-

Stellar (XLM) exhibits robust market activity, with its RSI indicating bullish momentum while remaining below overbought conditions.

-

The DMI analysis supports the bullish sentiment, showing a strengthening trend as buyers maintain control.

-

Market experts project that if current trends hold, Stellar could see significant price movement, potentially breaking the $0.30 level.

Stellar’s (XLM) technical indicators reveal strong bullish signals, with potential for price surges above $0.30 in the coming weeks.

Stellar Price Trends: An Overview of Bullish Signals

Stellar’s recent price action reflects a compelling shift in market sentiment, evidenced by key technical indicators. The asset has increased by 11% over the last week, elevating its market capitalization to approximately $9 billion. An examination of its Relative Strength Index (RSI) and Directional Movement Index (DMI) signals a surge in bullish sentiment, setting the stage for potential price acceleration.

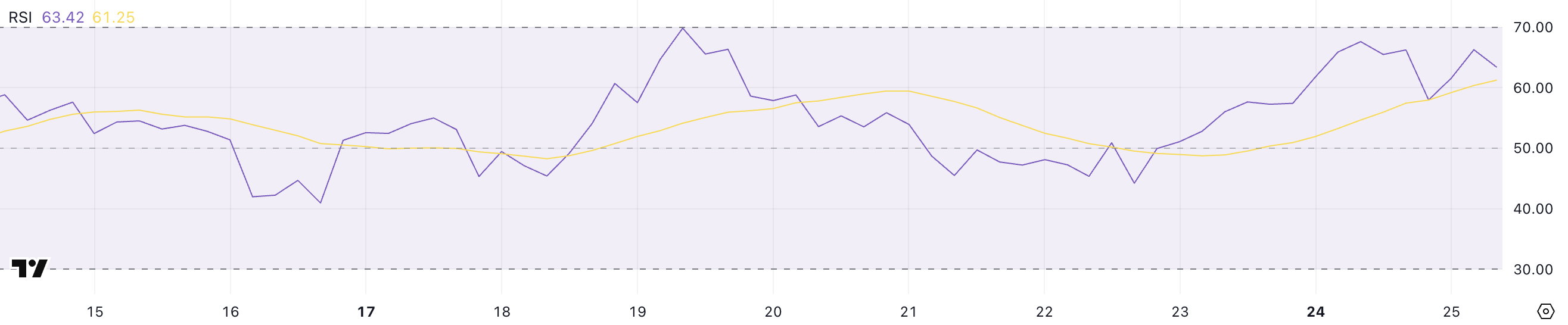

Understanding the Implications of XLM’s RSI Movement

The current RSI of 63.42 indicates that while bullish momentum is strong, the asset has yet to reach overbought levels, suggesting there may still be room for upward price movement. Since early March, the inability of the RSI to breach the 70 level denotes a cautious yet optimistic market environment, with buyers likely awaiting further validation before executing larger trades.

XLM RSI. Source: TradingView.

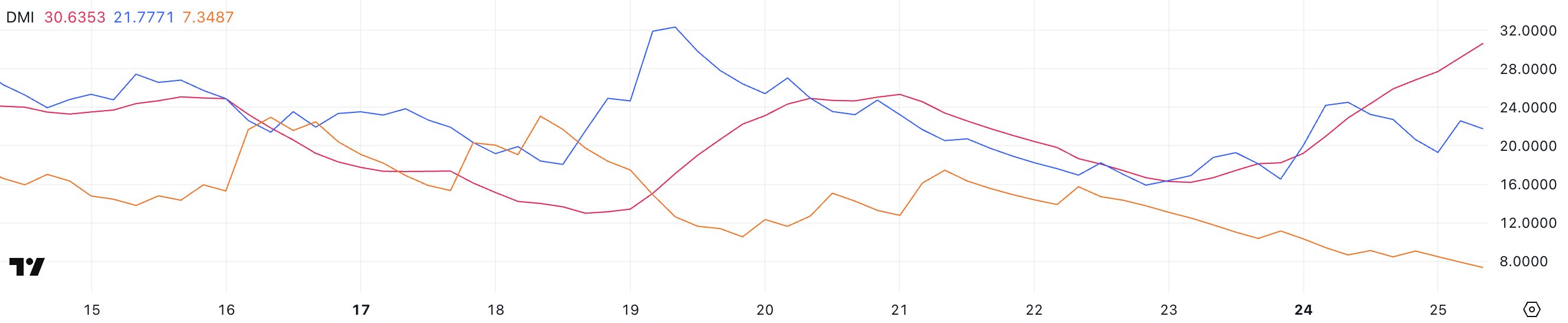

DMI Analysis Confirms Bullish Control

Current readings from the DMI (Directional Movement Index) reveal that the ADX is at 30.63, reflecting a robust uptrend backed by buyers. The +DI line currently stands significantly above the -DI line, providing clear evidence that bullish pressure remains dominant in the market. Despite a slight dip in the +DI, the overall trend remains strong, with bulls demonstrating resilience.

XLM DMI. Source: TradingView.

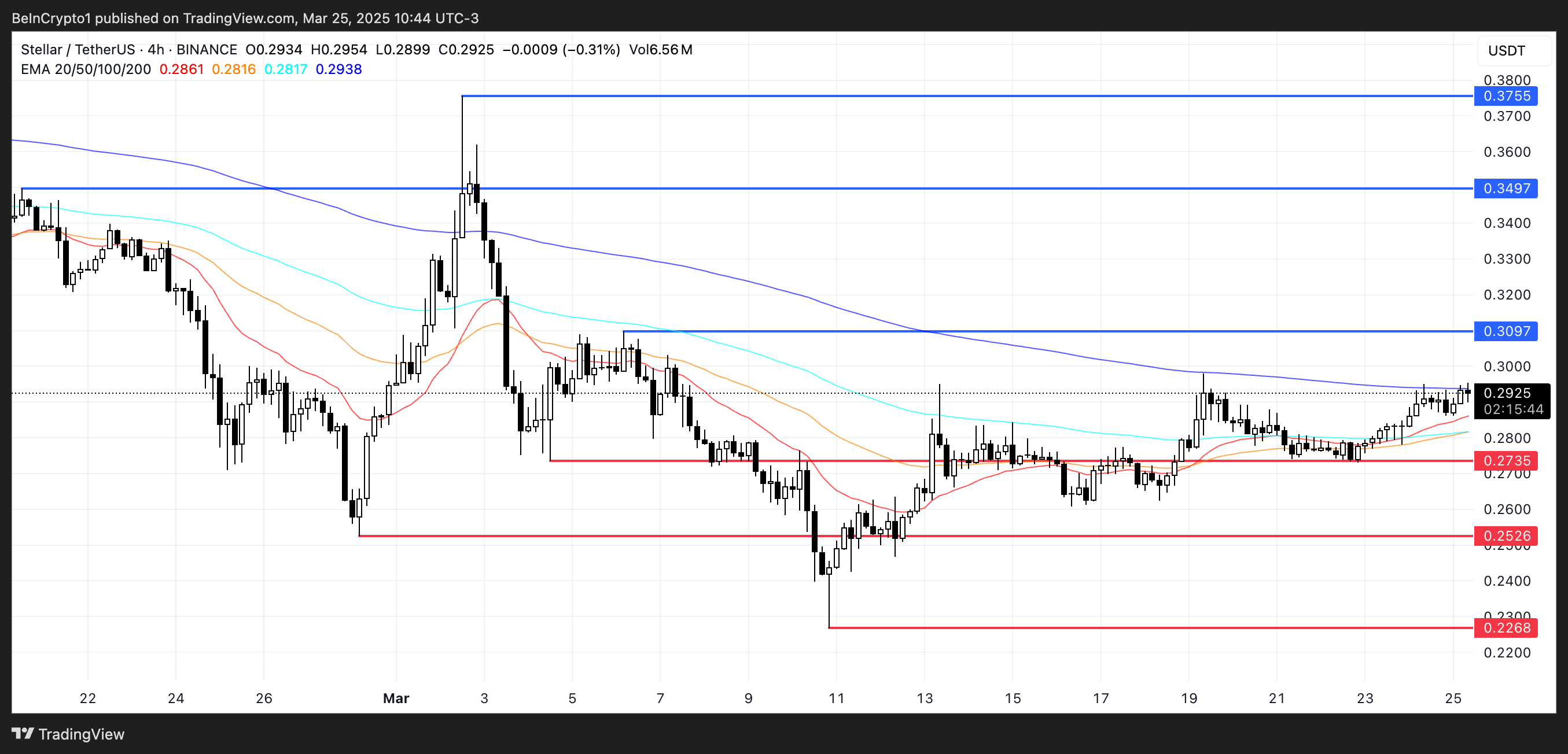

Short-Term Moving Averages Indicate a Potential Golden Cross

Stellar’s exponential moving averages (EMAs) are converging, signaling the possibility of a bullish “golden cross” pattern. This occurs when shorter-term moving averages cross above longer-term ones, often seen as a precursor to continued upward movement. Should this pattern emerge, market analysts foresee a potential breakout above the critical $0.30 threshold, enhancing bullish forecasts further.

XLM Price Analysis. Source: TradingView.

Conclusion

In summary, Stellar (XLM) is demonstrating promising signs of bullish momentum through its technical indicators. With strong RSI readings, supportive DMI figures, and the potential for a golden cross, the cryptocurrency may be on the verge of significant upward movement. Traders and investors should closely monitor these indicators as Stellar aims for a price breakout, potentially exceeding $0.40 in the weeks ahead.