- Kanye West’s YZY token shows extreme volatility, with rapid gains and severe losses impacting early investors.

- High centralization of YZY, with 70% held by Kanye, raises concerns about market manipulation and investor risk.

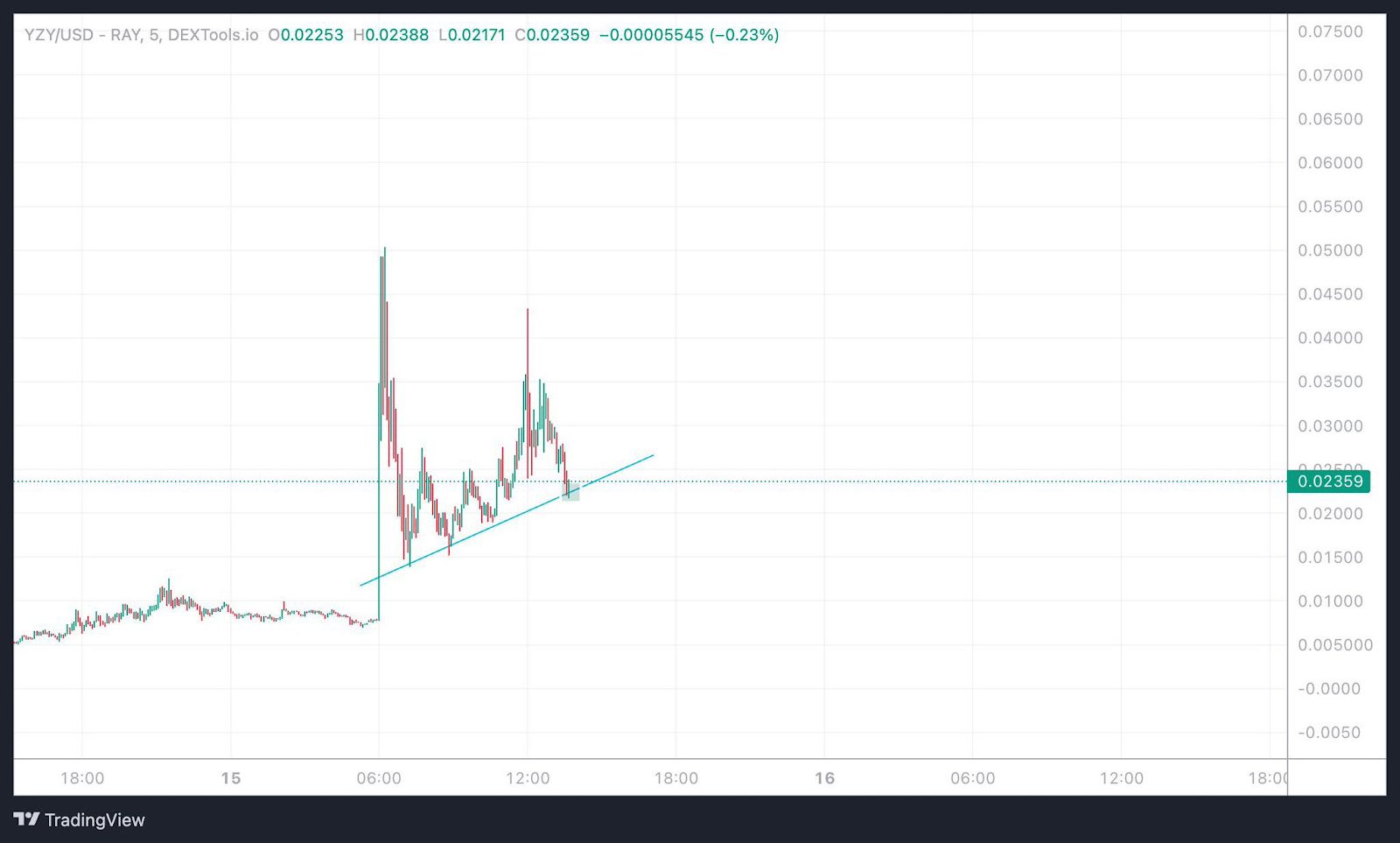

- Technical analysis suggests a potential breakout if support holds, but caution is advised due to speculative market conditions.

A crypto investor reportedly lost $465.6K within an hour after attempting to snipe Kanye West’s YZY token. Lookonchain said the trader likely used an automated bot to purchase YZY as soon as West mentioned it. Additionally, they paid 75 SOL ($10K) in fees to prioritize the transaction. However, market fluctuations resulted in severe losses within a short period.

YZY Token’s Market Movements and Investor Reactions

Some traders made substantial profits in spite of the first difficulties. Crypto investor Larry Arnault claimed that after Kanye West’s support, his $2,000 investment in YZY soared to $100,000.

Moreover, CoinDesk reported that the YZY token is structured to benefit Ye. He holds 70% of the total supply, while only 10% is allocated for liquidity and 20% for investors. This high centralization raises concerns about potential manipulation and sell-offs that could impact retail investors.

Technical Analysis and Market Sentiment

The price chart for YZY/USD on a five-minute timeframe shows an initial consolidation phase, followed by a sharp breakout according to analyst 1000xgirl. The price surged rapidly before facing resistance, leading to a retracement. Higher lows formed along an ascending trendline, indicating bullish momentum.

Source: 100xgirl

Source: 100xgirl

Multiple tests of this trendline suggest strong support. However, upper wicks on candlesticks show selling pressure at price peaks. The current price of 0.02359 remains above ascending support, hinting at a potential breakout if buyers maintain control . A move beyond the immediate resistance could push prices to new highs. Conversely, a breakdown below support may signal bearish momentum.

Crypto analyst 1000xgirl remains optimistic. They predict an imminent bounce back and anticipate a move toward a new all-time high. Additionally, other tokens like RichTokenSOL are gaining traction, further intensifying the competitive landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.