Analysis points to opportunities in Bitcoin, Solana and PEPE; Breakout in sight?

- Bitcoin in consolidation.

- Solana with upside potential.

- PEPE with reversal pattern.

Highly optimistic technical analyses are pointing to potential breakouts and reversals in assets such as Bitcoin (BTC), Solana (SOL) and PEPE. In this sense, investors’ attention is turning to these indicators, seeking to anticipate movements and optimize their trading strategies, with renowned cryptocurrency analyst Ali Martinez predicting bullish movements.

Bitcoin, the leading cryptocurrency on the market, is currently in a triangle pattern, indicating a period of consolidation. According to Martinez's graphical analysis, this pattern suggests a possible price movement of approximately 9% in the near future. The expectation is that the breakout of the triangle will define the direction of Bitcoin's next movement, whether upwards or downwards.

“Bitcoin $BTC wrapped up tight! Stuck in a triangle, gearing up for a 9% price move,” stated .

Source: TradingView/Ali Martinez

Source: TradingView/Ali Martinez

At the time of publication, the price of Bitcoin was quoted at US$83.467,75, up 0.7% in the last 24 hours.

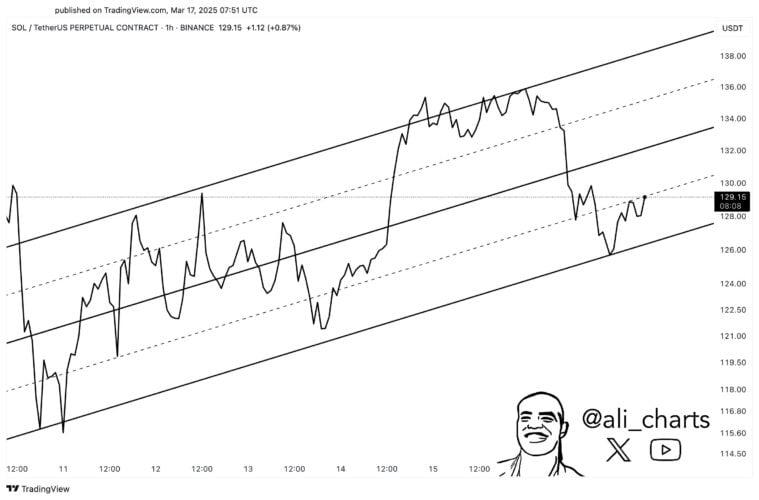

Meanwhile, Solana (SOL) shows potential for a significant jump in its price, as seen here The expert highlighted. The cryptocurrency is approaching the upper resistance of a channel, with analysts eyeing a possible upward movement towards the $140 mark. Overcoming this resistance could propel Solana to new heights, attracting the interest of investors and traders. Currently, Solana is trading at $128,33 with a retracement in its price of 0.7%.

Source: TradingView/Ali Martinez

Source: TradingView/Ali Martinez

In the memecoin universe, PEPE forms an inverted head and shoulders reversal pattern, signaling a possible breakout towards the $0,0000105 mark, second technical analysis. This chart pattern is often associated with trend changes, indicating that PEPE may be about to start an upward movement after a period of decline.

At the time of publication, PEPE was trading at $0,057124, up 6.5% in the last 24 hours. In one week, the memecoin’s price has increased by almost 10%, catching investors’ attention after a period of decline.

Source: TradingView/Ali Martinez

Source: TradingView/Ali Martinez

Pepe Coin Shows Signs of Recovery and Defies Market Expectations

After a period of intense fluctuations, the price of the Pepe coin presented signs of recovery, fostering optimistic expectations among investors. This upward movement follows an impressive 25% rally, indicating a possible reversal in the downward trend that has been marking its recent trajectory.

Resistance at the horizontal and descending trendlines has been a continuous challenge for Pepe. However, recent technical analysis suggests that if the coin manages to break through these barriers, it could see a 30-35% increase in its value. This scenario is supported by four-hour data from TradingView, provided by Worldofcharts, which shows Pepe facing resistance but with the potential to start a new bullish phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Pectra comes Fusaka: Ethereum takes the most crucial step towards "infinite scalability"

The Fusaka hard fork is a major Ethereum upgrade planned for 2025, focusing on scalability, security, and execution efficiency. It introduces nine core EIPs, including PeerDAS, to improve data availability and network performance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.