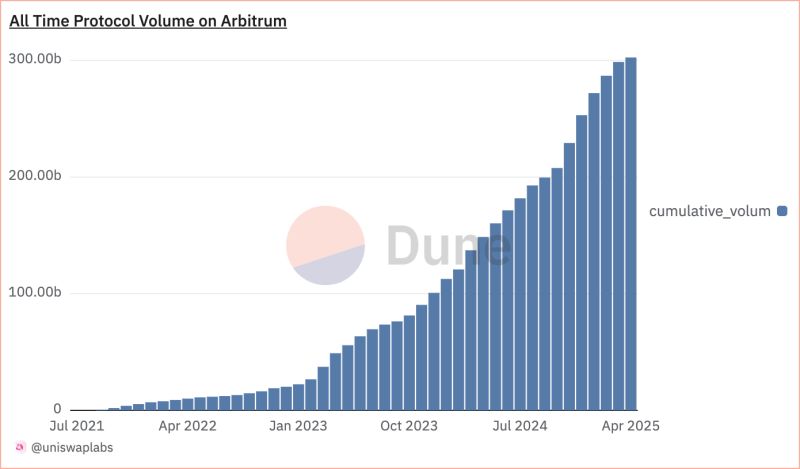

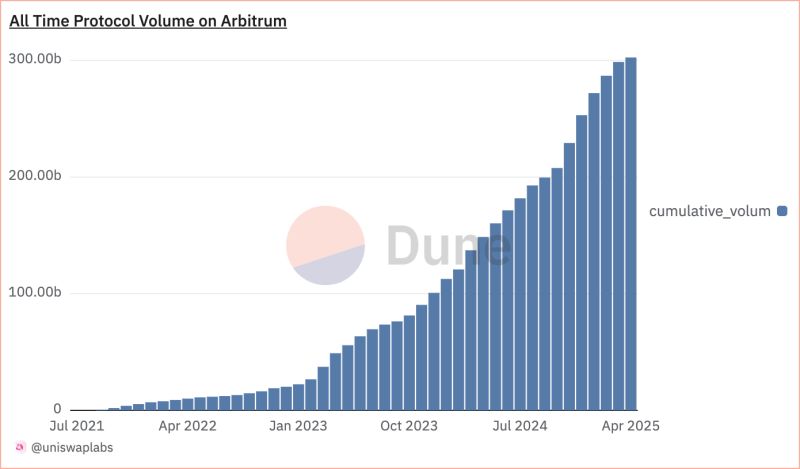

- Arbitrum became the first Layer 2 to surpass $300B in trading volume on Uniswap.

- Activity on Arbitrum One increased over 40% since early 2025, outpacing rival networks.

Arbitrum has just made history. For the first time, this Layer 2 solution has managed to break through $300 billion in trading volume on Uniswap, making it the first L2 to achieve this milestone.

This is no joke, especially considering how tight the competition between blockchain networks is today. This figure shows how much user trust in Arbitrum’s efficiency and scalability compared to other alternatives.

![Arbitrum Leads Layer 2s With $300B Uniswap Volume image 1]()

Source: Uniswap Labs

On the other hand, this surge is also in line with the CNF report , which states that on-chain activity on the Arbitrum One network has increased by 40.27% since the beginning of 2025. This figure is quite striking, especially since several other networks, such as Worldchain, Base, and Solana, have actually decreased.

From here, it begins to be seen that Arbitrum is not just a cheap alternative to Ethereum but has begun to be recognized as an active DeFi backbone.

Furthermore, it is not only the volume and activity that are prominent. On January 30, the Arbitrum team announced its integration with zkVerify, a modular Layer 1 network that allows the zero-knowledge (zk) proof verification process to run more efficiently.

This integration allows verification costs to be reduced by up to 91%. Imagine if you were a developer who had to verify a lot of transactions every day—this cost difference could mean a longer life for your project.

Arbitrum Backs Real-World Use Cases and Bold New Ideas

Still in Q1 2025, Arbitrum launched an incubator program called Onchain Labs . Its focus is on helping early-stage projects that are still vulnerable—both in terms of capital and business model. This approach is quite interesting, because instead of just being a home for mature projects, Arbitrum is opening up space for wild ideas that still need nurturing.

Then there’s news from the Bitso exchange. On March 26, they announced a new stablecoin pegged to the Mexican peso and issued through the Arbitrum network. The goal is clear: to facilitate cross-border payments in the Latin American region.

This is not only technical validation but also proof that Arbitrum is starting to be used for real needs outside of the traditional crypto space. Just imagine if a model like this were adopted in Southeast Asia or Africa—the potential could be crazy.

ARB Token Holds Strong Amid Market Shifts

Meanwhile, the ARB token has also seen interesting movement. In the last 24 hours, its price has increased by around 2.15%. In the last few days, its increase has reached around 6%. With a market cap of around $1.4 billion, ARB is ranked at the top of the Layer 2 token category.

This means that not only is its technology accepted, but also its market value and investor confidence are also accompanying it.