BlackRock CEO Forecast: Will a Recovery Follow the Crypto Market Crash ?

Crypto Market Crash: Recovery or More Losses Ahead?

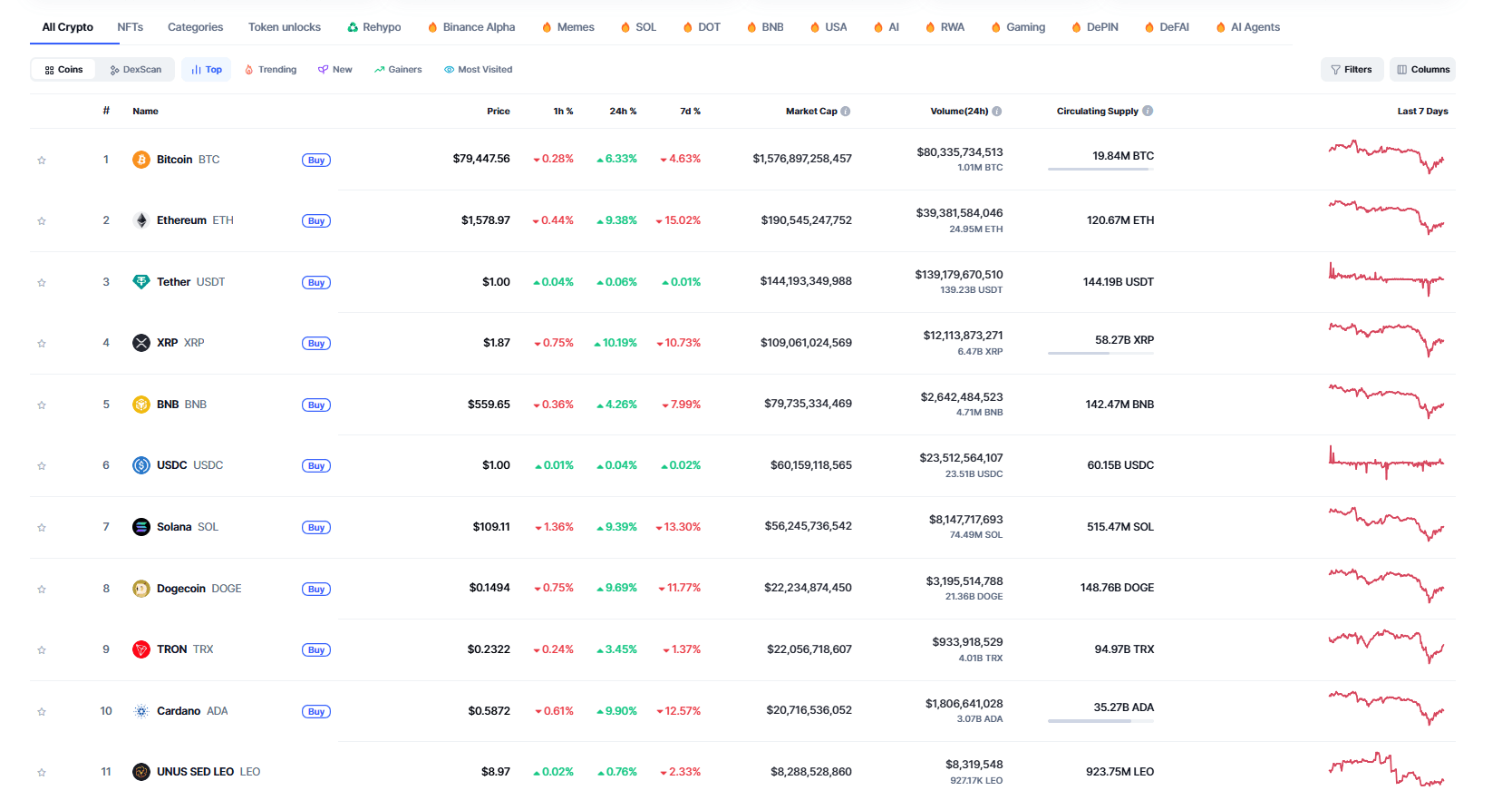

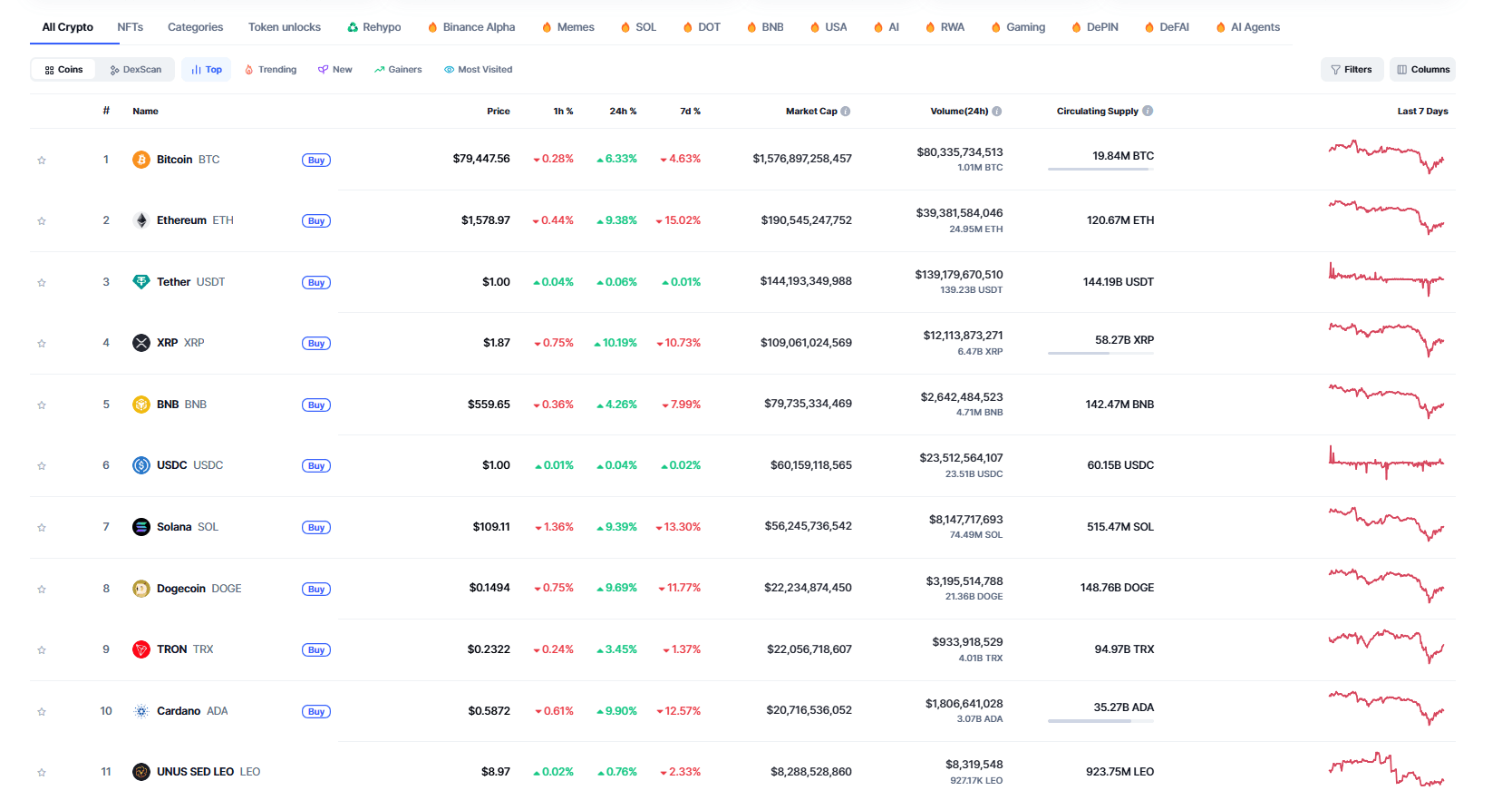

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Crypto Market Crash April 2025

Crypto Market Crash April 2025

BlackRock CEO Larry Fink Warns: Another 20% Drop Possible

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

Top Crypto Losers This Week

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

- Pi Network (PI): Down 36%, trading around $0.52

- Bittensor (TAO): Dropped 15.61%, now at $184.12

- Worldcoin (WLD): Fell 14.32%, to $0.6274

- Lido DAO (LDO): Down 14.09%, priced at $0.7036

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Will the Crypto Market Recover?

Whether the crypto market recovers soon depends on several macro and internal market factors:

1. Macro Conditions

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

2. Regulatory Landscape

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

3. Halving and Cycles

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

4. Retail vs Institutional Sentiment

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Possible Scenarios Ahead

🟢 Optimistic Scenario:

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

🟠 Neutral Scenario:

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

🔴 Bearish Scenario:

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

Final Thoughts

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

Crypto Market Crash: Recovery or More Losses Ahead?

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Crypto Market Crash April 2025

Crypto Market Crash April 2025

BlackRock CEO Larry Fink Warns: Another 20% Drop Possible

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

Top Crypto Losers This Week

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

- Pi Network (PI): Down 36%, trading around $0.52

- Bittensor (TAO): Dropped 15.61%, now at $184.12

- Worldcoin (WLD): Fell 14.32%, to $0.6274

- Lido DAO (LDO): Down 14.09%, priced at $0.7036

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Will the Crypto Market Recover?

Whether the crypto market recovers soon depends on several macro and internal market factors:

1. Macro Conditions

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

2. Regulatory Landscape

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

3. Halving and Cycles

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

4. Retail vs Institutional Sentiment

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Possible Scenarios Ahead

🟢 Optimistic Scenario:

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

🟠 Neutral Scenario:

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

🔴 Bearish Scenario:

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

Final Thoughts

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pudgy Penguins NFT surpasses Bored Ape in one month: A quick overview of what the PENGU token is

PENGU is the official token of the Pudgy Penguins NFT series and will be launched on the Solana blockchain by the end of 2024. Pudgy Penguins is an NFT project featuring 8,888 unique penguin images, initially released on Ethereum, and has now become the second-largest NFT project by market capitalization. The launch of PENGU aims to expand the community, attract new users, and is planned for deployment on multiple blockchains. The total token supply is 88,888,888,888, allocated to the community, liquidity pools, project team, and others. Solana was chosen to reach a new audience and leverage its fast transactions and low-cost advantages. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Glassnode: Bitcoin Weakly Fluctuates, Is Major Volatility Coming?

If signs of seller exhaustion begin to appear, a short-term move towards $95,000 and the short-term holder cost basis is still possible.

Should You Still Believe in Crypto

No industry has always been right from the beginning, until it truly changes the world.

Zeus unveils institutional-grade MPC infrastructure blueprint at Solana Breakpoint 2025, enabling Bitcoin to enter Solana’s on-chain capital markets

The focus will now shift to building MPC tools and providing support for developers, driving the creation of more native UTXO applications on Solana.