-

Shiba Inu (SHIB) is currently navigating murky waters as profit-taking by short-term holders raises concerns over a significant price rally.

-

With the MVRV Long/Short Difference at a six-month low, profit-taking signals could lead to a sustained downturn if support does not strengthen.

-

A noteworthy pivot point lies in Bitcoin’s trajectory; a surge beyond $90,000 could catalyze a SHIB breakout, as indicated by recent market trends.

Shiba Inu faces a potential downturn as profit-taking weakens support, but a Bitcoin rally above $90,000 could offer a lifeline for the meme coin.

Weak Support Raises Concerns for Shiba Inu

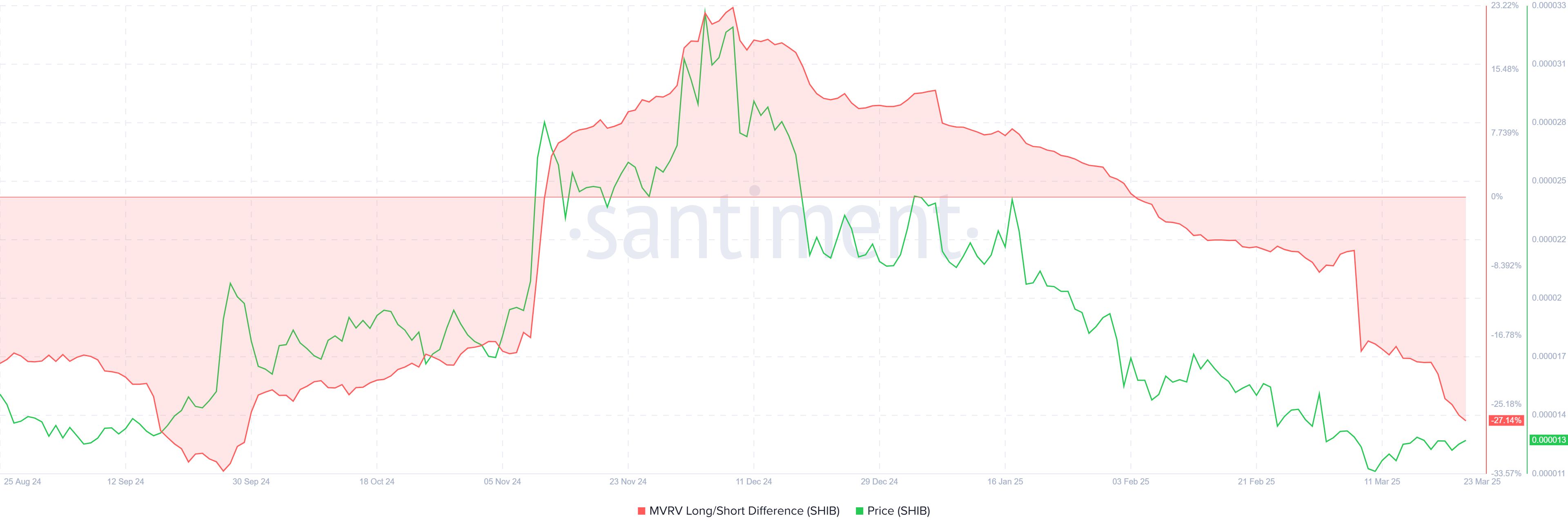

Shiba Inu’s recent price action has been characterized by uncertainty, primarily due to a lack of robust support from its investor base. This weakness is further underscored by the MVRV Long/Short Difference dropping to its lowest level in six months. This metric indicates that many short-term holders are cashing out, leading to concerns that SHIB could face increasing selling pressure moving forward.

With market sentiments shifting, Shiba Inu’s ability to maintain its price is now closely linked to broader market movements, especially those tied to Bitcoin’s performance. If Bitcoin sustains its upward momentum, it could ultimately bolster Shiba Inu’s price trajectory, but current signals suggest a precarious situation.

Impact of the MVRV Long/Short Difference

The decline in the MVRV Long/Short Difference for Shiba Inu represents a critical juncture. This key indicator reflects the profitability of long-term investments compared to short-term trades. When short-term holders realize their profits, this often leads to increased selling pressure, resulting in potential price declines for SHIB. As observed, this tendency is heightened in a volatile market environment, making it essential for long-term holders to step in and provide stability.

Shiba Inu MVRV Long/Short Difference. Source: Santiment

Historically, significant shifts in the MVRV ratio have led to major price adjustments. As of now, the reluctance of long-term investors to buy more SHIB poses challenges for the asset’s price performance. The current landscape illustrates a cautious market where buyers are hesitant, amplifying the volatility of Shiba Inu.

Bitcoin’s Influence on SHIB’s Price Action

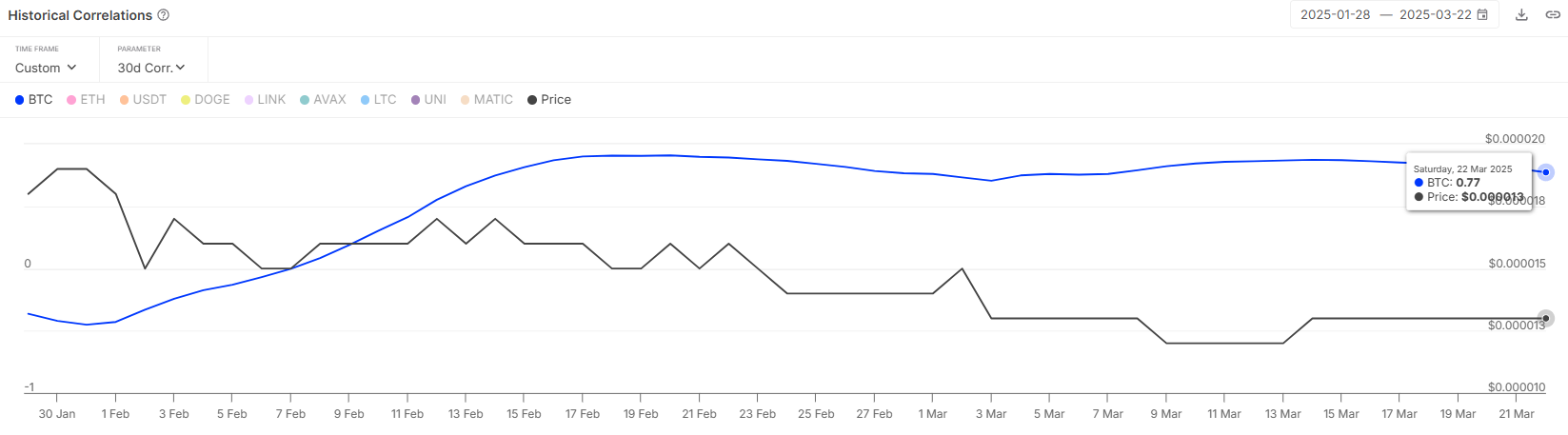

Bitcoin’s strong correlation with Shiba Inu, currently noted at 0.77, plays a pivotal role in determining SHIB’s price movements. If Bitcoin continues to exhibit bullish behavior and approaches the $90,000 threshold, this could signal a renewed optimism throughout the cryptocurrency market, including for Shiba Inu.

The prospect of Bitcoin hitting $90,000 poses as a critical support level that could instill confidence among Shiba Inu traders. Such momentum could pave the way for SHIB to successfully breach important resistance levels, setting the stage for potential price recovery.

Shiba Inu Correlation To Bitcoin. Source: IntoTheBlock

SHIB Strives for Price Recovery Amidst Fluctuations

Currently trading at approximately $0.00001296, Shiba Inu finds itself at a fragile support level of $0.00001275. Maintaining this support is critical for facilitating a bounce-back to higher levels. However, the scenario is heavily contingent on Bitcoin’s performance.

If Bitcoin experiences upward movement, it could provide the necessary lift for SHIB to reach the resistance level at $0.00001462. Conversely, any slip in Bitcoin’s value may see SHIB stabilize around the $0.00001275 mark or even drop to $0.00001141, depending on bearish market pressures.

Shiba Inu Price Analysis. Source: TradingView

A break above the crucial $0.00001462 resistance is imperative for altering the current bearish-neutral outlook on SHIB’s market trajectory. If such a rally occurs, it could set the stage for a more bullish sentiment, with $0.00001676 emerging as a new target for Shiba Inu.

Conclusion

In summary, Shiba Inu continues to confront significant challenges as profit-taking by short-term holders impacts market dynamics. The cryptocurrency’s fate hangs on the broader market trends, particularly Bitcoin. While there are positive indicators for potential recovery, a more considerable dependence on external factors, particularly from Bitcoin, will determine the immediate future for SHIB. Establishing solid support is vital for any recovery efforts as investors watch for possible bullish signs.