Bitcoin struggles under $100K as China hits back with US tariffs

Bitcoin price has been at the center of attention as it hovers around the $100,000 mark, a key psychological and technical level. The cryptocurrency market has been highly reactive to global economic developments, with Bitcoin experiencing volatility in response to macroeconomic factors. Recently, China's announcement of retaliatory tariffs on U.S. goods has added another layer of uncertainty to financial markets. This article delves into Bitcoin's price action, examining whether it can break past the $100,000 barrier or if further downside risks are imminent.

Bitcoin Price Analysis: Will Bitcoin Break Past $100,000 or Face More Downside?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin price is currently navigating a crucial level near $99,300 following China’s announcement of retaliatory tariffs on certain U.S. goods. The recent market movements suggest that Bitcoin is reacting to macroeconomic tensions, particularly in response to China’s imposition of additional tariffs on coal, liquefied natural gas, crude oil, and select vehicles. With Bitcoin recovering from a low of $92,800 on Monday, the question remains—can it sustain momentum above the $100,000 mark, or will further downside risks emerge?

How Strong Is Bitcoin’s Resistance at $100,000?

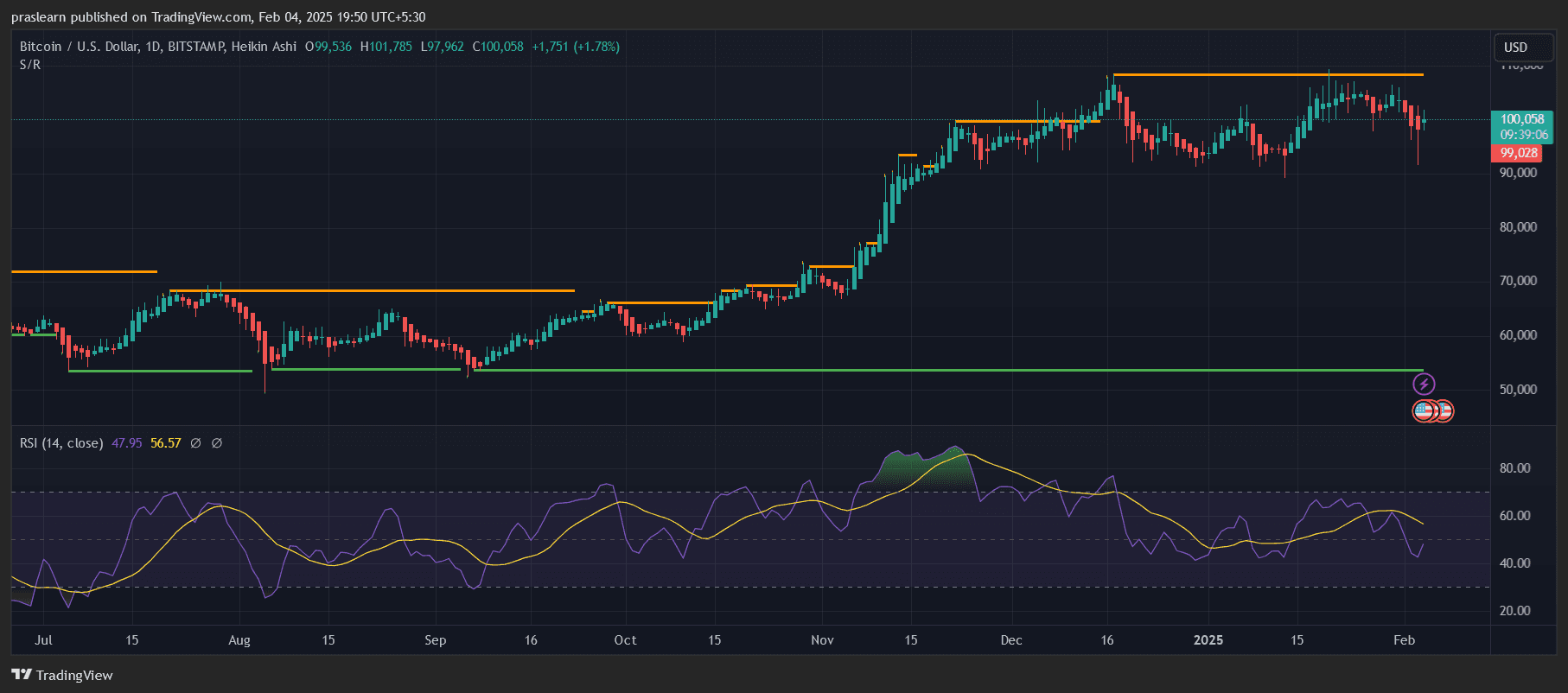

The $100,000 level is proving to be a psychological barrier as Bitcoin struggles to establish a strong foothold above it. From a technical perspective, the price action indicates multiple rejection points near this level, as seen in the chart. The orange resistance lines mark areas where Bitcoin has previously faced selling pressure, suggesting that unless a strong breakout occurs, a retracement remains likely.

Additionally, the Relative Strength Index (RSI) is currently hovering around 56.57, indicating neutral momentum. However, the RSI has shown a slight downward trajectory, hinting at weakening buying pressure. If buyers fail to reclaim dominance, Bitcoin might continue its range-bound movement below $100,000.

Is Bitcoin’s Uptrend at Risk?

While Bitcoin remains in an overall bullish structure , there are warning signs of a potential correction. The recent recovery from $92,800 suggests that Bitcoin still has strong demand at lower levels, but it also highlights heightened volatility. The green horizontal support line at approximately $50,000 represents a historical level where Bitcoin consolidated in the past. Though such a deep retracement seems unlikely in the near term, a break below $95,000 could expose Bitcoin to further downside risks.

Furthermore, geopolitical uncertainties, including China’s trade policies and U.S. tariff responses, are likely to weigh on market sentiment. If global economic conditions deteriorate, risk assets like Bitcoin may see increased selling pressure.

What’s Next for Bitcoin Price Action?

Looking ahead, Bitcoin’s ability to hold above $99,000 will be critical. If Bitcoin successfully breaks past $100,000 with strong volume, the next major resistance is around $110,000, as indicated by previous price peaks. However, failure to break higher could lead to a retest of the $97,000-$98,500 support zone, followed by deeper corrections if selling accelerates.

With the ongoing trade tensions and macroeconomic developments influencing risk assets, Bitcoin’s short-term trajectory remains uncertain. Traders should monitor key levels, including the $100,000 resistance and the $95,000-$97,000 support, to gauge Bitcoin’s next move.

Conclusion

Bitcoin’s flirtation with the $100,000 mark remains a focal point for traders. The impact of China’s retaliatory tariffs on global markets, coupled with Bitcoin’s technical resistance, suggests that volatility is far from over. While Bitcoin maintains a bullish bias, failure to clear $100,000 decisively could lead to further consolidation or downside risk. Traders and investors should stay vigilant and keep an eye on macroeconomic shifts that could drive Bitcoin’s next major move

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.