‘Banana Zone’ Bitcoin Rally Still in Play Despite Downside Deviation, According to Crypto Analyst

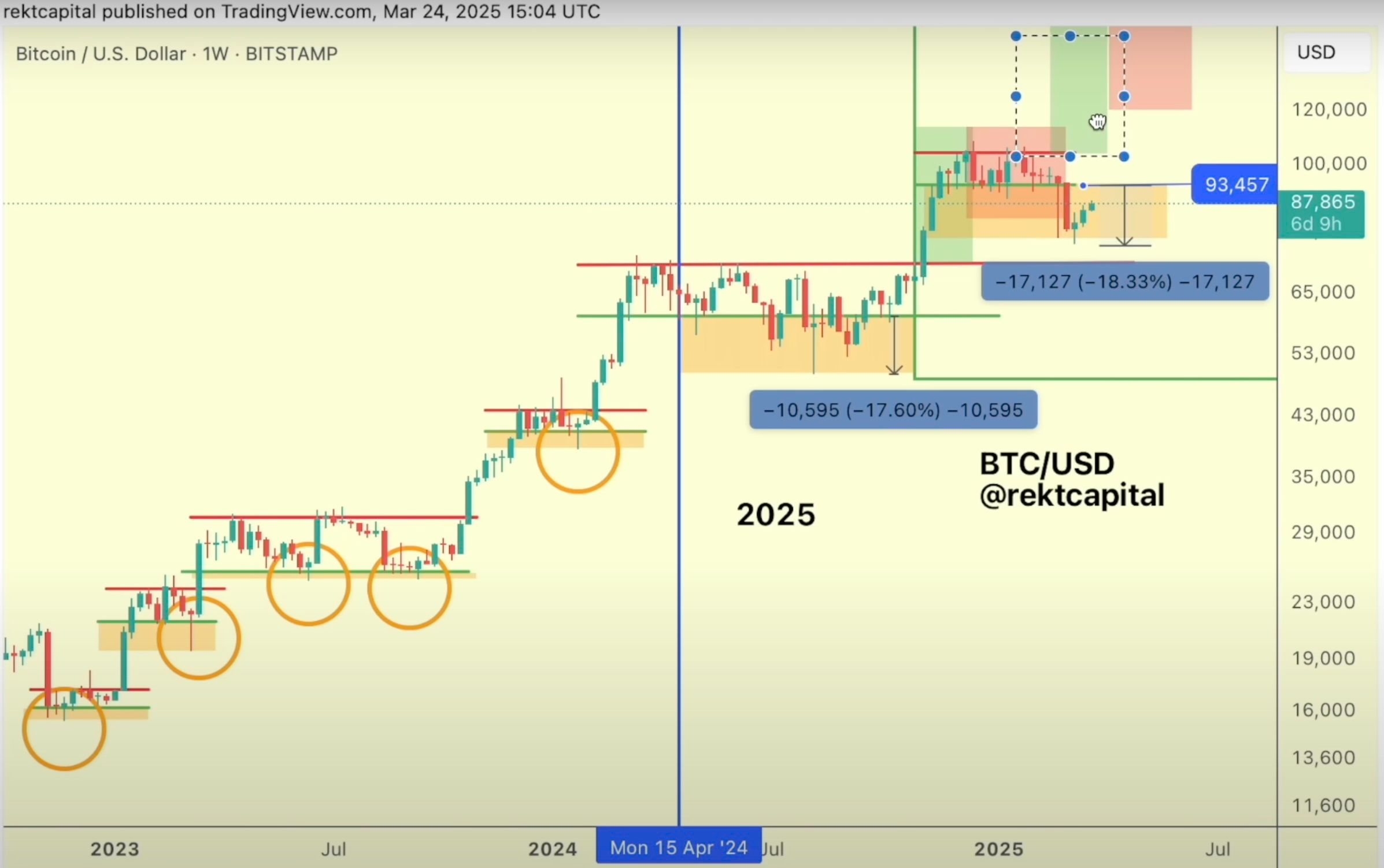

An analyst who nailed Bitcoin’s pre-halving correction last year says that an explosive BTC move to the upside remains in play despite this month’s correction.

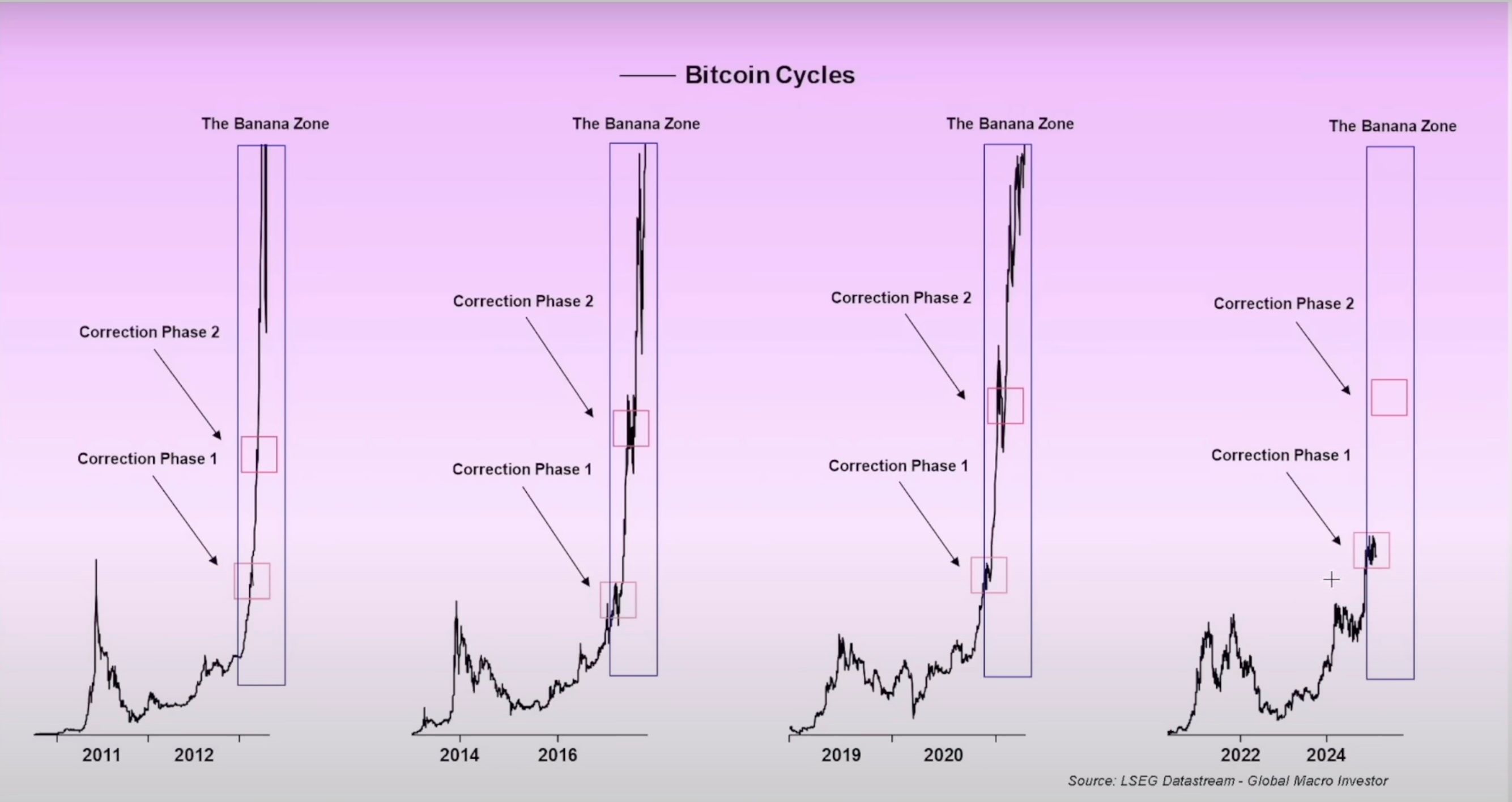

The analyst, pseudonymously known as Rekt Capital, tells his 107,000 YouTube subscribers that Bitcoin remains in the “banana zone” based on historical precedence.

The banana zone is a term used by crypto analysts to describe a period of rapid and explosive price growth for digital assets.

“This is the banana zone still. The banana zone doesn’t just occur in just one vertical line towards the upside. The banana zone is comprised of an uptrend, of a first price discovery correction, of a second price discovery uptrend, and also of a second price discovery correction. And this is also what the chart maps out as well, that we can have a correction phase here and then a correction phase there. But this is all part of the process in an otherwise strong, parabolic upside movement.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

He also says past cycles saw multiple corrections during the banana zone and predicts Bitcoin will repeat a similar pattern.

“These price discovery corrections can occur quite frequently…

If we’re talking about this current pullback here, this is the first price discovery correction. 2021 saw three. 2017 saw four. So I think we can bank on at least one more price discovery correction occurring in the future.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

Bitcoin is trading for $87,305 at time of writing, flat on the day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.