Greeks.live: The cryptocurrency market sentiment is divided, with options trading mainly focusing on contracts expiring on February 16th

Macro analyst Adam from Greeks.live posted on the X platform, stating that market sentiment is diverging. Some traders expect to break through the $96,000-$98,000 range, while others remain bearish and continue to sell call options. The price fluctuates within the $95,000-$96,000 range while the S&P 500 index hits a historical high. Options trading strategy:

Traders actively roll over bullish option spreads and bearish positions to collect premiums with a primary focus on contracts expiring on February 16th.

It's worth noting that despite being in an environment of low volatility at 36%, there is still significant trading activity selling call options in the $98,000-$99,000 exercise price range with an expiration date of February 16th.

The strategy includes balancing short-term premium collection with long-term positions expiring in March/April/June as protection.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

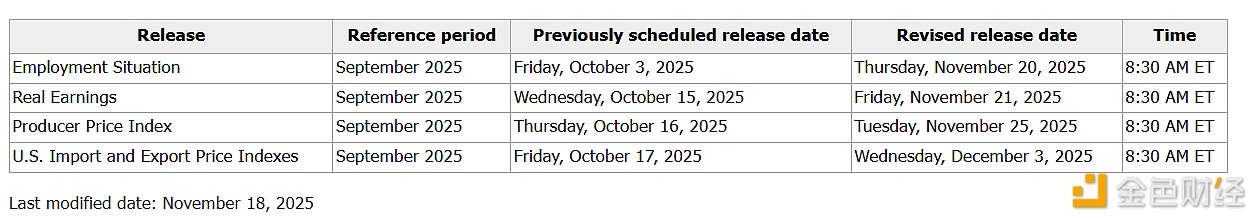

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.