Glassnode: Bitcoin's profit pressure ratio has risen to 0.23, the highest level since September last year

ChainCatcher reports that, according to Glassnode data, the Bitcoin profitability stress ratio has currently reached 0.23, the highest level since September last year. This indicator is used to measure the relative size of supply in a loss state, reflecting market pressure.

Glassnode points out that historically, when this index exceeds 0.2 it usually signifies periods of intensified market pressure. If this value continues to rise, it could potentially indicate further increases in market pressure and possibly reinforce a broader shift in market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

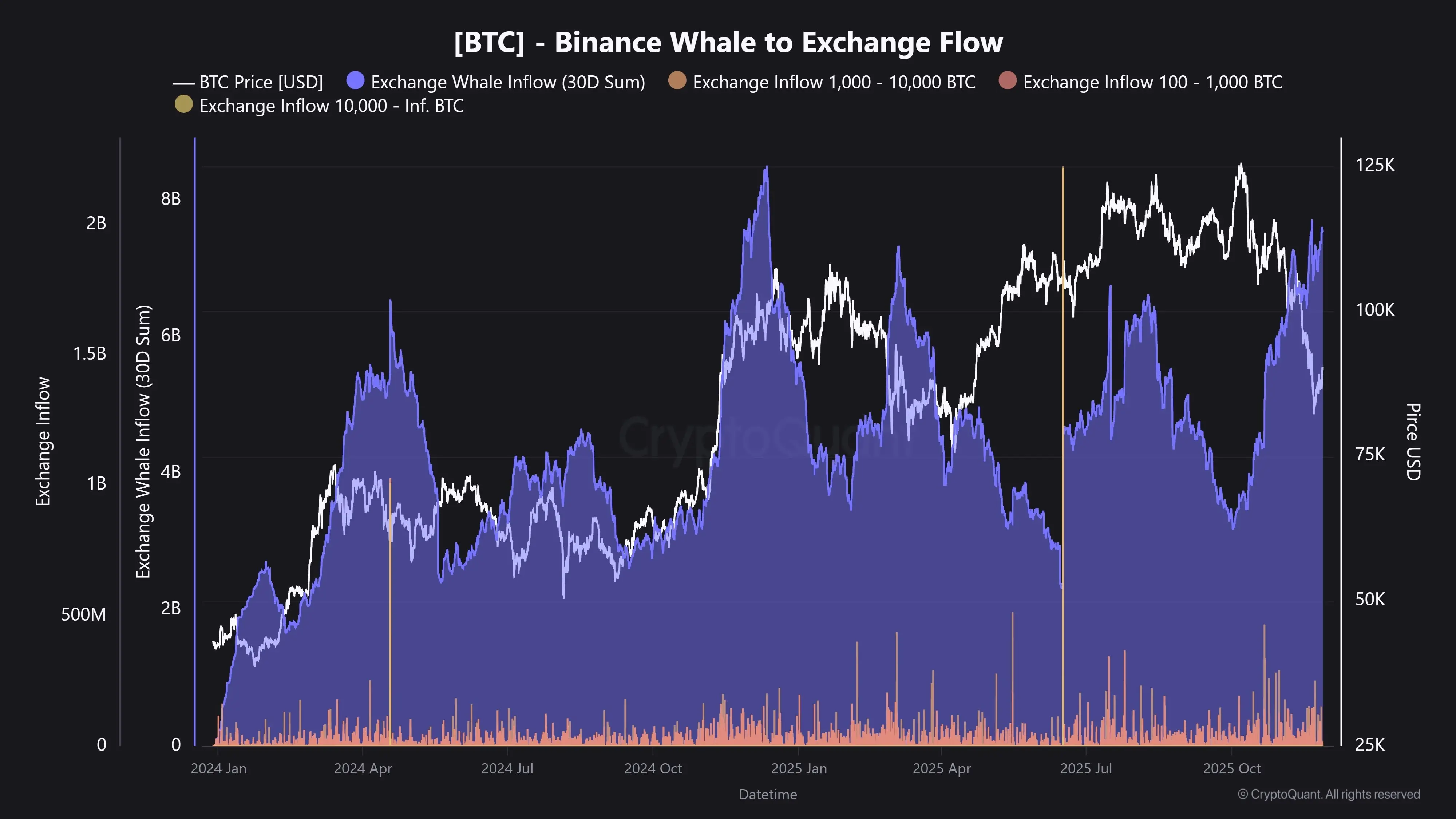

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended