Greeks.live: The market trend this week continues to be weak and consolidated, with limited expected declines

ChainCatcher News, Adam, an analyst at Greeks.live, posted on social media that the market trend this week remained weak despite several positive news from the US government. However, the market did not buy it and the implied volatility IV fell to its lowest level in nearly a year.

Since BTC effectively fell below the $100,000 mark, large option holders have been continuously selling short-term bullish options. The volume of large-scale bullish option trades has significantly increased while large-scale bearish transactions are declining. This indicates that although the market is not optimistic about rising prices, fear of falling prices has also weakened. Institutions generally believe that February will be a garbage time without any market trends; indeed it seems like there's really a lack of hotspots and funds in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

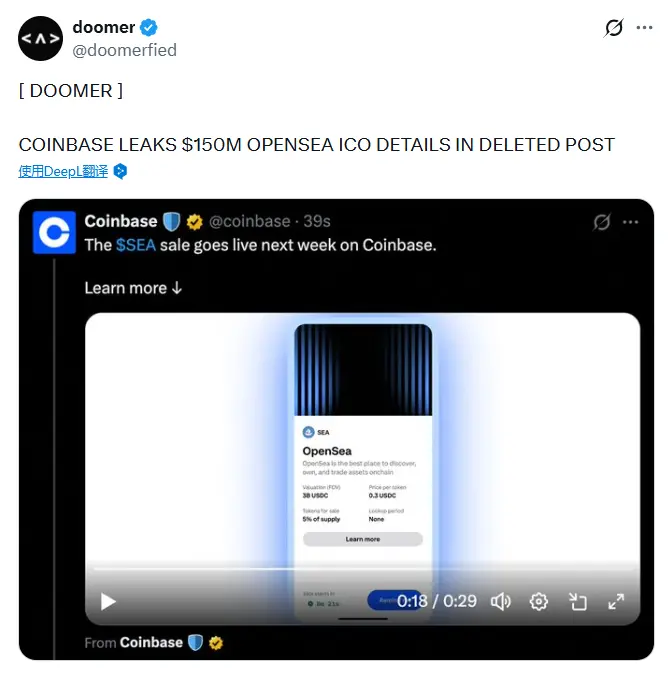

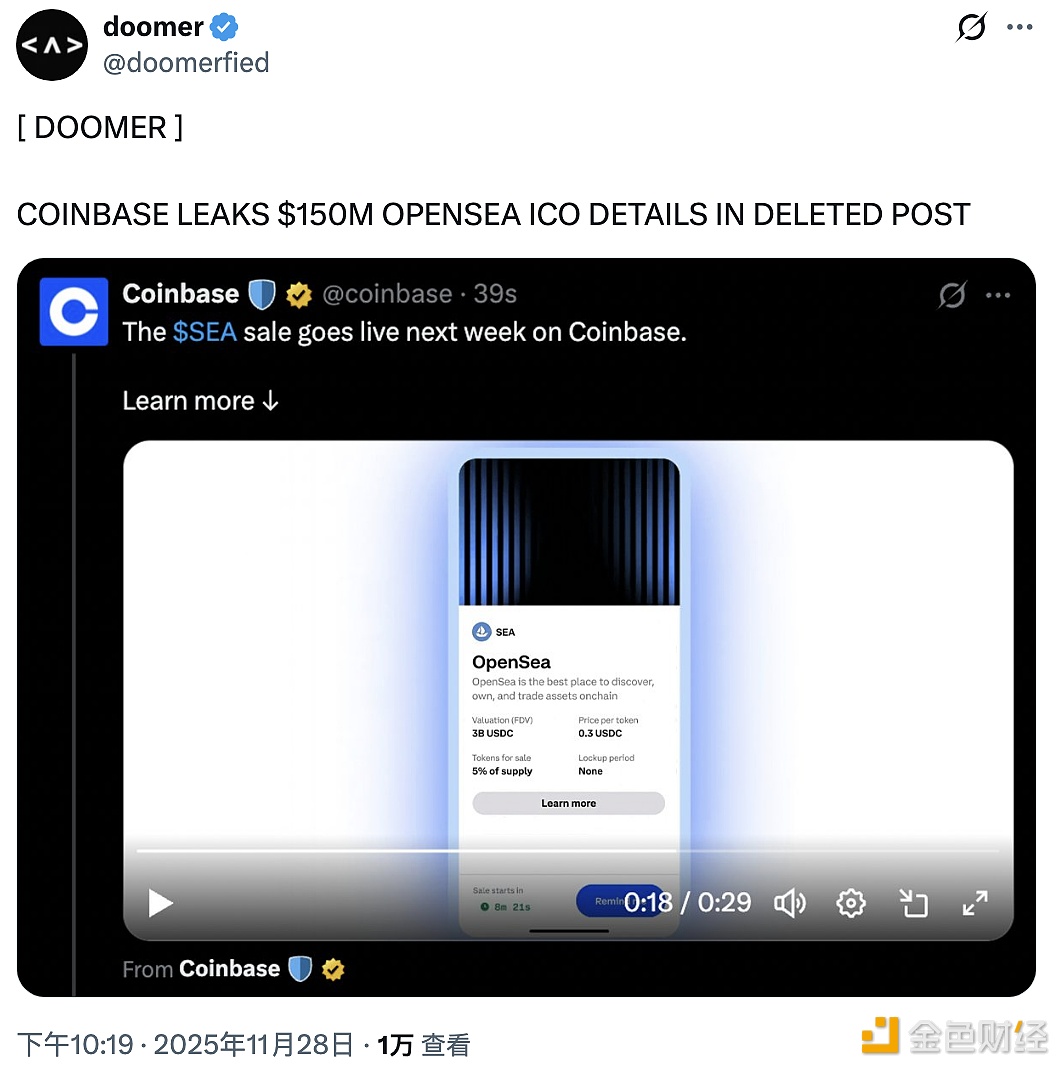

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.