Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

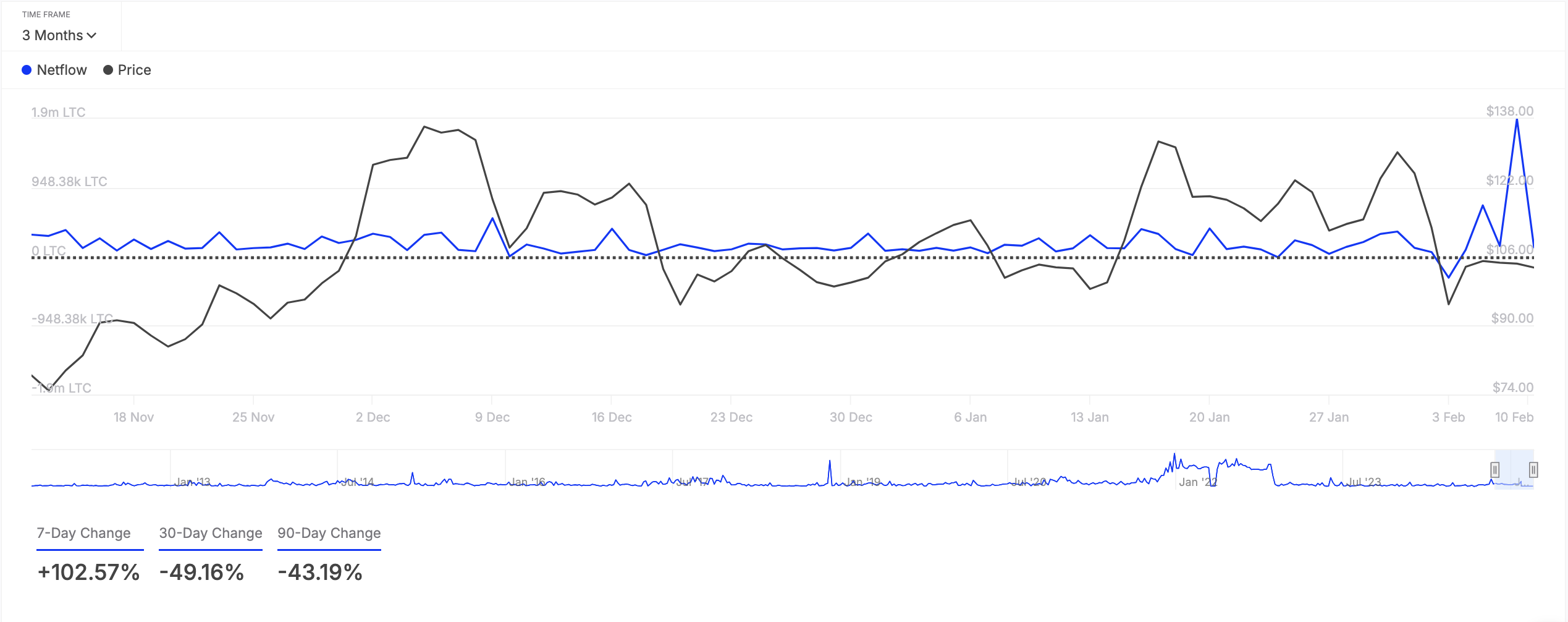

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

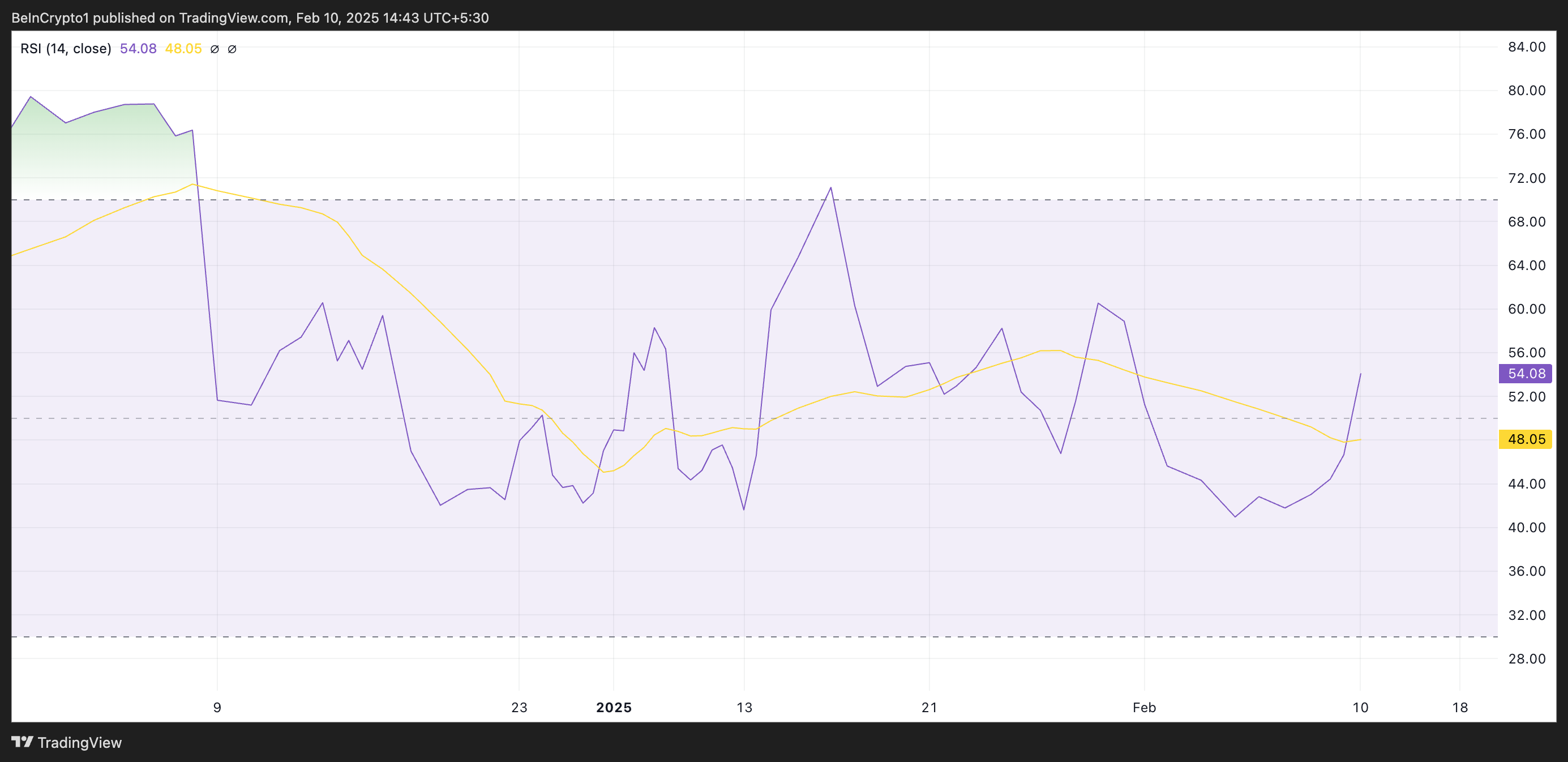

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like