-

Whales have made significant moves in the crypto space, with $80 million recently parked in Solana (SOL), propelling the chain’s activity to outpace Ethereum.

-

As bullish momentum builds, Solana is witnessing increased whale accumulation and robust network traffic, indicating strong market confidence and potential breakout scenarios.

-

According to a recent report by COINOTAG, “Whale accumulation alongside rising network metrics suggests that SOL may soon breach critical resistance levels.”

Solana’s market activity surges as whales accumulate $80 million in SOL, indicating a potential bullish breakout and surpassing Ethereum in network traffic.

Solana’s Breakout Attempt: Analyzing Key Influences

The recent spike in Solana’s price action isn’t occurring in isolation; various factors are aligning to support this momentum. Galaxy Digital has withdrawn approximately 606,000 SOL tokens valued at $79.7 million from exchanges, subsequently staking 462,000 SOL (around $60 million). This move signals a confident shift among key institutional investors, bolstering long-term convictions in the chain’s fundamentals.

In addition, Solana’s network metrics indicate remarkable growth, with active addresses reaching 29 million—a 17% increase since last month—and total transactions soaring to 374 million, dominating other blockchain networks.

Furthermore, decentralized exchange (DEX) trading volumes have surged to $2.27 billion daily, overtaking Ethereum (ETH) and highlighting Solana’s growing position in the DeFi landscape. Transaction fees have also increased by 42% to reach $7.67 million, reflecting heightened on-chain demand and user engagement. This momentum illustrates not only a rise in user adoption but also an expanding ecosystem across Solana’s DeFi and NFT initiatives, further supporting the current upward trend.

Market Dynamics: A Cautious Approach

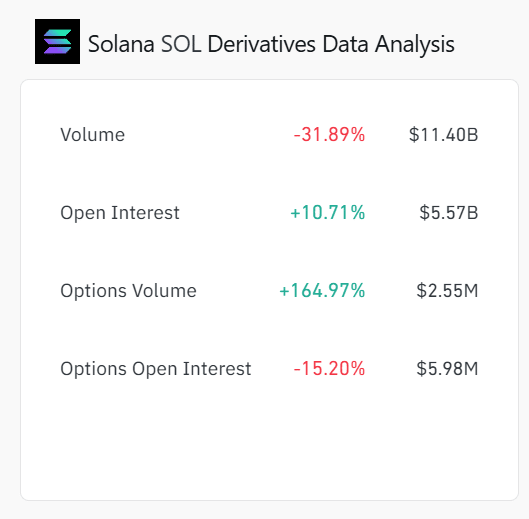

While the spot market shows robust momentum, recent derivatives data illustrates a more cautious stance among traders. Open Interest rose by 10.71% to reach $5.57 billion, while Options Volume skyrocketed by 164.97% to $2.55 million, indicating increased interest in market positions.

However, total trading volume fell by 31.89%, and Options Open Interest declined by 15.20%, hinting that traders are approaching the market with selectivity, potentially hedging existing positions or waiting for clearer signals before committing to long positions. This cautious sentiment is particularly relevant given the strong resistance level at $145.

Source: Coinglass

Shifting Market Sentiment: Liquidations Reveal Trends

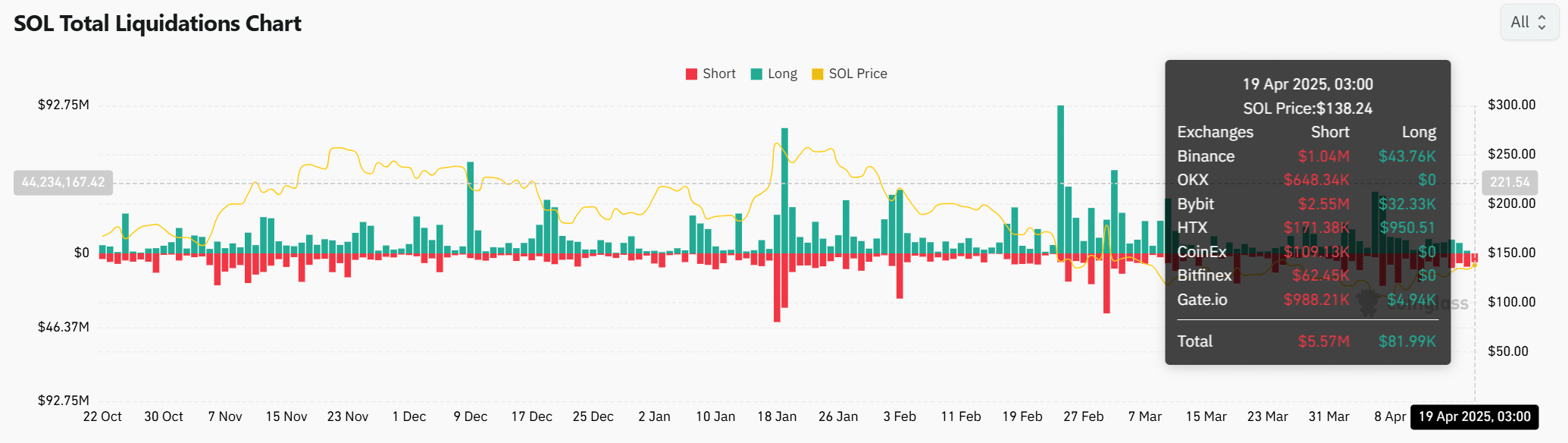

Analyzing recent liquidations sheds light on the market’s current dynamics. Short liquidations reached $5.57 million compared to just $81,900 in long positions, indicating that sellers were potentially unprepared for the recent bullish rally.

Source: CoinGlass

This trend shows that upward pressure could be building, possibly driven by a short squeeze. However, Funding Rates have remained largely neutral to slightly negative, suggesting that many traders are still hesitant to take aggressive long positions amid rising prices.

Future Outlook: Will Solana Sustain Its Bullish Momentum?

In summary, Solana is currently positioned at a critical juncture characterized by strong technical indicators, whale backing, and increasing on-chain activity. Yet, the $145 resistance level remains a significant challenge that needs to be overcome. Should the bulls successfully flip this level to support, SOL could experience an expedited move toward $180.

As the market oscillates at this pivotal point, both buyers and sellers remain active, yet further confirmation is required to establish a definitive market direction.