- Altcoin open interest fell sharply by $23.9B, marking a 60% drop in speculative trading activity.

- Leveraged bets created market instability, leading to large-scale liquidations in just a few months.

- Traders face new challenges as reduced interest signals caution and a shift in market sentiment.

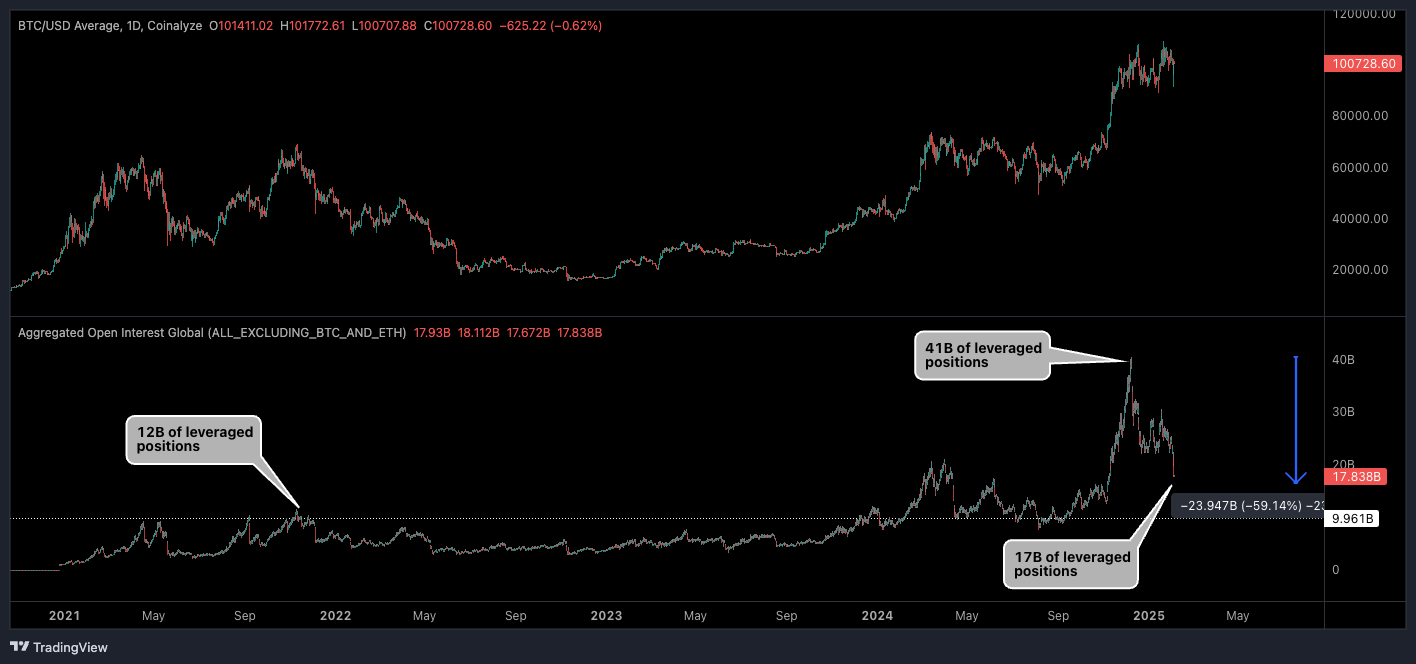

Two months ago, analyst Dom (@traderview2) warned of the precarious state of altcoin open interest, stating, “There’s much more interest in trading these coins than owning them.” His prediction has materialized, with total open interest in perpetual positions collapsing by 60%—from a peak of $41 billion to $17 billion. This $23.9 billion decline (-59.14%) highlights a sharp unwinding of leveraged positions and signals significant shifts in market dynamics.

Source: Dom

Source: Dom

The Boom and Bust of Speculation

The chart tells a tale of euphoria and subsequent capitulation. During the previous cycle in late 2021, altcoin open interest peaked at $12 billion before crashing. By mid-2024, that number soared to a record $41 billion, reflecting a frenzy of leveraged bets on price surges. However, the inflated levels of speculative activity set the stage for an inevitable correction.

Now, open interest has retraced to $17 billion, resembling previous patterns of market excess and liquidation cascades. Compared to 2021’s high, the 2024 peak illustrates how traders have increasingly embraced high-risk, high-reward strategies—only to face amplified losses when sentiment reverses.

Warnings Ignored

Dom’s December 2024 insights highlighted the unsustainable nature of these leveraged positions. When open interest hit $41 billion, he noted this as a “clear signal” of impending collapse. As the market shed over half its speculative capital in mere weeks, his call proved accurate. This crash reflects the inherent fragility of over-leveraged positions, particularly in volatile altcoin markets.

What’s Next for Altcoins?

The sharp decline in open interest may lead to market stabilization as excess leverage exits the system. However, it also signals reduced trader confidence, potentially resulting in a quieter period for altcoins . Whether this sets the stage for recovery or prolonged stagnation remains uncertain.

The takeaway is clear: leverage is a double-edged sword. Traders chasing outsized gains often face outsized losses. Dom’s analysis serves as a crucial reminder to approach speculative markets with caution. In his words, “What goes up with leverage usually comes down even faster.” For now, altcoin traders are left licking their wounds—and waiting for the dust to settle.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.