Crypto News Today: Litecoin Price Surges as Bitcoin Holds Steady Above $97K

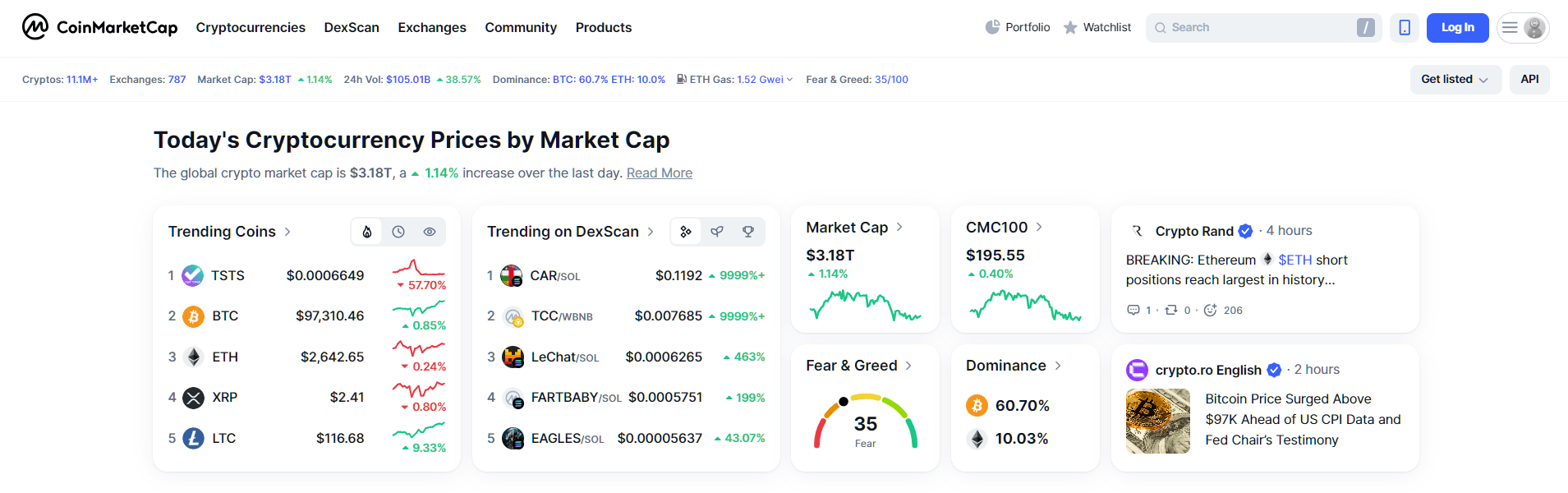

The cryptocurrency market is exhibiting resilience , with Bitcoin maintaining its position above the $97,000 threshold and Litecoin experiencing a notable surge. As of February 10, 2025, the global crypto market capitalization stands at approximately $3.18 trillion, reflecting a slight 1.14% increase over the past 24 hours.

By CoinMarketCap - Trending Coins on 2025-02-10

By CoinMarketCap - Trending Coins on 2025-02-10

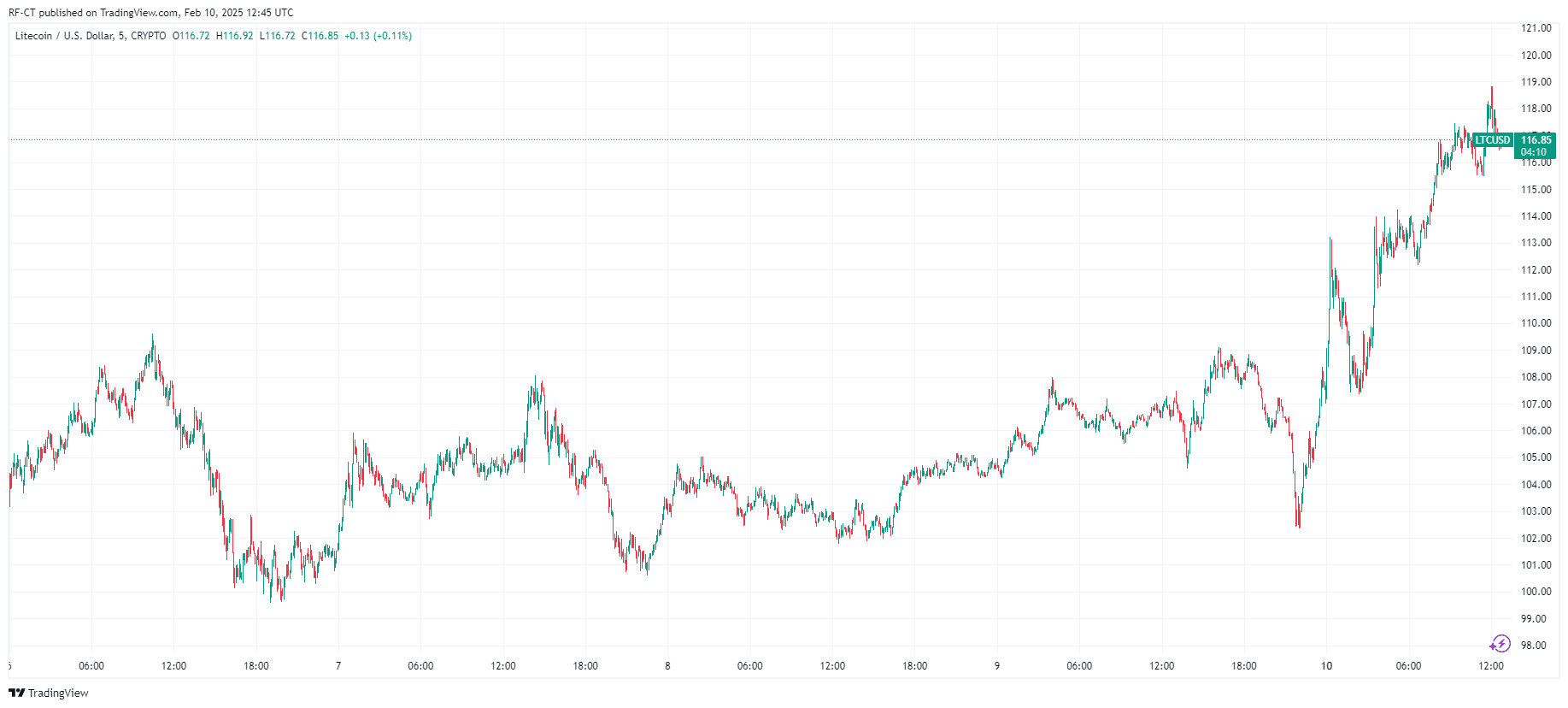

Litecoin Emerges as Top Performer

Litecoin (LTC) has outperformed major cryptocurrencies, recording a significant 9.52% increase to trade at $116.80. Analysts attribute this surge to growing optimism surrounding the potential approval of a spot Litecoin ETF by the U.S. Securities and Exchange Commission (SEC). The likelihood of such an approval has risen to 81%, with many traders anticipating a launch later this year.

By TradingView - LTCUSD_2025-02-10 (5D)

By TradingView - LTCUSD_2025-02-10 (5D)

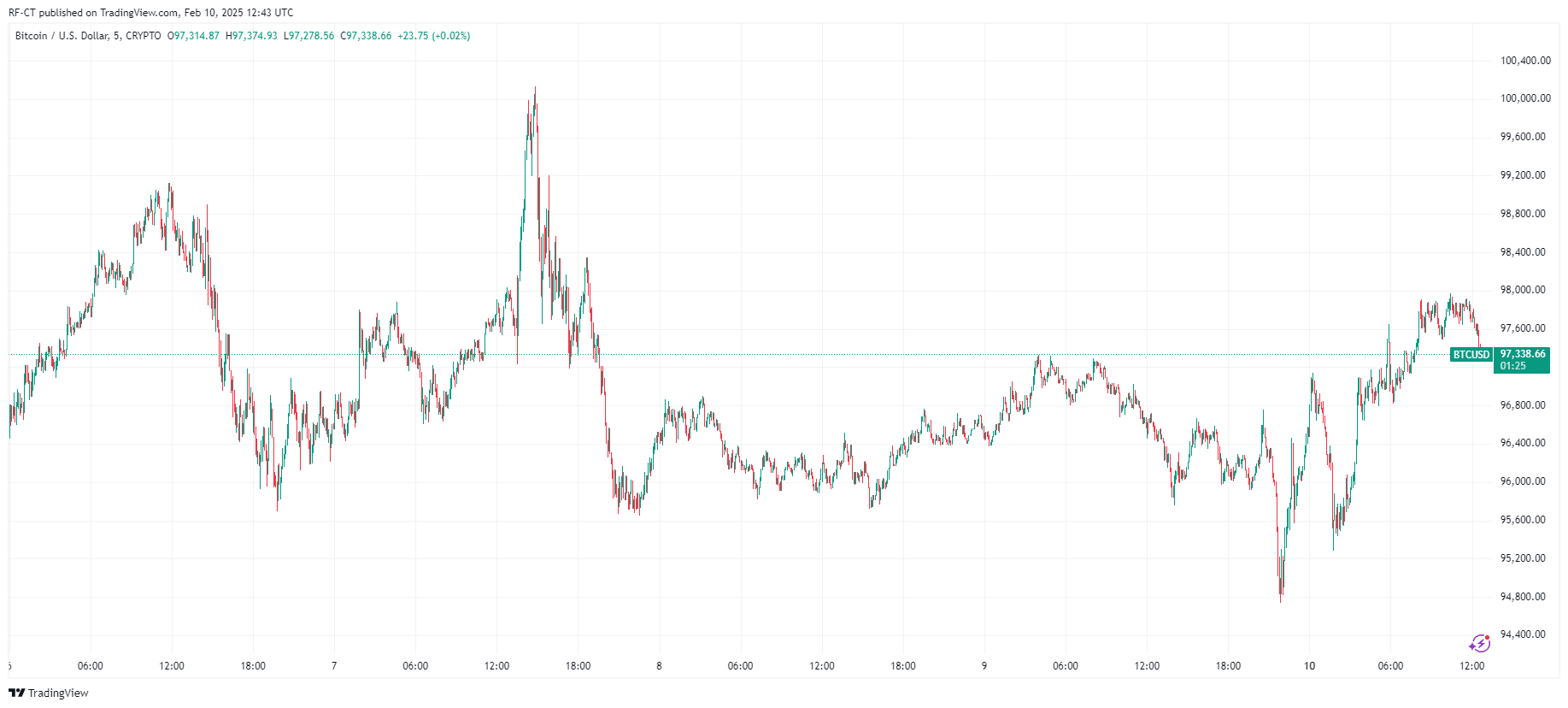

Bitcoin Defends Key Support Level

Bitcoin (BTC) has demonstrated stability, trading at around $97,336 marking a modest 1.01% gain in the last 24 hours. The leading cryptocurrency briefly dipped below $95,000 but quickly rebounded, reaching highs of $98,000, yet still below $100,000. This resilience underscores Bitcoin's strong support at the $95,000 level, a critical threshold for maintaining its bullish outlook.

By TradingView - BTCUSD_2025-02-10 (5D)

By TradingView - BTCUSD_2025-02-10 (5D)

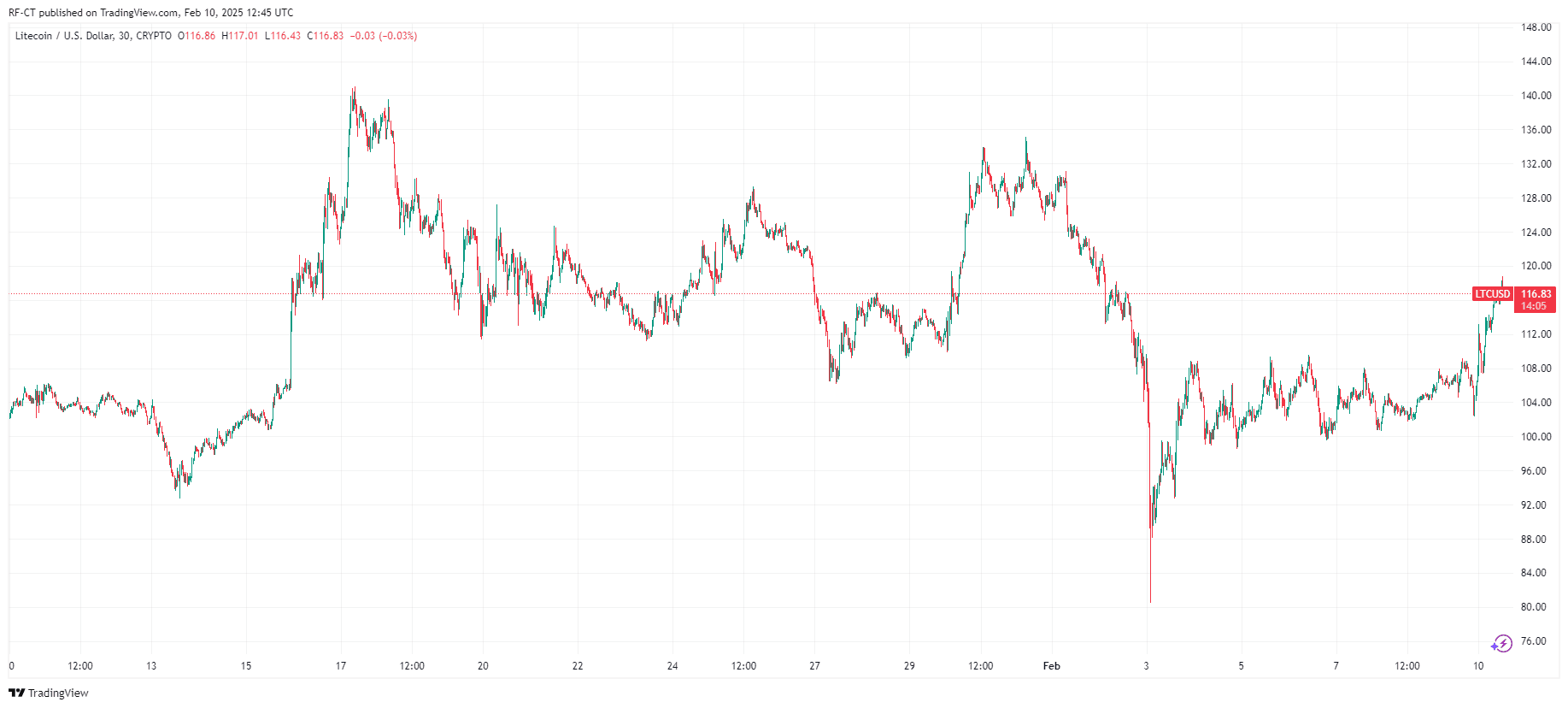

Market Outlook and Key Considerations

The overall cryptocurrency market remains stable, with the total market capitalization holding steady at $3.18 trillion. Bitcoin's ability to maintain its position above the $97,000 support level is crucial for sustaining its bullish momentum. Meanwhile, Litecoin's impressive performance highlights its potential as a promising asset in the current market landscape.

By TradingView - LTCUSD_2025-02-10 (1M)

By TradingView - LTCUSD_2025-02-10 (1M)

In summary, the cryptocurrency market is displaying signs of resilience, with Bitcoin defending key support levels and Litecoin leading in gains. Investors are advised to monitor these developments closely, as they may signal further opportunities in the evolving crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opportunities in Webster, NY: Capitalizing on Infrastructure Funding and Redevelopment Prospects

- Webster , NY, leverages $9.8M FAST NY grants to upgrade infrastructure at a 300-acre brownfield, attracting advanced manufacturing and logistics firms like fairlife®. - Redevelopment of the former Xerox Wilson Campus aims to create 250 jobs by 2025, supported by $650M in reconfiguration and state-backed industrial expansion initiatives. - Parallel urban revitalization at 600 Ridge Road targets mixed-use development, boosting property values and tax revenues while addressing blighted properties in West We

AI Grabs Headlines, Yet Gold Industry's Productivity Fuels Worth

- Two Gen Z entrepreneurs rejected Elon Musk's funding to develop a brain-inspired AI outperforming OpenAI and Anthropic models. - QGold Resources initiates economic assessment for its Oregon gold project with 1.543M oz reserves, signaling strategic expansion. - Galactic Gold appoints mining veteran Manley Guarducci to enhance operational efficiency amid industry consolidation. - Alamos Gold and B2Gold demonstrate resilience through record cash flow and production growth despite geopolitical risks. - Gold

Bitcoin News Update: As Major Crypto Firms Target Affluent Investors, Authorities Increase Scrutiny

- Binance launches "Prestige" to target high-net-worth clients, competing with Morgan Stanley and Fidelity through tailored crypto services. - KuCoin secures MiCA license in Austria, enabling EEA operations and emphasizing compliance with global regulatory standards. - Binance faces lawsuit alleging $50M+ in Hamas-related transactions, highlighting crypto's regulatory challenges amid expanded AML measures in South Korea. - Houdini Pay introduces privacy tools for freelancers, addressing wallet transparency

XRP News Today: Institutional ETFs May Exhaust XRP Reserves Earlier Than Expected

- XRP's institutional ETFs (e.g., Franklin Templeton's XRPZ) drive rapid supply depletion risks as inflows outpace expectations. - Analyst Zach Rector models potential $168 price targets if XRP ETF inflows mirror Bitcoin's $62B 2024–2025 surge pattern. - ETFs enhance XRP liquidity for SMEs and fintechs but expose risks from whale manipulation and unclear Asian regulations. - Market analysts warn XRP's limited 60.25B circulating supply faces accelerated institutional demand pressures amid growing ETF adopti