Date: Mon, March 31, 2025 | 05:40 AM GMT

The cryptocurrency market is facing bearish pressure as Ethereum (ETH) has dropped by over 11% over the past week. The downward momentum is partly influenced by escalating global trade tensions, with Donald Trump set to impose reciprocal tariffs on all countries on April 2, as reported by Watcher Guru .

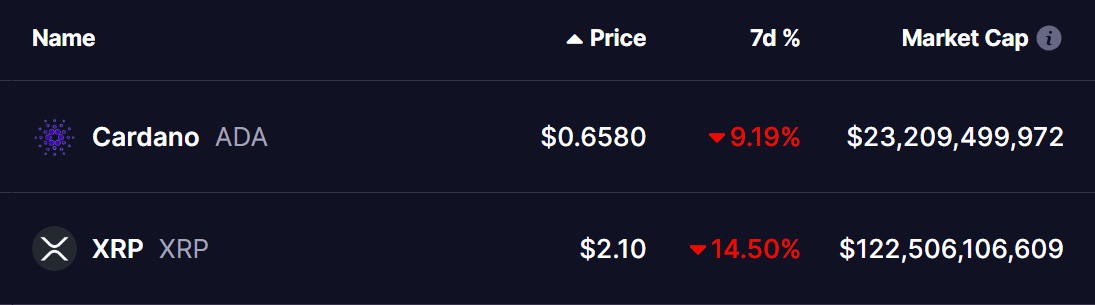

Following this, top altcoins like Cardano (ADA) and XRP have taken significant hits, with ADA falling 9% and XRP dropping 14% in the last seven days. Both altcoins are now testing critical support levels, raising the question: What comes next?

Source: Coinmarketcap

Source: Coinmarketcap

Cardano (ADA) – Testing the Symmetrical Triangle Support

On the daily chart, ADA has formed a symmetrical triangle pattern, a structure often signaling a breakout in either direction. The ongoing sell-off has pulled ADA down from its high of $1.17 to around $0.65, now sitting at a key support level marked within the triangle (circled in the chart).

Cardano (ADA) Daily Chart/Coinsprobe (Source: Tradingview)

Cardano (ADA) Daily Chart/Coinsprobe (Source: Tradingview)

Should ADA hold this support, a bounce could be expected, leading to a potential recovery. If it manages to break above the 50-day moving average (50MA) resistance, it could confirm a short-term uptrend. Conversely, a breakdown below the triangle could push ADA further toward $0.50 or lower.

XRP (XRP) – Facing a Bearish Head and Shoulders Pattern

XRP’s daily chart paints a more bearish picture, having formed a Head and Shoulders pattern, a traditionally bearish signal. The current decline has taken XRP below the 150-day moving average (150MA) at $2.17, pushing it into a crucial support zone between $1.90 and $2.11 (highlighted in red on the chart). This level has historically prevented breakdowns, and XRP is currently trading near $2.10, the upper boundary of the support zone.

XRP (XRP) Daily Chart/Coinsprobe (Source: Tradingview)

XRP (XRP) Daily Chart/Coinsprobe (Source: Tradingview)

If XRP manages to bounce from this support, it could invalidate the bearish pattern and resume an uptrend. However, if it breaks below, XRP may test the 200-day moving average (200MA) at $1.74, potentially signaling further downside.

What’s Next for These Altcoins?

While both ADA and XRP are testing key support levels, their next move largely depends on Bitcoin (BTC) dominance. BTC dominance has rebounded from rising wedge support, climbing from 61.34% to 62.18%.

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

As BTC dominance nears its resistance trendline, two scenarios could unfold:

- Rejection at Resistance – If BTC dominance gets rejected from its resistance trendline, altcoins like ADA and XRP could see a relief bounce.

- Breakout Above Resistance – If BTC dominance breaks out, it could trigger another wave of selling pressure on altcoins, including ADA and XRP, leading to further downside.

Final Thoughts

Both ADA and XRP are at make-or-break points. Their ability to hold current support levels will determine their short-term trend. Investors should monitor BTC dominance, key moving averages, and support zones for ADA and XRP, as these indicators will likely dictate the next significant moves for these altcoins.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.