- ETH enters Q2 testing ~$1790 support after sharp Q1 drop (-45%)

- Positive April/May seasonality contrasts with low whale activity 2020-low fees

- Holding ~$1790 support key for potential rebound; $1900 is first resistance

As Q1 comes to a close, Ethereum investors shift their focus toward Q2 prospects. April and May historically stand out as some of the stronger months for the crypto market. Historical data shows April delivered an average Ethereum return near 20% in past cycles, while May consistently outperformed with an average gain closer to 30%. This strong seasonal tendency raises a question for Ethereum (ETH) on whether it can surpass the $3,000 mark by the end of May this year.

Many analysts remain generally bullish on ETH’s longer-term potential to break key resistance levels eventually. However, beneath this general outlook, recent on-chain activity suggests a more complex and cautious narrative.

On-Chain Data Shows Declining Whale Activity, Low Fees

According to blockchain analyst Ali Martinez, there has been a major decline noted in whale Ethereum transactions since February 25. Activity among these large wallets reportedly dropped by 63.8% during that observed period.

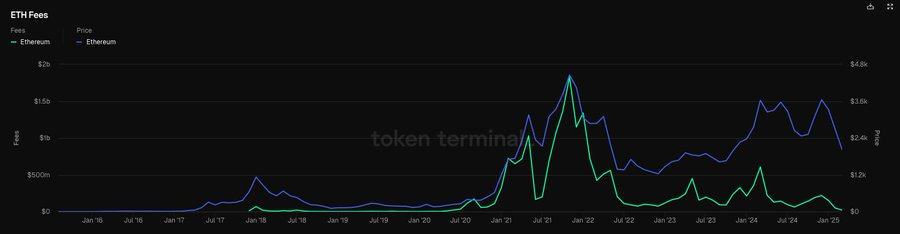

Data also shows Ethereum is estimated to generate just $22 million in total network transaction fees for March—the lowest level since 2020., according to data sources like TokenTerminal.

Related: Three Reasons Why Crypto Market Might Recover Strongly in Q2 2025

Source: Tokenterminal

Source: Tokenterminal

While fees and price don’t always move together, history shows that rising fees often signal stronger price action for ETH. Conversely, falling fees can mean a period of market slowdown or lack of investor interest.

What Does This Mean for ETH Price?

While a sharp drop in whale activity might seem concerning initially, it does not necessarily guarantee further immediate downside for Ethereum’s price.

In fact, it could also mean a period of consolidation—a common phase before a big price movement. This consolidation could either set the stage for a bullish breakout or suggest that the market is pausing to reassess before the next move.

What Levels Are Key for ETH’s Next Move?

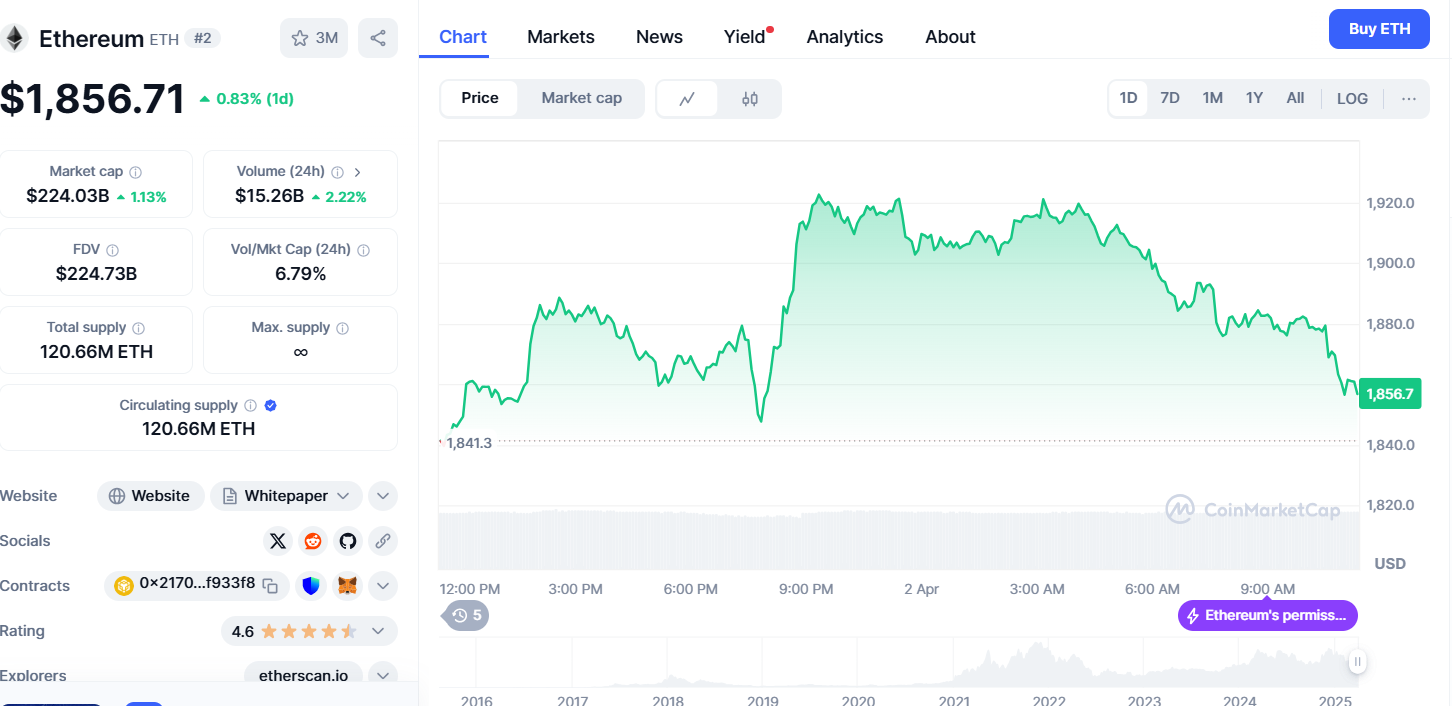

Source: CoinMarketCap

Source: CoinMarketCap

Related: Deep Dive: Vitalik Buterin’s 2-of-3 Proof System for Ethereum Layer 2s

ETH is also currently attempting to break back above the $1,900 level. Successfully reclaiming this area, which acted as prior support, could mark the start of a renewed bullish trend, particularly if the move is sustained on increased volume.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.