XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

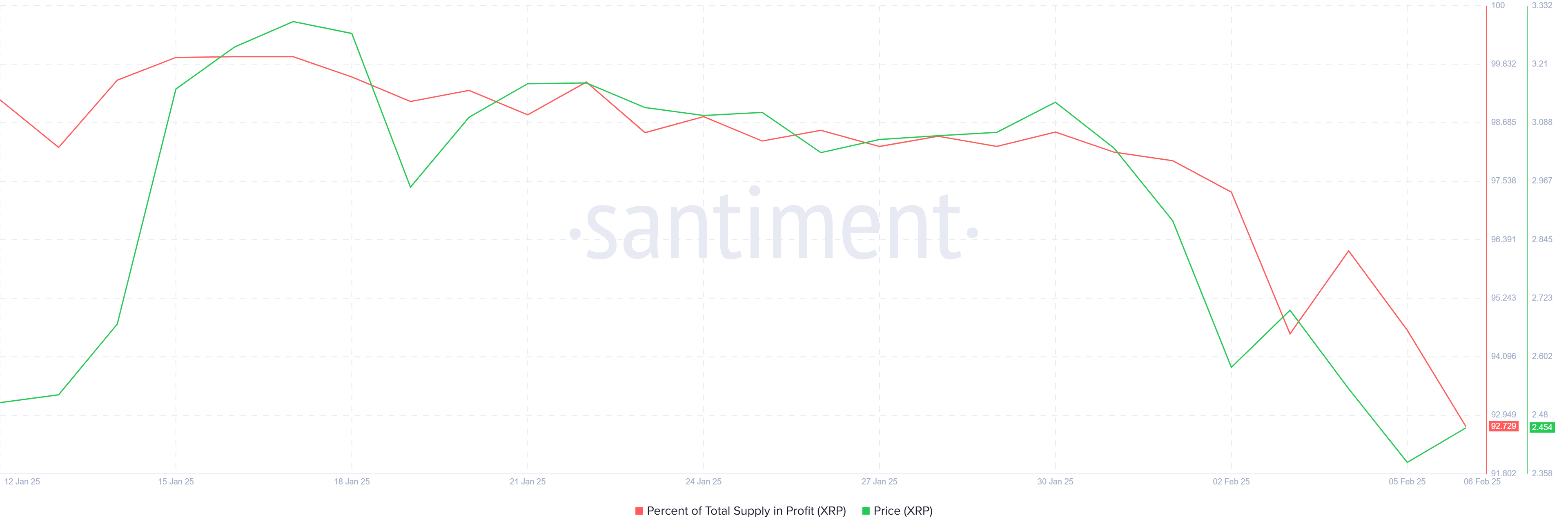

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

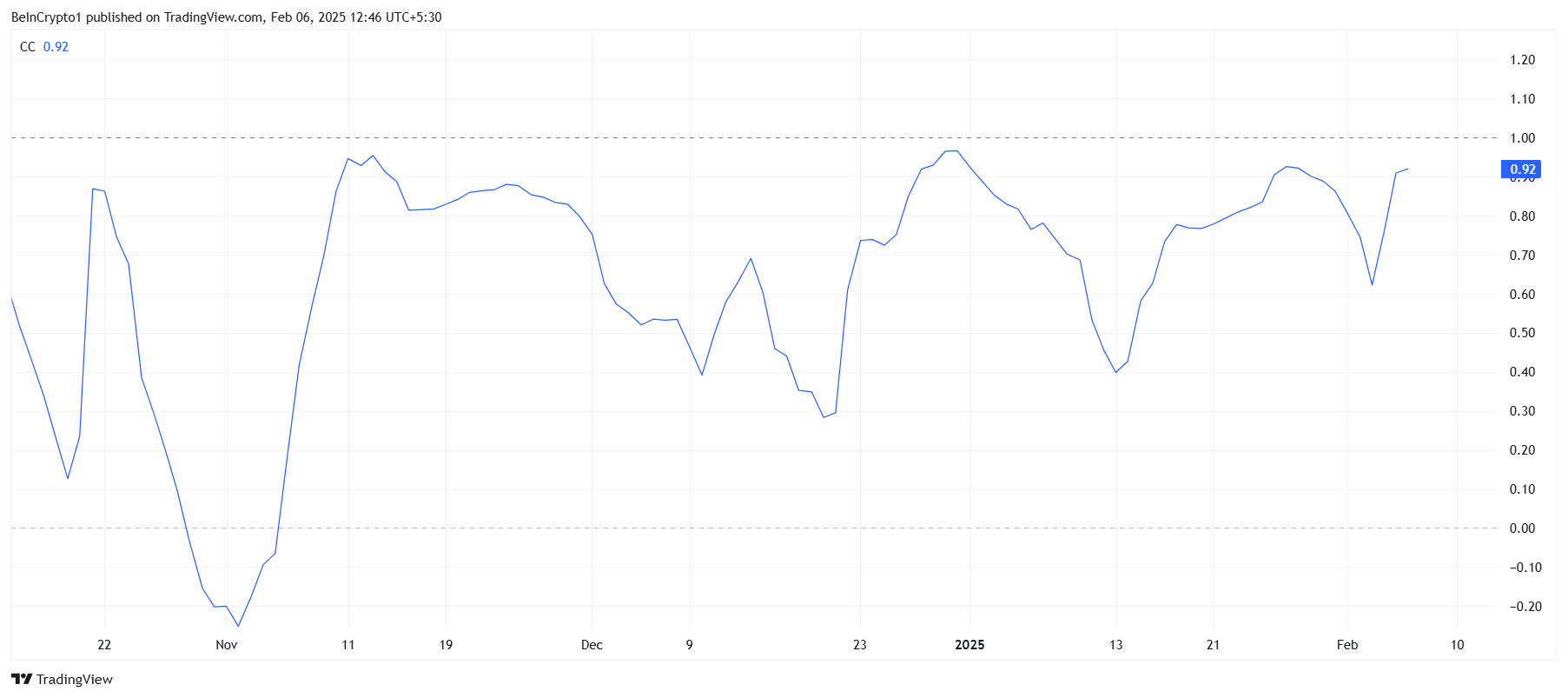

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap News Today: Uniswap's 100 Million UNI Token Burn Sparks 38% Rally as Deflationary Changes Transform DeFi

- Uniswap's UNI token surged 38% after the Foundation and Labs launched the "UNIfication" governance overhaul, activating protocol fees and token burns. - The proposal includes a 100M UNI retroactive burn (16% of supply), fee redirection to deflationary mechanisms, and a 20M UNI Growth Budget for DeFi innovation. - Structural changes consolidate teams under Uniswap Labs, eliminate interface fees, and establish a 5-member board to align governance with DUNA's decentralized framework. - Market reaction saw U

Solana's Value Soars: Key Factors Fueling Investor Confidence Toward the End of 2025

- Solana (SOL) surges in late 2025 due to infrastructure upgrades, institutional adoption, and strong on-chain metrics. - Firedancer validator client boosts TPS to 1M+, while Alpenglow aims for sub-second finality, enhancing scalability for real-time finance. - Institutional holdings of SOL jump 841% to 16M tokens, with Visa and R3 partnerships validating its role in cross-chain global finance. - Network records 17.2M active addresses and 543M weekly transactions, maintaining 8% DeFi market share despite b

Uniswap Latest Updates Today:

- UNI token surged over 40% to $10+ as Uniswap Labs and Foundation proposed "UNIfication" to distribute protocol fees to holders via token burns and a "token jar." - The plan includes burning 100M UNI ($800M) and allocating 16.7%-25% of v2/v3 pool fees to holders, merging the Foundation into Labs to streamline operations. - Market reactions saw UNI jump 30% in a day, reaching $10.50, with a $7.19B market cap, driven by optimism over DeFi fee capture and DUNA approval easing regulatory concerns. - Critics w

Bitcoin Leverage Liquidations Spike in November 2025: A Warning Story for Crypto Derivatives Traders

- November 2025 saw $20B+ in crypto derivatives liquidated as Bitcoin fell below $100,000, driven by 1001:1 leverage and automated stop-loss mechanisms. - Leverage-driven cascading liquidations pushed Ethereum to four-month lows and exposed systemic risks in unregulated platforms like Hyperliquid and Aster. - Regulators proposed CFTC/SEC role clarifications and domestic leveraged trading, but experts warn structural imbalances persist despite growing retail risk awareness. - Institutional investors shifted