Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

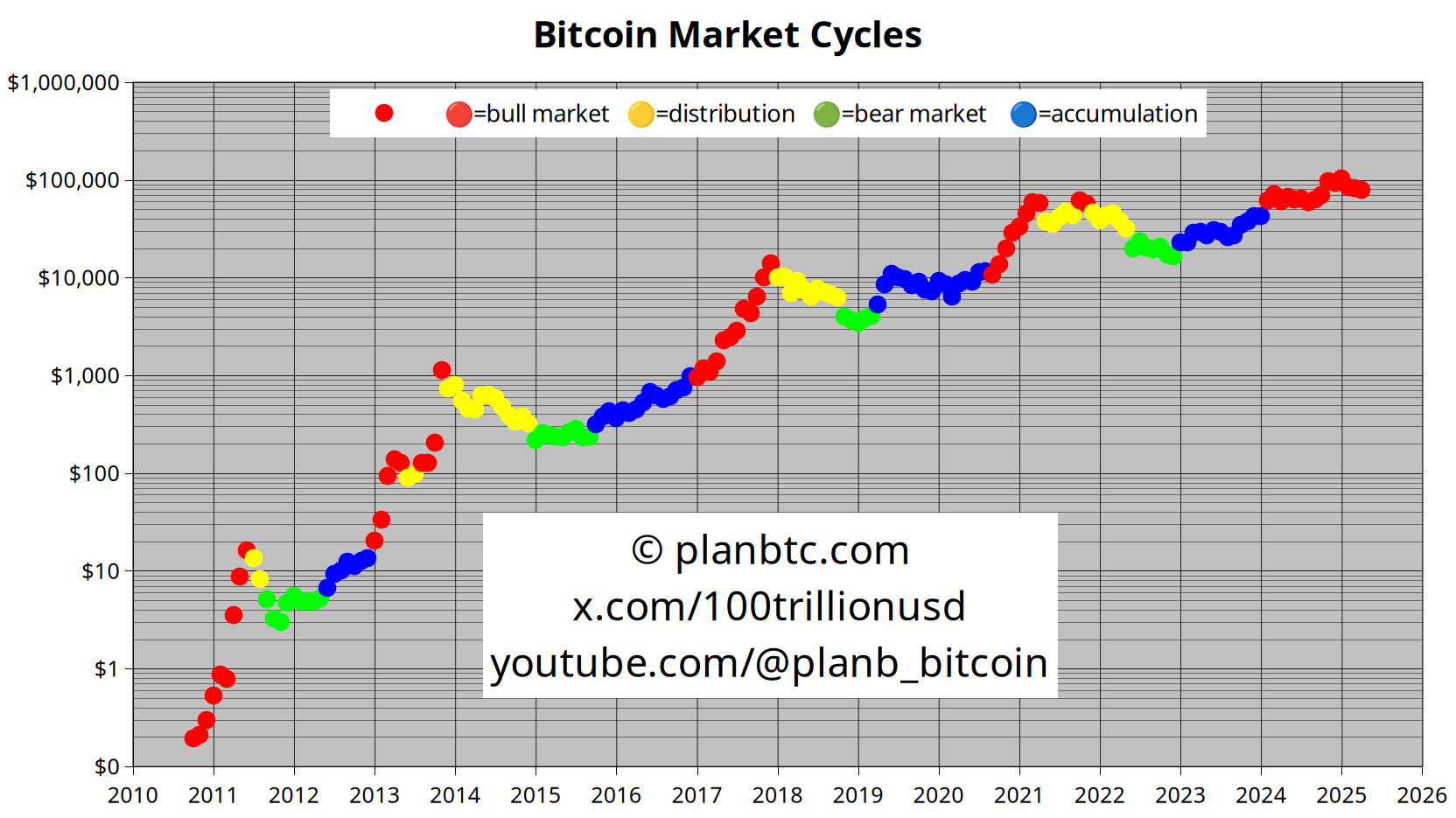

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano News Today: While ADA Faces Challenges, Mutuum's Robust DeFi Approach Draws $18.9M During Presale

- Mutuum Finance (MUTM) raised $18.9M in Phase 6, with token price rising 250% to $0.035 amid strong demand from 18,200 holders. - The project combines P2C/P2P lending with smart contract automation and a buy-and-distribute mechanism to create a deflationary, non-custodial DeFi alternative. - CertiK/Halborn audits and Q4 2025 testnet plans highlight security focus, while 45.5% token allocation to presale and card-based payments boost accessibility. - MUTM's $0.04 Phase 7 price hike and $0.06 launch target

Bitcoin’s Steep Drop in Late 2025: The Intersection of Broader Economic Risks and Changing Market Sentiment

- Bitcoin plummeted from $126,000 to $81,000 in late 2025 amid a $1T crypto market contraction driven by macroeconomic, regulatory, and behavioral factors. - The Fed's delayed rate-cut signals and elevated interest rates intensified capital flight from high-beta assets like Bitcoin to safer investments. - SEC's regulatory ambiguity and institutional "whale" BTC withdrawals exacerbated selling pressure, while miners added technical downward momentum. - Investor sentiment reached historic lows, with $3.79B i

Hyperliquid Tops Net Flows with $53.2M in 24 Hours

Hyperliquid leads crypto market net flows with $53.2M in 24 hours, signaling rising investor interest.Why Investors Are Flocking to HyperliquidWhat This Means for the DeFi Market

BitMine Adds 14,618 ETH Worth $44.3M to Treasury

BitMine makes a bullish move by acquiring 14,618 ETH valued at $44.3 million for its growing crypto treasury.Ethereum Becomes a Strategic Treasury AssetMarket Reacts to Bullish Signal