Bitcoin (BTC) Must Break This Key Level for Potential Upside Reversal, According to Crypto Analyst

A crypto strategist known for making timely Bitcoin calls says BTC must clear one price area to signal the beginning of a fresh leg up.

In a new video, pseudonymous analyst Credible tells his 69,000 YouTube subscribers that he’s looking at Bitcoin’s immediate resistance at $94,000.

According to the analyst, Bitcoin’s downside momentum will likely persist as long as BTC trades below what he believes is a “local supply” zone.

“We’re looking for some sort of a bottoming structure to form here, some sort of a shift in market structure for a potential reversal to the upside. And that gets confirmed once we clear this local supply here (at $94,000).

And most importantly is seeing an impulsive move to the upside. And yes, sometimes they can be tricky to spot or identify… So we’re looking for again [an] impulsive move to the upside, ideally breaking local supply, and that is our indication that we’ve started the next leg to the upside.”

Source: Credible/YouTube

Source: Credible/YouTube

An impulsive rally in this case is based on Elliott Wave theory, which states that a bullish asset tends to witness a five-wave surge where waves one, three and five are upside moves and waves two and four are corrective periods.

Looking at the trader’s chart, he seems to predict that BTC will soar close to $104,000 if it takes out resistance at $94,000.

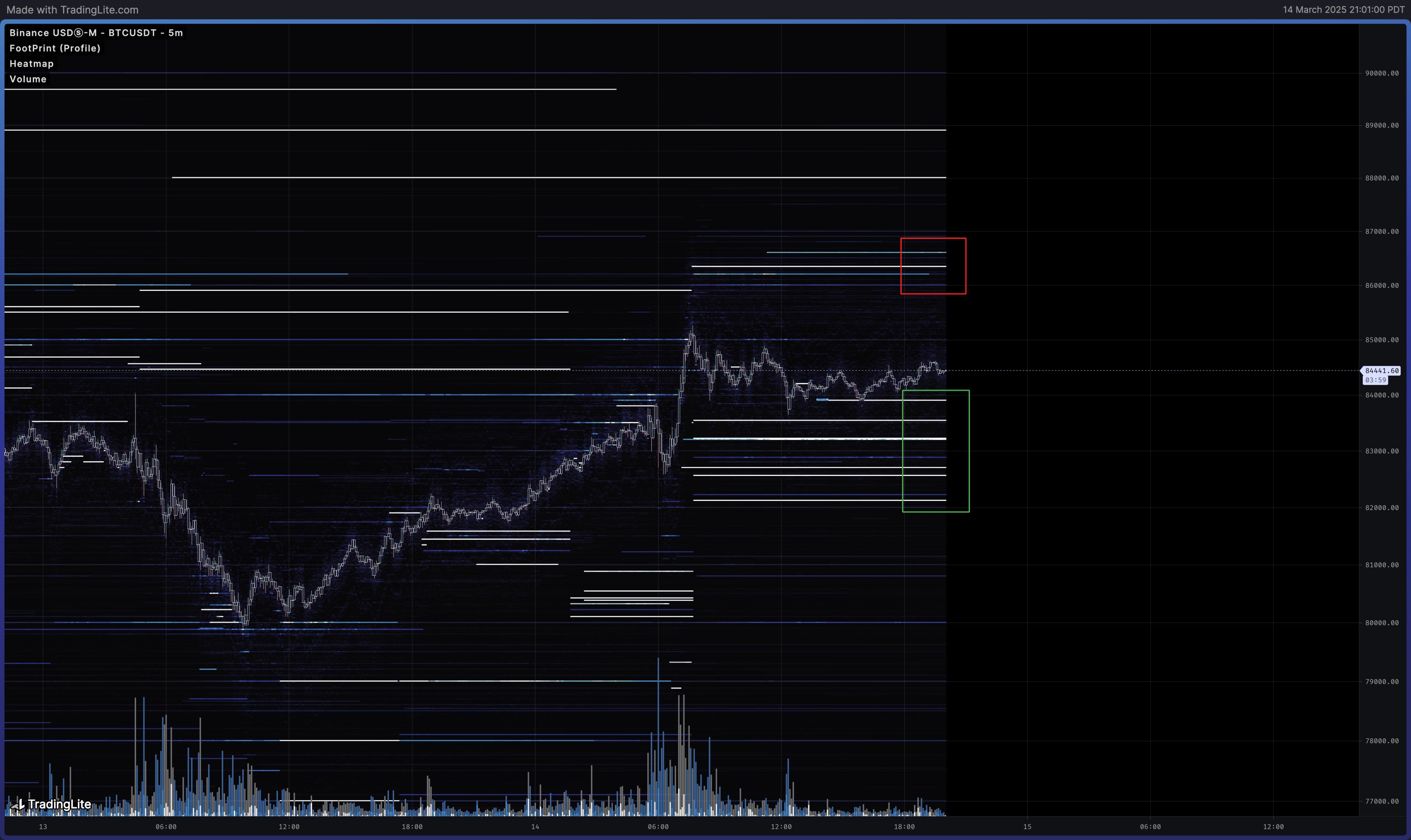

While Credible believes it is within the realm of possibility for BTC to end its downtrend after bouncing from a low of $76,000, he notes that Bitcoin’s heatmap indicates thick sell orders at around $86,000 with heavy demand below $84,000.

A heatmap tracks existing buy and sell orders on a crypto exchange order book.

“Something’s gotta give.”

Source: Credible/X

Source: Credible/X

At time of writing, Bitcoin is trading for $84,374.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...