Leveraged ETFs tied to bitcoin stockpiler Strategy drop nearly 50% in just five days

Quick Take Two leveraged exchange-traded funds linked to Michael Saylor’s Strategy have declined in price by nearly 50% during the last five days after BTC dropped below $87,000 on Tuesday. After the Strategy-tied funds MSTX and MTSU traded over $43 and $9 a share as of last week, respectively, the two ETFs have each fallen significantly as volume soared.

Two leveraged exchange-traded funds linked to bitcoin stockpiler Strategy have declined in price by nearly 50% during the last five days after BTC dropped below $87,000 on Tuesday.

Strategy-tied ETFs MSTX and MTSU, which traded above $43 and $9 per share, respectively, last week, plummeted on Tuesday amid a surge in trading volumes. MSTX traded at $23.83 a share and MSTU at $4.94 as of 3:07 p.m. ET, according to Yahoo Finance.

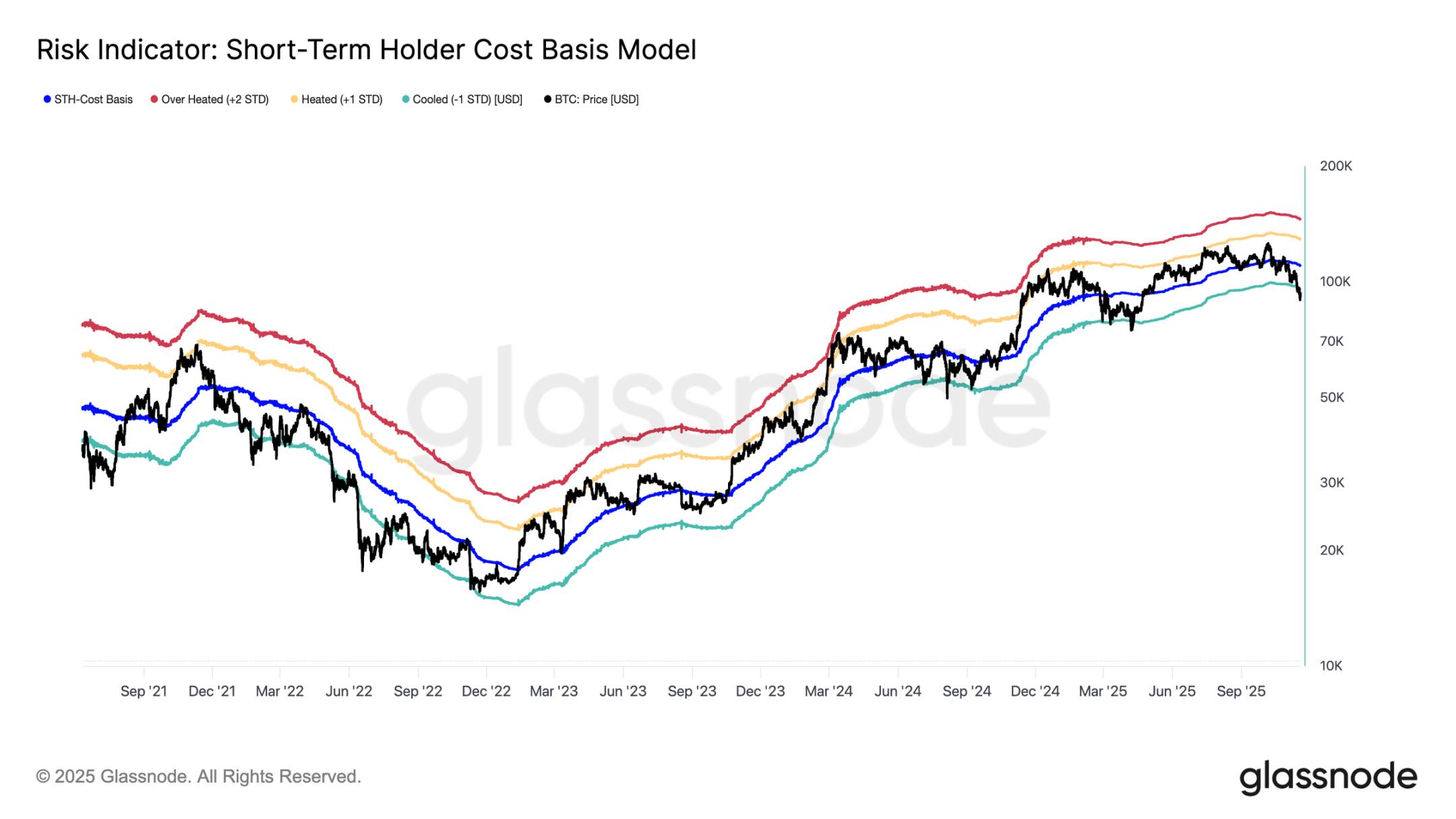

Broadly, equity markets have suffered a widespread selloff after U.S. president Donald Trump announced Monday he intends to impose tariffs on Canada and Mexico once a 30-day suspension expires next week. Bitcoin, the world’s largest cryptocurrency by market cap, was down nearly 7% to $87,942.26 as of 3:08 p.m. ET, according to The Block Price Page . Earlier in the day BTC traded hands at below $87,000, its lowest price since last November.

Leveraged ETFs use derivatives and debt to boost the possible returns of the specific asset they track. While the financial instruments offer a chance to realize greater returns, they carry more risk.

Strategy, formerly known as MicroStrategy, was down nearly 10% to roughly $255 per share on Tuesday, according to Yahoo Finance . Shares in the company, which owns nearly 500,000 bitcoin, tend to trade at a premium to the price of BTC.

Standard Chartered Global Head of Digital Assets Research Geoffrey Kendrick said Tuesday that the risk-off sentiment in traditional markets is impacting the digital asset sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin