Bitcoin Explosion: Expert Predicts Short-Term Price Spike

- Bitcoin Top Projection.

- Analysis of price cycles.

- Next top between 3 to 6 months.

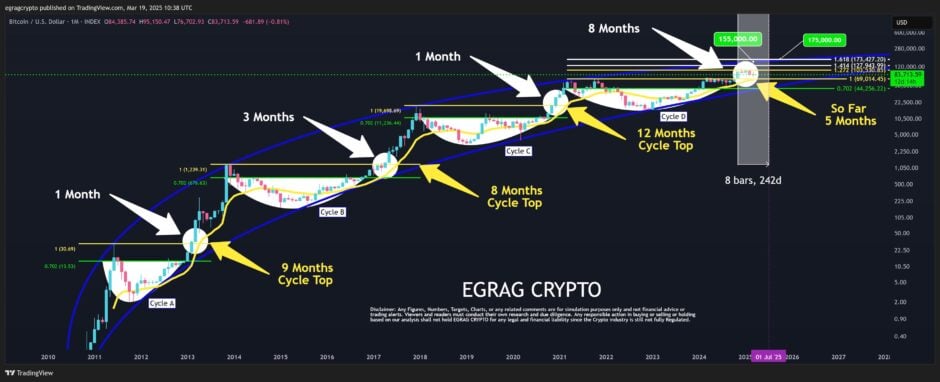

A recent analysis highlighted the prediction that the top of the cycle Bitcoin may be closer than you think, with projections pointing to a period between 3 to 6 months. This analysis, based on historical data and technical indicators shared by market expert Egrag Crypto, seeks to identify patterns in previous Bitcoin cycles to predict the cryptocurrency's future behavior. After a turbulent period, the largest crypto asset has once again recorded significant gains, trading higher today.

The expert’s analysis, which focuses on indicators such as Fib 1.0 and EMA 21, examines previous Bitcoin cycles to identify consolidation patterns and the periods required to reach cycle tops. The analyst identified different consolidation periods and times for BTC to reach cycle tops.

Compliant highlighted the expert in his technical analysis, in cycle A, Bitcoin consolidated for 1 month and took 9 months to reach the top of the cycle, while in cycle D, the longest consolidation was 8 months, with 5 months elapsed so far.

Source: Egrag Crypto

Source: Egrag Crypto

Based on this data, Egrag Crypto calculated the average of the periods needed to reach cycle tops, arriving at an average of 9,6 months. This average suggests that the top of the Bitcoin cycle could occur between August and September 2025. However, the expert's analysis also considers other projections, such as April and November 2025, depending on the cycles analyzed. Despite the different projections, the analysis converges to the prediction that the top of the Bitcoin cycle should occur in the next 3 to 6 months.

“The average is calculated as 9 + 8 + 12 = 9,6 months, suggesting that the top of the cycle will likely occur between August and September. I believe the top of the cycle will occur within the next 3 to 6 months,” he explained.

At the time of publication, the price of Bitcoin was quoted at US$83.951,21, up 2.7% in the last 24 hours.

Today investors will accompany They will be closely watching the Federal Reserve’s quarterly projections at 14 p.m. ET, known as the Summary of Economic Projections (SEP), for signals about the next steps in monetary policy. They will also be paying close attention to Fed Chairman Jerome Powell’s remarks during a press conference scheduled for 14:30 p.m. ET.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.