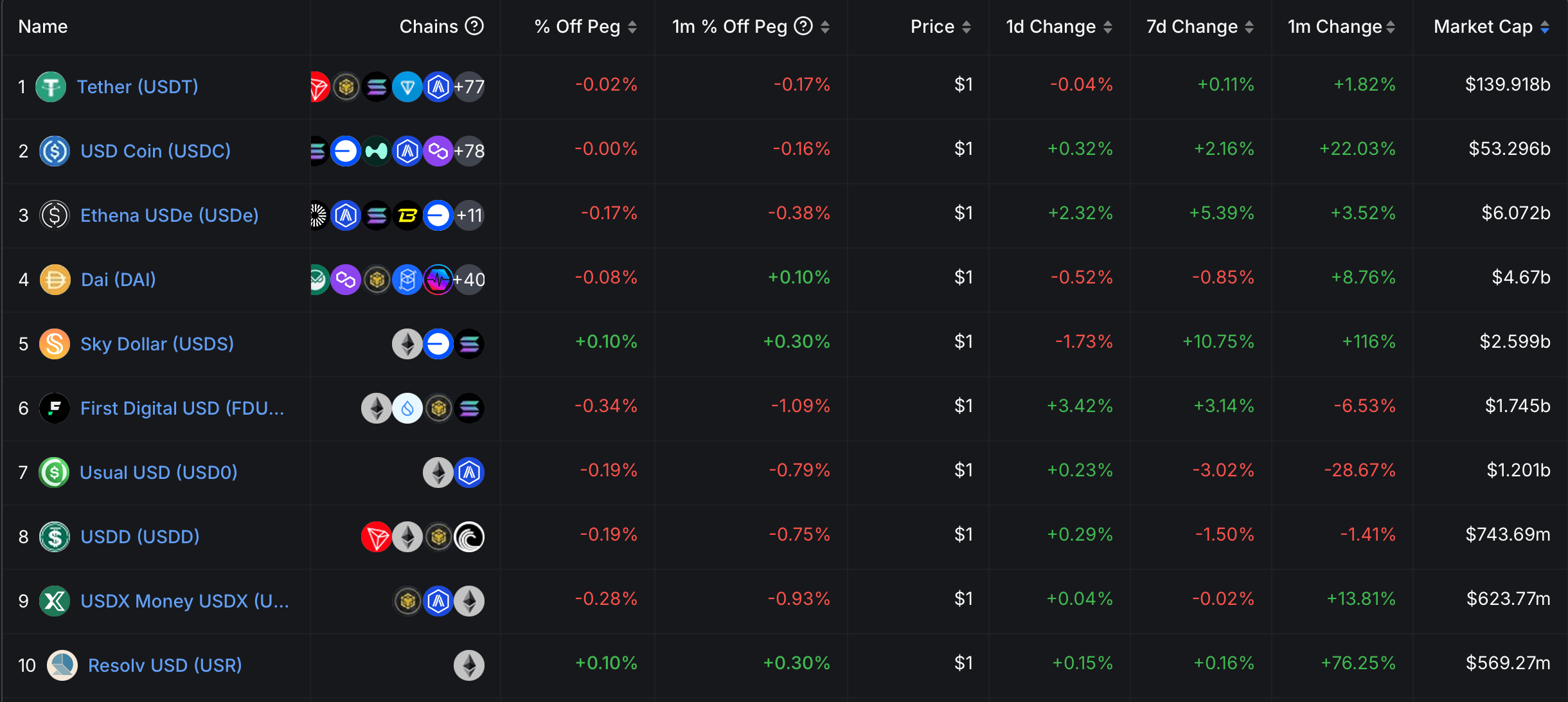

Seven of the top ten stablecoins recorded supply expansions, with industry titan tether (USDT) inching upward by a modest 1.82%. Dominating the growth charts, Sky’s USDS catapulted 116% in January to $2.599 billion, seizing the spotlight as this month’s unrivaled victor in terms of stablecoin growth.

Trailing closely, resolv usd (USR)—a protocol collateralized by ethereum (ETH) and hedged by perpetual futures plays—boosted its supply by 76.25%, now totaling $569.27 million. Circle’s USDC claimed third place with a 22.03% uptick since Jan. 1, solidifying its status as the sector’s second-largest asset at $53.296 billion.

Additional notables in the top ten include USDE (+3.52%), DAI (+8.76%), and USDX (+13.81%). As of this weekend, Ethereum anchors $117.327 billion of the total $217.296 billion in circulation, while Tron hosts $60.682 billion.

Solana secures third with $11.654 billion on Feb. 1, followed by Binance Smart Chain (BSC) at $6.961 billion and Base with $3.994 billion. Solana and Base emerged as February’s standout platforms in terms of stablecoin issuance.

January’s expansion signals a maturing digital asset arena, where Ethereum, Tron, and Solana maintain strategic footholds, while Base demonstrates agility in capturing emerging demand. While everyone’s buzzing about how far this bull market might run, folks are also wondering: Just how big could the stablecoin economy get on the ride up?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing CSCOUSDT, PEPUSDT, ACNUSDT STOCK Index perpetual futures

Stock Futures Rush: Trade popular stock futures and share $250,000 in equivalent TSLA tokenized shares. Each user can get up to $8,000 TSLA.

Bitget margin trading to support BGB cross margin trading and loans

Bitget margin trading to support BGB cross margin trading and loans