U.S. Spot Bitcoin ETFs Hit $750 Billion in Trading Volume Within One Year

In just one year, U.S. spot Bitcoin exchange-traded funds (ETFs) have crossed a major milestone, exceeding $750 billion in total trading volume since their introduction in January 2024.

After launching to much anticipation, spot Bitcoin ETFs rapidly gained traction, reaching $100 billion in volume by March 2024 and doubling that figure by April, fueled by Bitcoin’s surge to an all-time high close to $74,000.

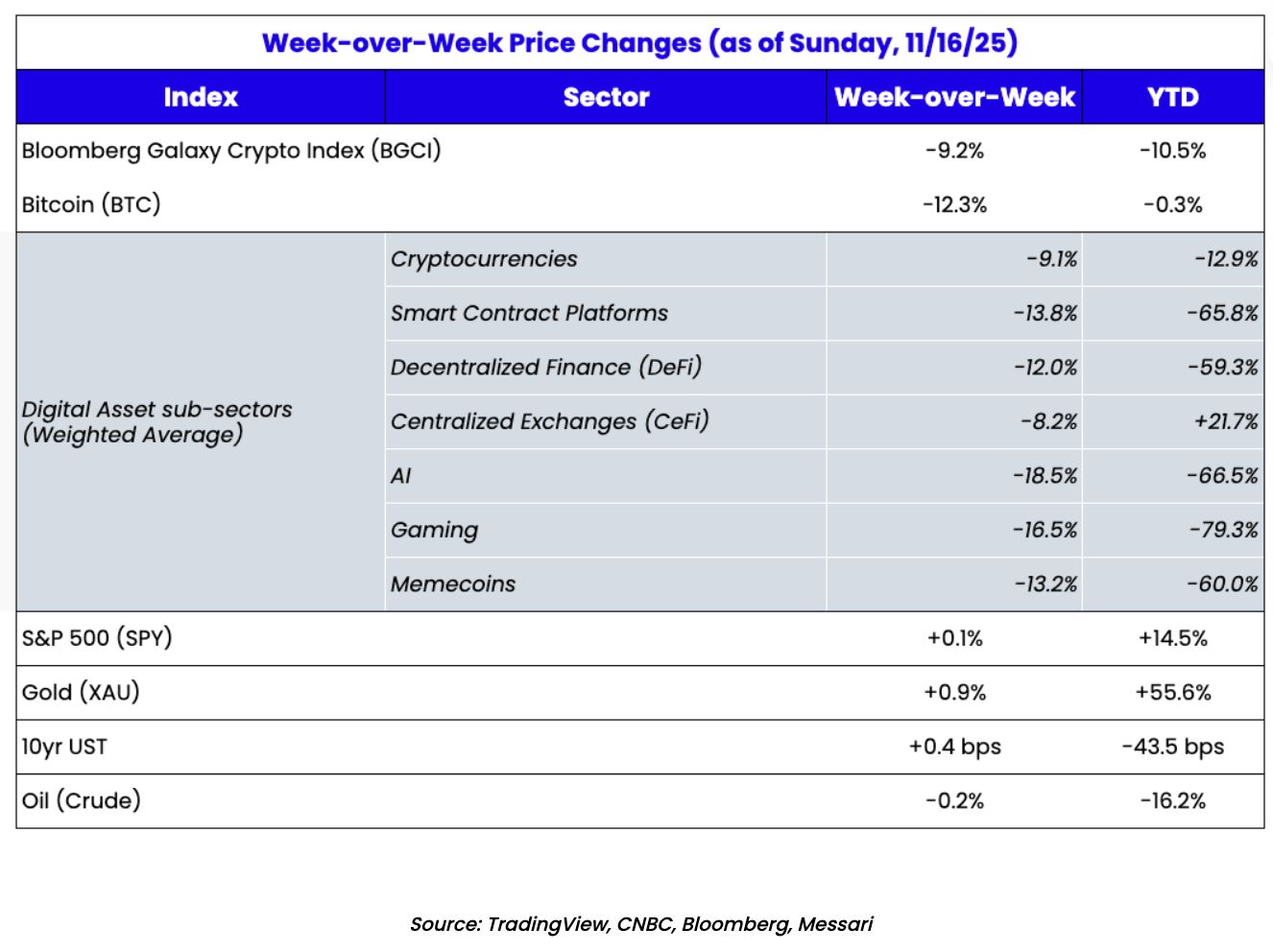

However, as the overall crypto market slowed down, Bitcoin’s price consolidation between $50,000 and $70,000 for several months resulted in a dip in ETF trading activity.

A major rebound occurred after the U.S. presidential election in November 2024, with Bitcoin’s rally following Donald Trump’s pro-crypto stance, propelling spot Bitcoin ETFs past the $500 billion mark in just one week.

By the end of trading on Thursday, U.S. spot Bitcoin ETFs had reached a cumulative volume of $753.2 billion.

This makes them among the most traded ETFs in the world, rivaling traditional financial products like the Vanguard SP 500 ETF (VOO) and the Invesco QQQ Trust (QQQ) Nasdaq-100 Index.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.