FARTCOIN’s 250% Rally Faces Potential End as Buyers Near Exhaustion

FARTCOIN's explosive rally may be losing steam as technicals flash warning signs. Traders now face a pivotal moment: ride the wave to $1.16 or brace for a slip to $0.37.

The Solana-based meme coin FARTCOIN has emerged as an unlikely outperformer over the past month. The altcoin has defied the broader market troubles and surged by nearly 250% in the past 30 days.

However, buyer exhaustion could soon set in, potentially triggering a wave of profit-taking among FARTCOIN holders eager to lock in gains.

FARTCOIN Enters Overbought Zone

FARTCOIN’s triple-digit rally has pushed its price above the upper band of its Bollinger Bands (BB) indicator, a sign that the meme coin is overbought.

FARTCOIN Bollinger Bands. Source:

TradingView

FARTCOIN Bollinger Bands. Source:

TradingView

The BB indicator identifies overbought or oversold conditions and measures an asset’s price volatility. It consists of three lines: a simple moving average (middle band) and two bands (upper and lower) representing standard deviations above and below the moving average.

When the price breaks above the upper band, it means the asset’s current value is moving significantly away from its average, making it overbought and due for a price correction.

This pattern suggests that FARTCOIN’s current price level may not be sustainable, increasing the likelihood of a near-term pullback.

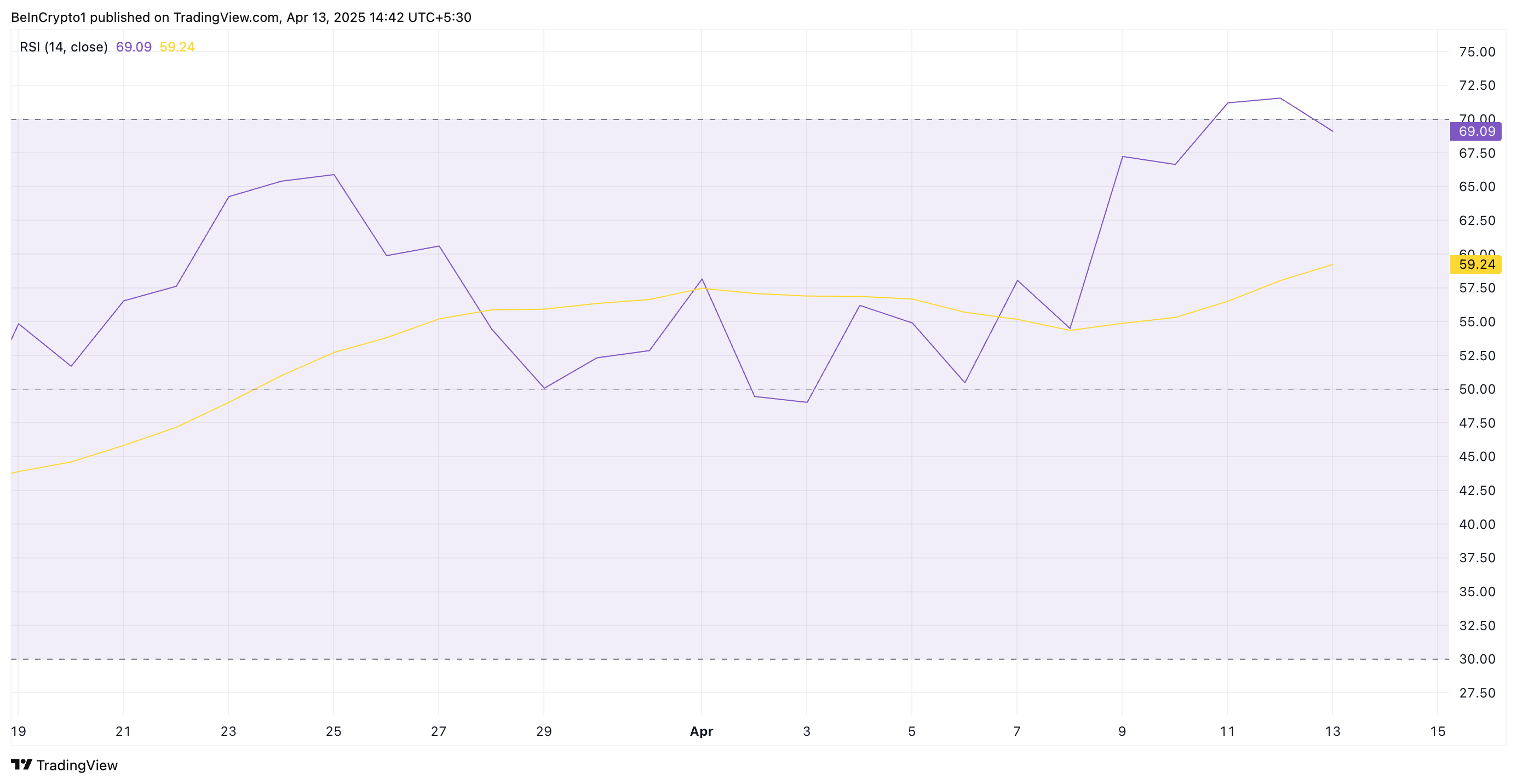

Moreover, readings from the token’s Relative Strength Index (RSI) confirm its nearly overbought status. At press time, this momentum indicator rests at 69.09.

FARTCOIN RSI. Source:

TradingView

FARTCOIN RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 69.09, FARTCOIN’s RSI signals that the meme coin is nearly overbought. Its upward momentum may be weakening, and a price correction could be near.

Will It Hit $1.16 or Slip Back to $0.37?

If the current momentum fades, FARTCOIN could face a short-term correction that causes it to shed some recent gains. In that scenario, the Solana-based asset could retest support at $0.74.

Should it fail to hold, the downtrend strengthens and could continue toward $0.37.

FARTCOIN Price Analysis. Source:

TradingView

FARTCOIN Price Analysis. Source:

TradingView

However, if FARTCOIN maintains its uptrend, it could rally to $1.16.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.