Date: Wed, March 19, 2025 | 07:45 PM GMT

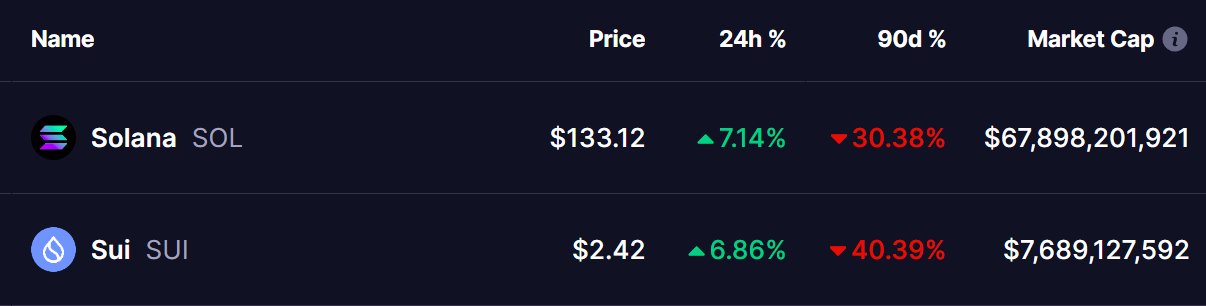

The crypto market is showing early signs of a rebound as Ethereum (ETH) has bounced back from last week’s low of $1,774 and is now trading at $2,033 with a 6% jump today, which comes following the Federal Reserve’s decision to keep interest rates unchanged. As sentiment gradually improves, top altcoins like Solana (SOL) and Sui (SUI) are beginning to show momentum as well.

Both tokens have taken a hit over the past few months, but today’s strong gains and their current price action suggest that a recovery might be brewing—especially as they approach key resistance levels within bullish falling wedge patterns.

Source: Coinmarketcap

Source: Coinmarketcap

Solana (SOL)

Solana’s daily chart reveals a falling wedge pattern—a classic bullish reversal setup that has been forming since its rejection at the $295 high on January 19. The correction that followed dragged SOL down over 60%, bottoming out at $112 on March 11, where buyers stepped in to defend the key support.

Solana (SOL) Daily Chart/Coinsprobe (Source: Tradingview)

Solana (SOL) Daily Chart/Coinsprobe (Source: Tradingview)

Since then, SOL has bounced to $133 and is now approaching the upper boundary of the wedge. If the price breaks out and holds above this resistance with a successful retest, SOL could aim for the 50-day moving average and the $181 zone—representing a potential 39% rally from current levels.

Sui (SUI)

SUI is also forming a falling wedge pattern, having entered this downtrend after peaking at $0.059 on January 6. The price dropped to a low of $1.97, where strong buying interest started to appear near the wedge’s support level.

Sui (SUI) Daily Chart/Coinsprobe (Source: Tradingview)

Sui (SUI) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, SUI has recovered to $2.42 and is edging closer to the upper resistance of the wedge. A breakout here, followed by a confirmation retest, could pave the way for a move toward the 50-day moving average and the $3.25 target.

Continued bullish momentum might even push SUI toward $3.73 and the 100-day moving average—marking a potential 55% gain from current prices.

Can These Breakouts Ignite a Broader Recovery?

Both SOL and SUI are approaching key technical levels, with bullish falling wedge patterns pointing toward a possible breakout. If confirmed by volume and follow-through, these breakouts could signal the start of a broader recovery in the altcoin market.

With Ethereum’s strong performance setting the tone and the overall market reacting positively to the Fed’s dovish stance, SOL and SUI could be among the early beneficiaries of renewed investor confidence.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.